Melrose Mergers and Acquisitions Presentation Deck

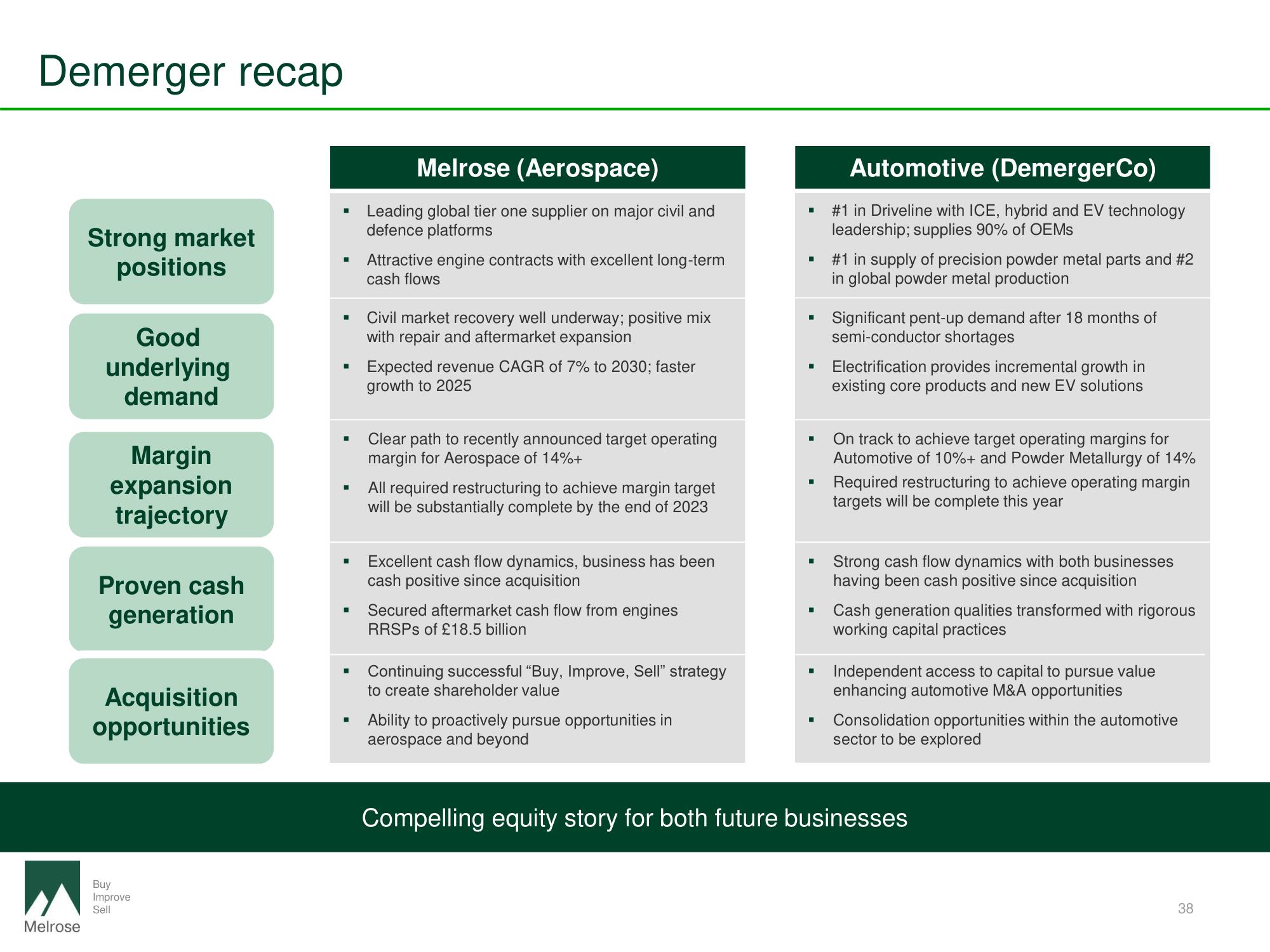

Demerger recap

Melrose

Strong market

positions

Good

underlying

demand

Margin

expansion

trajectory

Proven cash

generation

Acquisition

opportunities

Buy

Improve

Sell

■

■

■

■

■

■

■

■

Melrose (Aerospace)

Leading global tier one supplier on major civil and

defence platforms

Attractive engine contracts with excellent long-term

cash flows

Civil market recovery well underway; positive mix

with repair and aftermarket expansion

Expected revenue CAGR of 7% to 2030; faster

growth to 2025

Clear path to recently announced target operating

margin for Aerospace of 14%+

All required restructuring to achieve margin target

will be substantially complete by the end of 2023

Excellent cash flow dynamics, business has been

cash positive since acquisition

Secured aftermarket cash flow from engines

RRSPs of £18.5 billion

Continuing successful "Buy, Improve, Sell" strategy

to create shareholder value

Ability to proactively pursue opportunities in

aerospace and beyond

I

■

■

■

■

■

Automotive (DemergerCo)

#1 in Driveline with ICE, hybrid and EV technology

leadership; supplies 90% of OEMs

#1 in supply of precision powder metal parts and #2

in global powder metal production

Significant pent-up demand after 18 months of

semi-conductor shortages

Electrification provides incremental growth in

existing core products and new EV solutions

On track to achieve target operating margins for

Automotive of 10%+ and Powder Metallurgy of 14%

Required restructuring to achieve operating margin

targets will be complete this year

Strong cash flow dynamics with both businesses

having been cash positive since acquisition

Cash generation qualities transformed with rigorous

working capital practices

Independent access to capital to pursue value

enhancing automotive M&A opportunities

Consolidation opportunities within the automotive

sector to be explored

Compelling equity story for both future businesses

38View entire presentation