Paysafe Results Presentation Deck

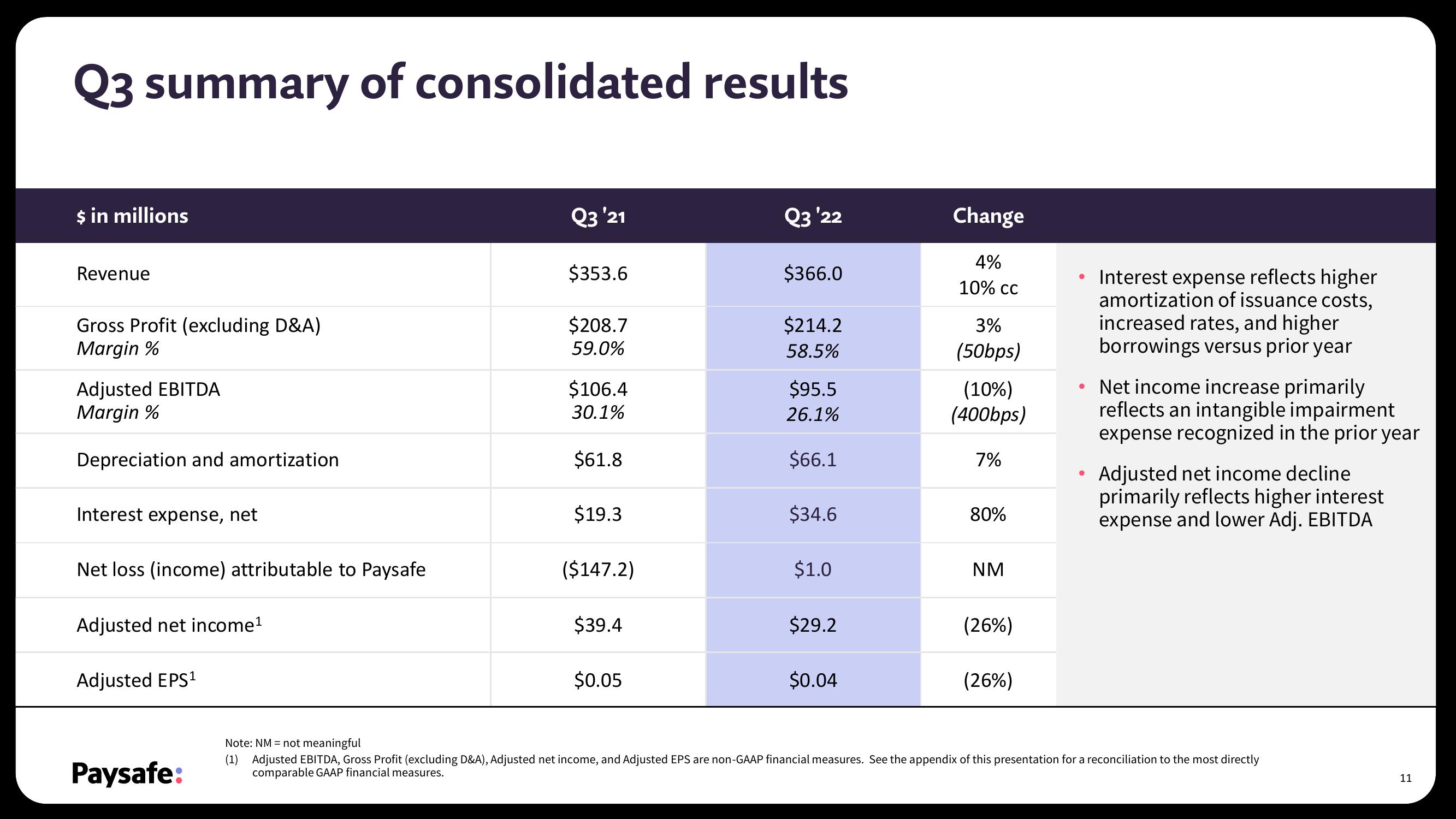

Q3 summary of consolidated results

$ in millions

Revenue

Gross Profit (excluding D&A)

Margin %

Adjusted EBITDA

Margin %

Depreciation and amortization

Interest expense, net

Net loss (income) attributable to Paysafe

Adjusted net income¹

Adjusted EPS¹

Paysafe:

Q3 '21

$353.6

$208.7

59.0%

$106.4

30.1%

$61.8

$19.3

($147.2)

$39.4

$0.05

Q3 '22

$366.0

$214.2

58.5%

$95.5

26.1%

$66.1

$34.6

$1.0

$29.2

$0.04

Change

4%

10% CC

3%

(50bps)

(10%)

(400bps)

7%

80%

NM

(26%)

(26%)

●

Interest expense reflects higher

amortization of issuance costs,

increased rates, and higher

borrowings versus prior year

Net income increase primarily

reflects an intangible impairment

expense recognized in the prior year

Adjusted net income decline

primarily reflects higher interest

expense and lower Adj. EBITDA

Note: NM = not meaningful

(1) Adjusted EBITDA, Gross Profit (excluding D&A), Adjusted net income, and Adjusted EPS are non-GAAP financial measures. See the appendix of this presentation for a reconciliation to the most directly

comparable GAAP financial measures.

11View entire presentation