Azerion SPAC Presentation Deck

Comparable peers

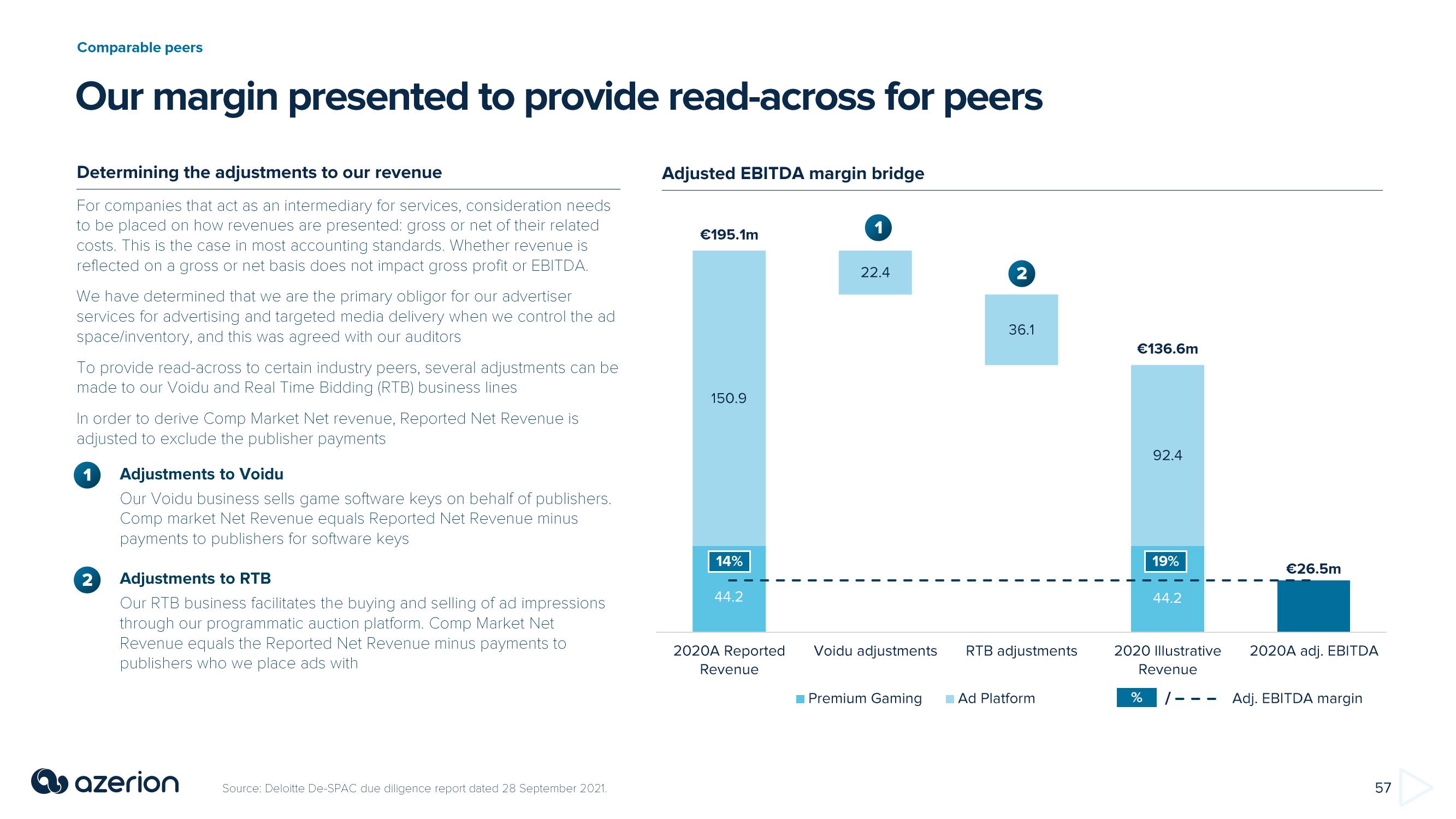

Our margin presented to provide read-across for peers

Determining the adjustments to our revenue

For companies that act as an intermediary for services, consideration needs

to be placed on how revenues are presented: gross or net of their related

costs. This is the case in most accounting standards. Whether revenue is

reflected on a gross or net basis does not impact gross profit or EBITDA.

We have determined that we are the primary obligor for our advertiser

services for advertising and targeted media delivery when we control the ad

space/inventory, and this was agreed with our auditors

To provide read-across to certain industry peers, several adjustments can be

made to our Voidu and Real Time Bidding (RTB) business lines

In order to derive Comp Market Net revenue, Reported Net Revenue is

adjusted to exclude the publisher payments

1 Adjustments to Voidu

Our Voidu business sells game software keys on behalf of publishers.

Comp market Net Revenue equals Reported Net Revenue minus

payments to publishers for software keys

2

Adjustments to RTB

Our RTB business facilitates the buying and selling of ad impressions

through our programmatic auction platform. Comp Market Net

Revenue equals the Reported Net Revenue minus payments to

publishers who we place ads with

azerion Source: Deloitte De-SPAC due diligence report dated 28 September 2021.

Adjusted EBITDA margin bridge

€195.1m

150.9

14%

44.2

2020A Reported

Revenue

1

22.4

Voidu adjustments

Premium Gaming

2

36.1

RTB adjustments

Ad Platform

€136.6m

92.4

%

19%

44.2

2020 Illustrative

Revenue

€26.5m

2020A adj. EBITDA

Adj. EBITDA margin

57View entire presentation