Disney Shareholder Engagement Presentation Deck

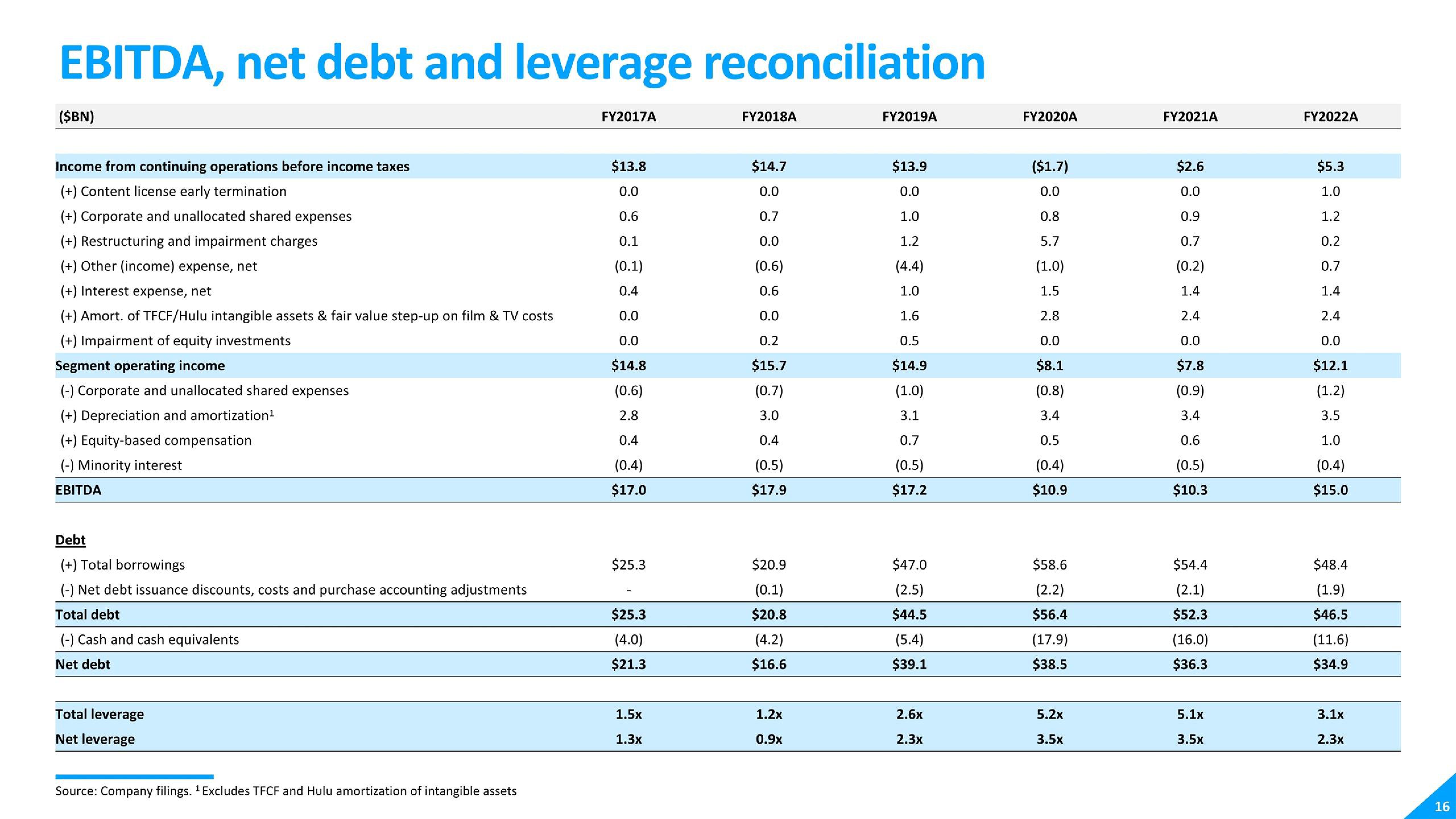

EBITDA, net debt and leverage reconciliation

($BN)

Income from continuing operations before income taxes

(+) Content license early termination

(+) Corporate and unallocated shared expenses

(+) Restructuring and impairment charges

(+) Other (income) expense, net

(+) Interest expense, net

(+) Amort. of TFCF/Hulu intangible assets & fair value step-up on film & TV costs

(+) Impairment of equity investments

Segment operating income

(-) Corporate and unallocated shared expenses

(+) Depreciation and amortization¹

(+) Equity-based compensation

(-) Minority interest

EBITDA

Debt

(+) Total borrowings

(-) Net debt issuance discounts, costs and purchase accounting adjustments

Total debt

(-) Cash and cash equivalents

Net debt

Total leverage

Net leverage

Source: Company filings. ¹ Excludes TFCF and Hulu amortization of intangible assets

FY2017A

$13.8

0.0

0.6

0.1

(0.1)

0.4

0.0

0.0

$14.8

(0.6)

2.8

0.4

(0.4)

$17.0

$25.3

$25.3

(4.0)

$21.3

1.5x

1.3x

FY2018A

$14.7

0.0

0.7

0.0

(0.6)

0.6

0.0

0.2

$15.7

(0.7)

3.0

0.4

(0.5)

$17.9

$20.9

(0.1)

$20.8

(4.2)

$16.6

1.2x

0.9x

FY2019A

$13.9

0.0

1.0

1.2

(4.4)

1.0

1.6

0.5

$14.9

(1.0)

3.1

0.7

(0.5)

$17.2

$47.0

(2.5)

$44.5

(5.4)

$39.1

2.6x

2.3x

FY2020A

($1.7)

0.0

0.8

5.7

(1.0)

1.5

2.8

0.0

$8.1

(0.8)

3.4

0.5

(0.4)

$10.9

$58.6

(2.2)

$56.4

(17.9)

$38.5

5.2x

3.5x

FY2021A

$2.6

0.0

0.9

0.7

(0.2)

1.4

2.4

0.0

$7.8

(0.9)

3.4

0.6

(0.5)

$10.3

$54.4

(2.1)

$52.3

(16.0)

$36.3

5.1x

3.5x

FY2022A

$5.3

1.0

1.2

0.2

0.7

1.4

2.4

0.0

$12.1

(1.2)

3.5

1.0

(0.4)

$15.0

$48.4

(1.9)

$46.5

(11.6)

$34.9

3.1x

2.3x

16View entire presentation