OpenText Investor Presentation Deck

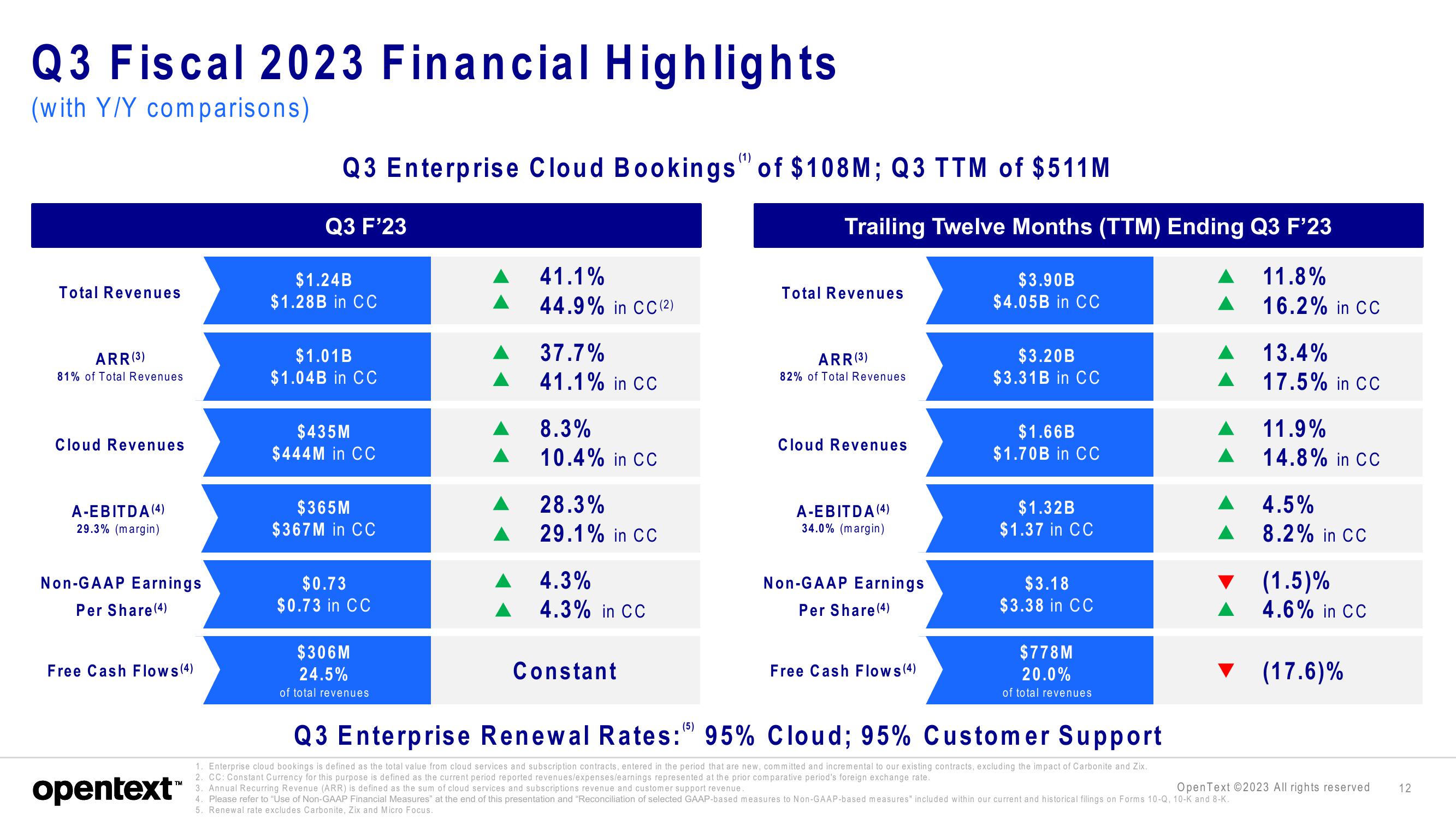

Q3 Fiscal 2023 Financial Highlights

(with Y/Y comparisons)

Total Revenues

ARR (3)

81% of Total Revenues.

Cloud Revenues

A-EBITDA (4)

29.3% (margin)

Non-GAAP Earnings

Per Share (4)

Free Cash Flows (4)

opentext

TM

Q3 Enterprise Cloud Bookings" of $108M; Q3 TTM of $511M

Q3 F'23

$1.24B

$1.28B in CC

$1.01B

$1.04B in CC

$435M

$444M in CC

$365M

$367M in CC

$0.73

$0.73 in CC

$306M

24.5%

of total revenues

41.1%

44.9% in CC (2)

37.7%

41.1% in CC

8.3%

10.4% in CC

28.3%

29.1% in CC

4.3%

4.3% in CC

Constant

(5)

Trailing Twelve Months (TTM) Ending Q3 F'23

11.8%

16.2% in CC

Total Revenues

ARR (3)

82% of Total Revenues

Cloud Revenues

A-EBITDA (4)

34.0% (margin)

Non-GAAP Earnings

Per Share (4)

Free Cash Flows (4)

$3.90B

$4.05B in CC

$3.20B

$3.31B in CC

$1.66B

$1.70B in CC

$1.32B

$1.37 in CC

$3.18

$3.38 in CC

$778M

20.0%

of total revenues

X

13.4%

17.5% in CC

Q3 Enterprise Renewal Rates: 95% Cloud; 95% Customer Support

1. Enterprise cloud bookings is defined as the total value from cloud services and subscription contracts, entered in the period that are new, committed and incremental to our existing contracts, excluding the impact of Carbonite and Zix.

2. CC: Constant Currency for this purpose is defined as the current period reported revenues/expenses/earnings represented at the prior comparative period's foreign exchange rate.

3. Annual Recurring Revenue (ARR) is defined as the sum of cloud services and subscriptions revenue and customer support revenue.

4. Please refer to "Use of Non-GAAP Financial Measures" at the end of this presentation and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures" included within our current and historical filings on Forms 10-Q, 10-K and 8-K.

5. Renewal rate excludes Carbonite, Zix and Micro Focus.

11.9%

14.8% in CC

4.5%

8.2% in CC

(1.5)%

4.6% in CC

▼ (17.6)%

OpenText ©2023 All rights reserved

12View entire presentation