Main Street Capital Investor Day Presentation Deck

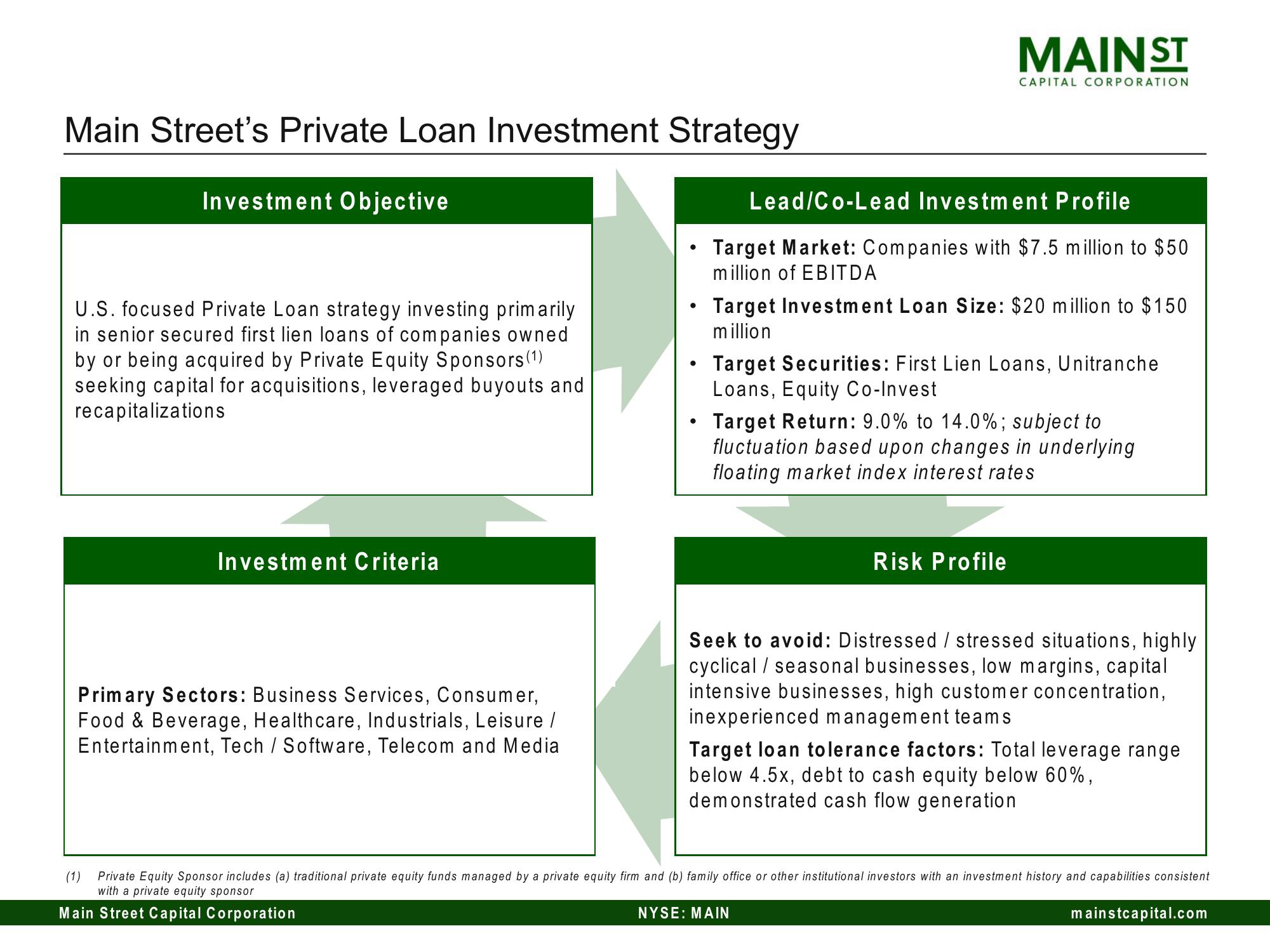

Main Street's Private Loan Investment Strategy

Investment Objective

U.S. focused Private Loan strategy investing primarily

in senior secured first lien loans of companies owned

by or being acquired by Private Equity Sponsors (1)

seeking capital for acquisitions, leveraged buyouts and

recapitalizations

Investment Criteria

Primary Sectors: Business Services, Consumer,

Food & Beverage, Healthcare, Industrials, Leisure /

Entertainment, Tech / Software, Telecom and Media

•●

MAIN ST

Lead/Co-Lead Investment Profile

Target Market: Companies with $7.5 million to $50

million of EBITDA

• Target Investment Loan Size: $20 million to $150

million

CAPITAL CORPORATION

• Target Securities: First Lien Loans, Unitranche

Loans, Equity Co-Invest

Target Return: 9.0% to 14.0%; subject to

fluctuation based upon changes in underlying

floating market index interest rates

Risk Profile

Seek to avoid: Distressed / stressed situations, highly

cyclical / seasonal businesses, low margins, capital

intensive businesses, high customer concentration,

inexperienced management teams

NYSE: MAIN

Target loan tolerance factors: Total leverage range

below 4.5x, debt to cash equity below 60%,

demonstrated cash flow generation

(1) Private Equity Sponsor includes (a) traditional private equity funds managed by a private equity firm and (b) family office or other institutional investors with an investment history and capabilities consistent

with a private equity sponsor

Main Street Capital Corporation

mainstcapital.comView entire presentation