J.P.Morgan Results Presentation Deck

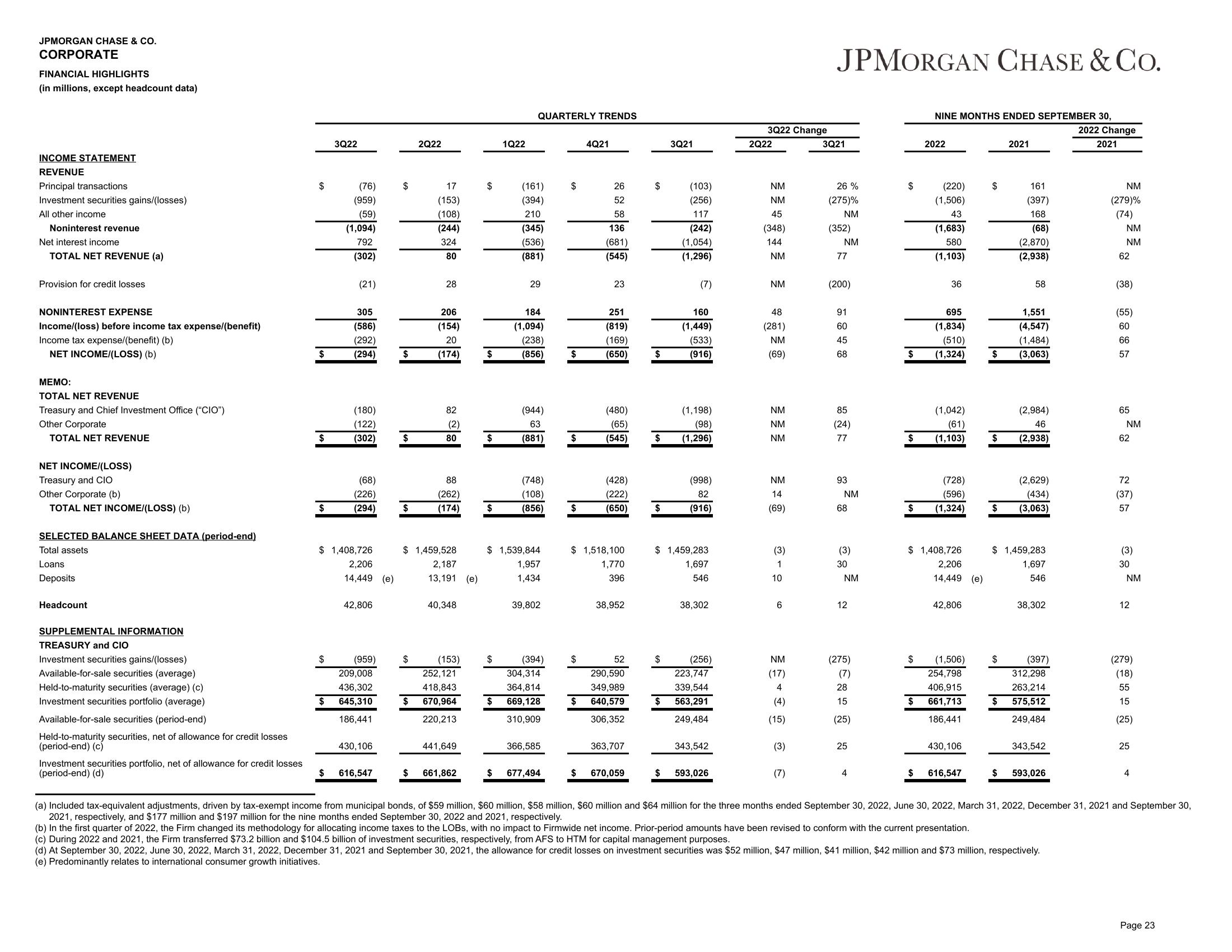

JPMORGAN CHASE & CO.

CORPORATE

FINANCIAL HIGHLIGHTS

(in millions, except headcount data)

INCOME STATEMENT

REVENUE

Principal transactions

Investment securities gains/(losses)

All other income

Noninterest revenue

Net interest income

TOTAL NET REVENUE (a)

Provision for credit losses

NONINTEREST EXPENSE

Income/(loss) before income tax expense/(benefit)

Income tax expense/(benefit) (b)

NET INCOME/(LOSS) (b)

MEMO:

TOTAL NET REVENUE

Treasury and Chief Investment Office ("CIO")

Other Corporate

TOTAL NET REVENUE

NET INCOME/(LOSS)

Treasury and CIO

Other Corporate (b)

TOTAL NET INCOME/(LOSS) (b)

SELECTED BALANCE SHEET DATA (period-end)

Total assets

Loans

Deposits

Headcount

SUPPLEMENTAL INFORMATION

TREASURY and CIO

Investment securities gains/(losses)

Available-for-sale securities (average)

Held-to-maturity securities (average) (c)

Investment securities portfolio (average)

Available-for-sale securities (period-end)

Held-to-maturity securities, net of allowance for credit losses.

