Granite Ridge Investor Presentation Deck

Overview

Strategy & Execution

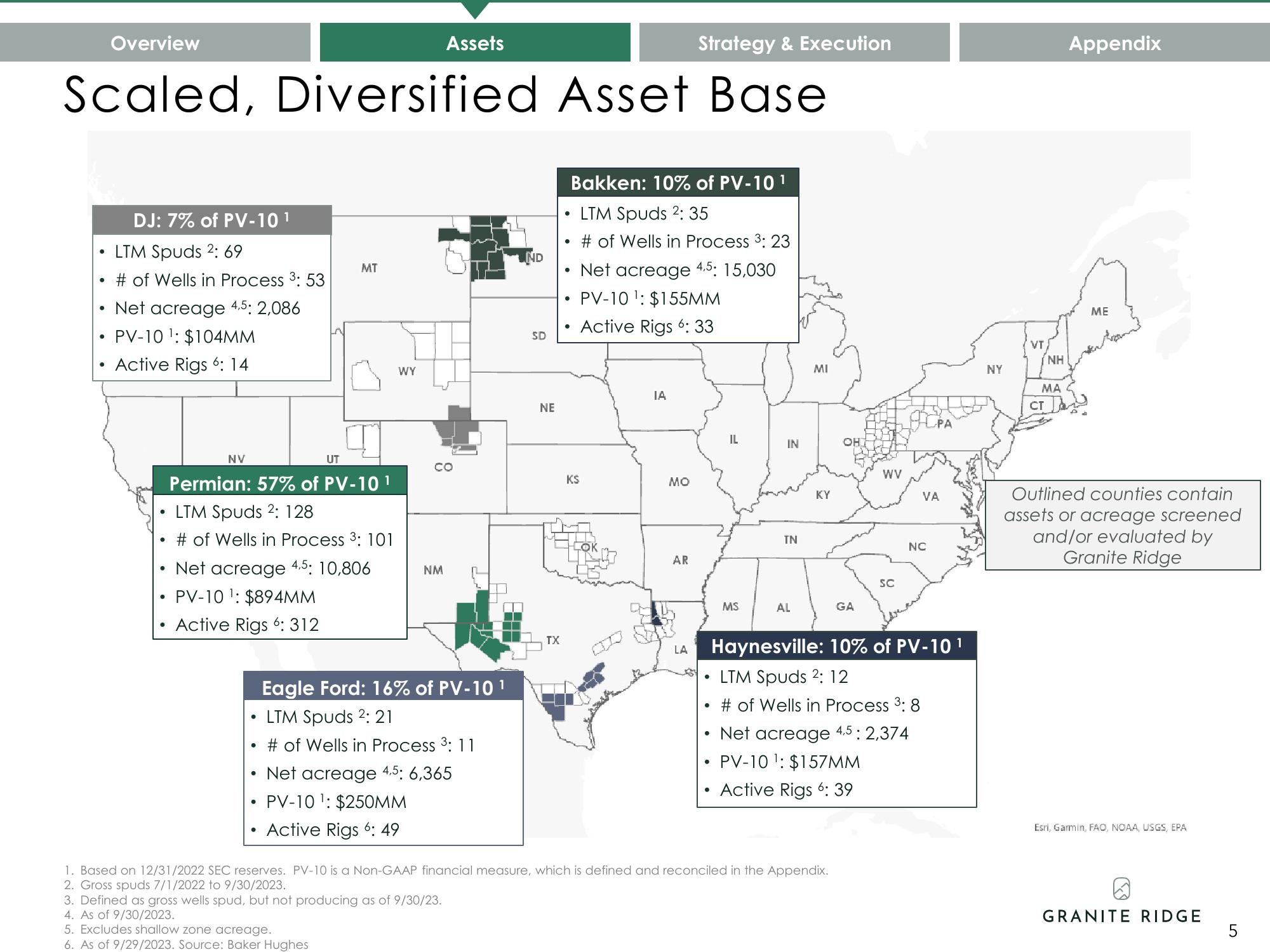

Scaled, Diversified Asset Base

DJ: 7% of PV-10¹

LTM Spuds 2: 69

# of Wells in Process ³: 53

Net acreage 4,5: 2,086

• PV-10¹: $104MM

Active Rigs 6: 14

NV

●

UT

MT

Permian: 57% of PV-10¹

LTM Spuds 2: 128

# of Wells in Process 3: 101

Net acreage 4.5: 10,806

• PV-10¹: $894MM

Active Rigs 6: 312

WY

Assets

со

NM

Eagle Ford: 16% of PV-10¹

LTM Spuds 2: 21

# of Wells in Process 3: 11

Net acreage 4.5: 6,365

• PV-10¹: $250MM

Active Rigs 6: 49

ND

SD

NE

TX

●

●

●

●

Bakken: 10% of PV-10¹

LTM Spuds 2: 35

# of Wells in Process ³:23

Net acreage 4.5: 15,030

PV-10¹: $155MM

Active Rigs 6: 33

KS

ΤΑ

MO

AR

LA

●

IL

MS

IN

TN

AL

MI

KY

OH

1. Based on 12/31/2022 SEC reserves. PV-10 is a Non-GAAP financial measure, which is defined and reconciled in the Appendix.

2. Gross spuds 7/1/2022 to 9/30/2023.

3. Defined as gross wells spud, but not producing as of 9/30/23.

4. As of 9/30/2023.

5. Excludes shallow zone acreage.

6. As of 9/29/2023. Source: Baker Hughes

GA

WV

SC

PA

VA

NC

Haynesville: 10% of PV-10¹

LTM Spuds 2: 12

# of Wells in Process 3:8

Net acreage 4.5: 2,374

PV-10¹: $157MM

Active Rigs 6: 39

NY

VT/

NH

MA

ст

Appendix

ΜΕ

Outlined counties contain

assets or acreage screened

and/or evaluated by

Granite Ridge

Esri, Garmin, FAO, NOAA, USGS, EPA

D

GRANITE RIDGE

5View entire presentation