Deutsche Bank Fixed Income Presentation Deck

Well diversified loan book, CLP guidance unchanged

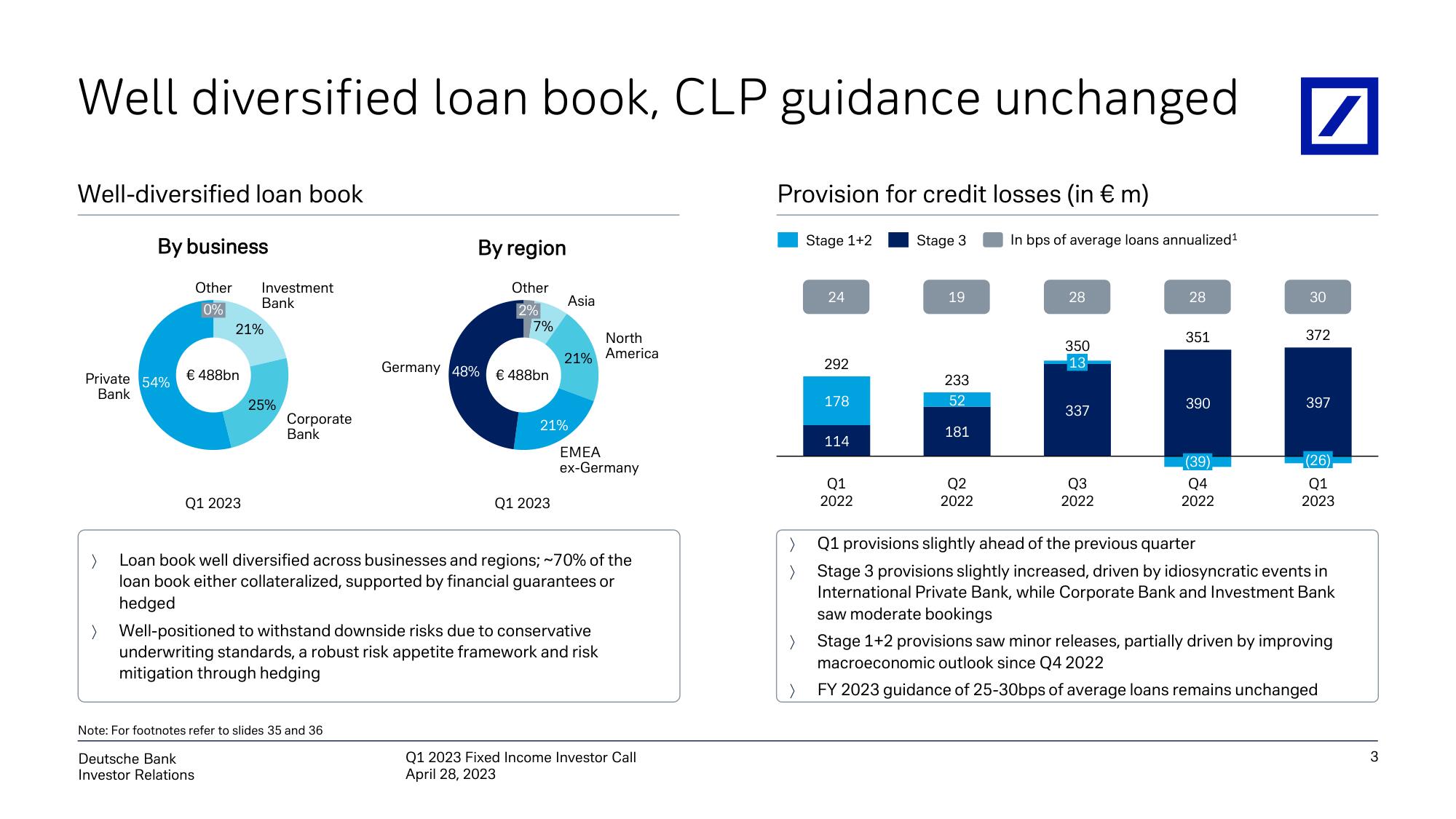

Well-diversified loan book

By business

Private 54%

Bank

Other Investment

Bank

0%

21%

€ 488bn

Q1 2023

25%

Corporate

Bank

By region

Other

2%

7%

Note: For footnotes refer to slides 35 and 36

Deutsche Bank

Investor Relations

Germany 48% € 488bn

Asia

Q1 2023

North

21% America

21%

EMEA

ex-Germany

Loan book well diversified across businesses and regions; ~70% of the

loan book either collateralized, supported by financial guarantees or

hedged

Well-positioned to withstand downside risks due to conservative

underwriting standards, a robust risk appetite framework and risk

mitigation through hedging

Q1 2023 Fixed Income Investor Call

April 28, 2023

Provision for credit losses (in € m)

Stage 3

Stage 1+2

24

292

178

114

Q1

2022

19

233

52

181

Q2

2022

In bps of average loans annualized¹

28

350

13

337

Q3

2022

28

351

390

(39)

Q4

2022

/

30

372

397

(26)

Q1

2023

Q1 provisions slightly ahead of the previous quarter

Stage 3 provisions slightly increased, driven by idiosyncratic events in

International Private Bank, while Corporate Bank and Investment Bank

saw moderate bookings

Stage 1+2 provisions saw minor releases, partially driven by improving

macroeconomic outlook since Q4 2022

FY 2023 guidance of 25-30bps of average loans remains unchanged

3View entire presentation