(period-end) (c)

Investment securities portfolio, net of allowance for credit losses

(period-end) (d)

$

$

$

$

$

$

3Q22

$

(76)

(959)

(59)

(1,094)

792

(302)

(21)

305

(586)

(292)

(294)

$1,408,726

(180)

(122)

(302)

(68)

(226)

(294)

2,206

14,449 (e)

42,806

(959)

209,008

436,302

645,310

186,441

430,106

616,547

$

$

$

2Q22

$

17

(153)

(108)

(244)

324

80

28

206

(154)

20

(174)

82

(2)

80

88

(262)

(174)

$ 1,459,528

2,187

13,191 (e)

40,348

(153)

252,121

418,843

670,964

220,213

441,649

661,862

$

$

$

1Q22

$

QUARTERLY TRENDS

(161)

(394)

210

(345)

(536)

(881)

29

184

(1,094)

(238)

(856)

(944)

63

(881)

(748)

(108)

(856)

$1,539,844

1,957

1,434

39,802

(394)

304,314

364,814

$ 669,128

310,909

366,585

$ 677,494

$

$

$

4Q21

$

26

52

58

136

(681)

(545)

23

251

(819)

(169)

(650)

(480)

(65)

(545)

(428)

(222)

(650)

$ 1,518,100

1,770

396

38,952

52

290,590

349,989

640,579

306,352

363,707

670,059

$

$

$

$

D

3Q21

$

(103)

(256)

117

(242)

(1,054)

(1,296)

$

(7)

160

(1,449)

(533)

(916)

(1,198)

(98)

(1,296)

$ 1,459,283

1,697

546

(998)

82

(916)

38,302

(256)

223,747

339,544

563,291

249,484

343,542

$ 593,026

3Q22 Change

2Q22

NM

NM

45

(348)

144

NM

NM

48

(281)

NM

(69)

NM

NM

NM

NM

14

(69)

(3)

1

10

6

NM

(17)

4

(4)

(15)

(3)

(7)

JPMORGAN CHASE & CO.

3Q21

26%

(275)%

NM

(352)

NM

77

(200)

91

60

45

68

85

(24)

77

93

NM

68

(3)

30

NM

12

(275)

(7)

28

15

(25)

25

$

$

$

NINE MONTHS ENDED SEPTEMBER 30,

$

2022

695

(1,834)

(510)

$ (1,324)

(220)

(1,506)

43

$

(1,683)

580

(1,103)

36

(1,042)

(61)

(1,103)

$1,408,726

2,206

14,449 (e)

(728)

(596)

(1,324)

(1,506)

254,798

406,915

$ 661,713

186,441

42,806

430,106

616,547

$

$

$

1,551

(4,547)

(1,484)

$ (3,063)

2021

$

161

(397)

168

(68)

(2,870)

(2,938)

$

58

(2,984)

46

(2,938)

$ 1,459,283

1,697

546

(2,629)

(434)

(3,063)

38,302

(397)

312,298

263,214

575,512

249,484

343,542

593,026

2022 Change

2021

(c) During 2022 and 2021, the Firm transferred $73.2 billion and $104.5 billion of investment securities, respectively, from AFS to HTM for capital management purposes.

(d) At September 30, 2022, June 30, 2022, March 31, 2022, December 31, 2021 and September 30, 2021, the allowance for credit losses on investment securities was $52 million, $47 million, $41 million, $42 million and $73 million, respectively.

(e) Predominantly relates to international consumer growth initiatives.

NM

(279)%

(74)

NM

NM

62

(38)

(55)

60

66

57

65

NM

62

72

(37)

57

(3)

30

NM

12

(279)

(18)

55

15

(25)

25

4

(a) Included tax-equivalent adjustments, driven by tax-exempt income from municipal bonds, of $59 million, $60 million, $58 million, $60 million and $64 million for the three months ended September 30, 2022, June 30, 2022, March 31, 2022, December 31, 2021 and September 30,

2021, respectively, and $177 million and $197 million for the nine months ended September 30, 2022 and 2021, respectively.

(b) In the first quarter of 2022, the Firm changed its methodology for allocating income taxes to the LOBS, with no impact to Firmwide net income. Prior-period amounts have been revised to conform with the current presentation.

Page 23View entire presentation