Pershing Square Activist Presentation Deck

O

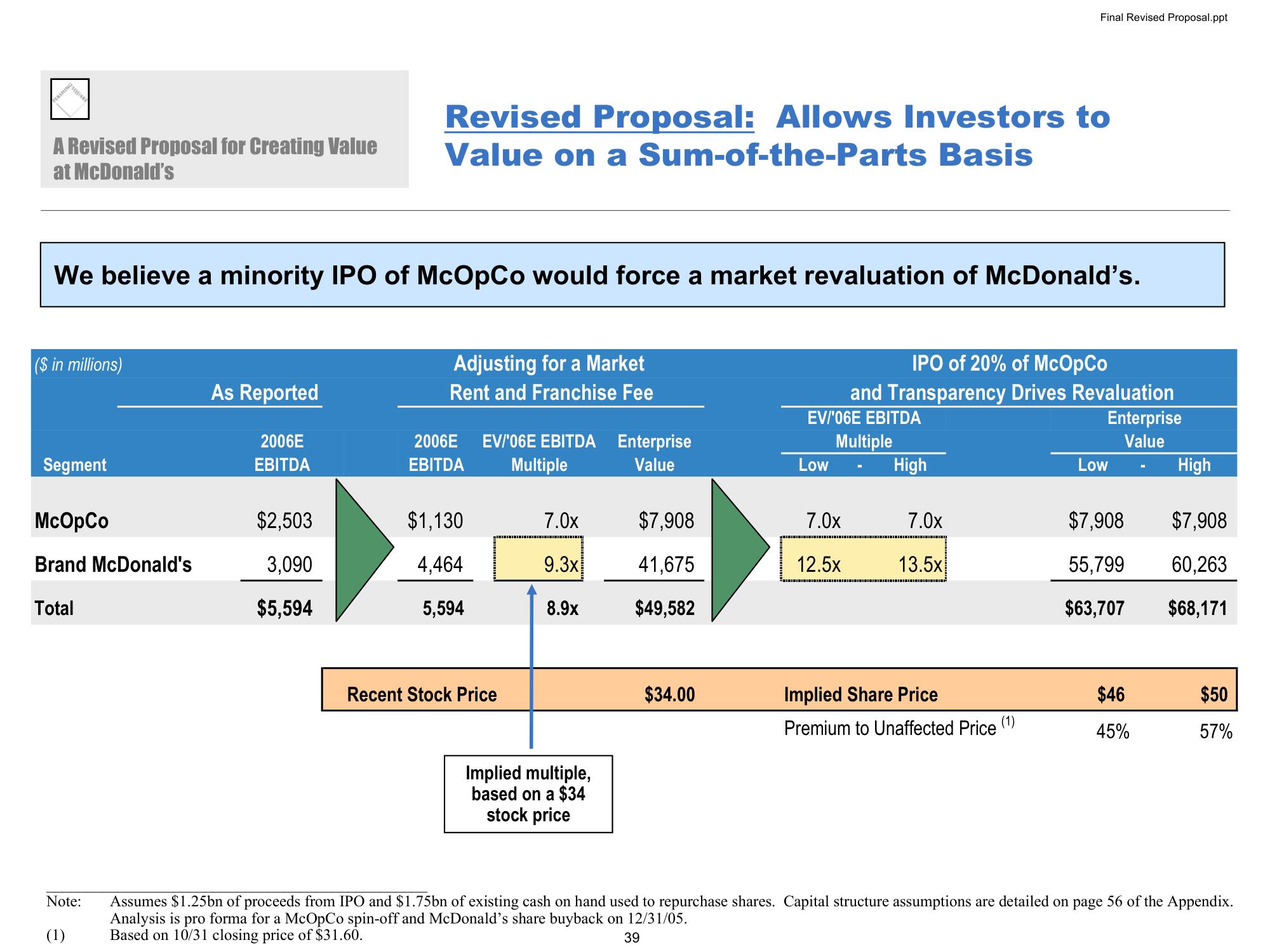

A Revised Proposal for Creating Value

at McDonald's

($ in millions)

We believe a minority IPO of McOpCo would force a market revaluation of McDonald's.

Segment

McOpCo

Brand McDonald's

Total

Note:

(1)

As Reported

2006E

EBITDA

$2,503

3,090

$5,594

Revised Proposal: Allows Investors to

Value on a Sum-of-the-Parts Basis

Adjusting for a Market

Rent and Franchise Fee

2006E EV/'06E EBITDA Enterprise

EBITDA Multiple

Value

$1,130

4,464

5,594

Recent Stock Price

7.0x

9.3x

8.9x

Implied multiple,

based on a $34

stock price

$7,908

41,675

$49,582

$34.00

IPO of 20% of McOpCo

and Transparency Drives Revaluation

EV/'06E EBITDA

Enterprise

Multiple

Value

Low

Final Revised Proposal.ppt

High

7.0x

7.0x

12.5x 13.5x

Implied Share Price

Premium to Unaffected Price

(1)

Low

High

$7,908

$7,908

55,799

60,263

$63,707 $68,171

$46

45%

$50

57%

Assumes $1.25bn of proceeds from IPO and $1.75bn of existing cash on hand used to repurchase shares. Capital structure assumptions are detailed on page 56 of the Appendix.

Analysis is pro forma for a McOpCo spin-off and McDonald's share buyback on 12/31/05.

Based on 10/31 closing price of $31.60.

39View entire presentation