Bigbear AI SPAC Presentation Deck

Transaction Detail

TRANSACTION HIGHLIGHTS

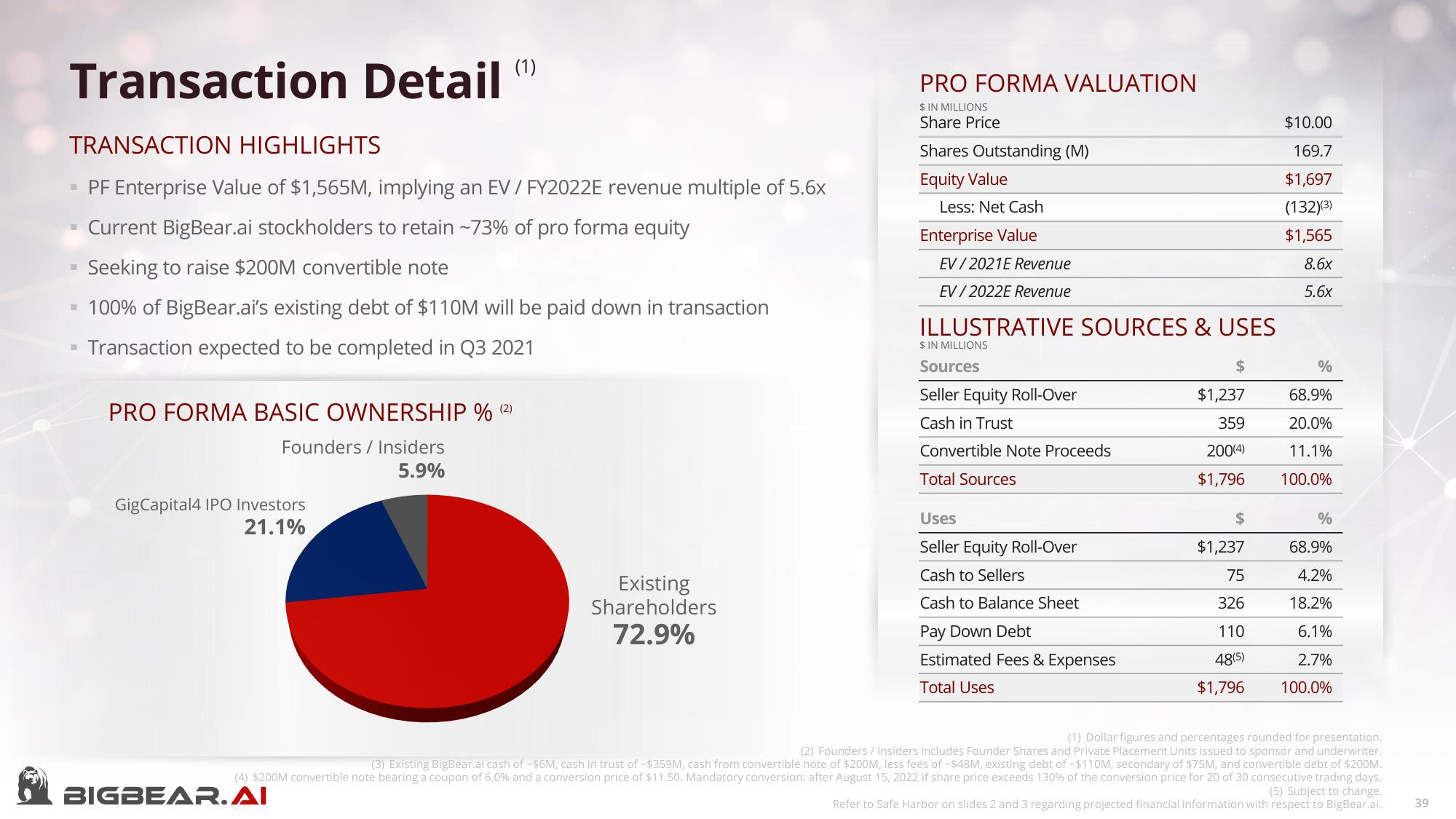

- PF Enterprise Value of $1,565M, implying an EV / FY2022E revenue multiple of 5.6x

Current BigBear.ai stockholders to retain ~73% of pro forma equity

Seeking to raise $200M convertible note

- 100% of BigBear.ai's existing debt of $110M will be paid down in transaction

Transaction expected to be completed in Q3 2021

(1)

PRO FORMA BASIC OWNERSHIP % (²)

Founders / Insiders

5.9%

GigCapital4 IPO Investors

21.1%

BIGBEAR. AI

Existing

Shareholders

72.9%

PRO FORMA VALUATION

$ IN MILLIONS

Share Price

Shares Outstanding (M)

Equity Value

Less: Net Cash

Enterprise Value

EV/2021E Revenue

EV/2022E Revenue

ILLUSTRATIVE SOURCES & USES

$ IN MILLIONS

Sources

Seller Equity Roll-Over

Cash in Trust

Convertible Note Proceeds

Total Sources

Uses

Seller Equity Roll-Over

Cash to Sellers

Cash to Balance Sheet

Pay Down Debt

Estimated Fees & Expenses

Total Uses

$

$1,237

359

200(4)

$1,796

$

$1,237

75

326

110

48(5)

$1,796

$10.00

169.7

$1,697

(132)(3)

$1,565

8.6x

5.6x

%

68.9%

20.0%

11.1%

100.0%

%

68.9%

4.2%

18.2%

6.1%

2.7%

100.0%

(1) Dollar figures and percentages rounded for presentation.

(2) Founders / Insiders includes Founder Shares and Private Placement Units issued to sponsor and underwriter.

(3) Existing BigBear.ai cash of -$6M, cash in trust of -$359M, cash from convertible note of $200M, less fees of -$48M, existing debt of -$110M, secondary of $75M, and convertible debt of $200M.

(4) $200M convertible note bearing a coupon of 6.0% and a conversion price of $11.50. Mandatory conversion: after August 15, 2022 if share price exceeds 130% of the conversion price for 20 of 30 consecutive trading days.

(5) Subject to change.

Refer to Safe Harbor on slides 2 and 3 regarding projected financial information with respect to BigBear ai.

39View entire presentation