Matson Investor Presentation Deck

15

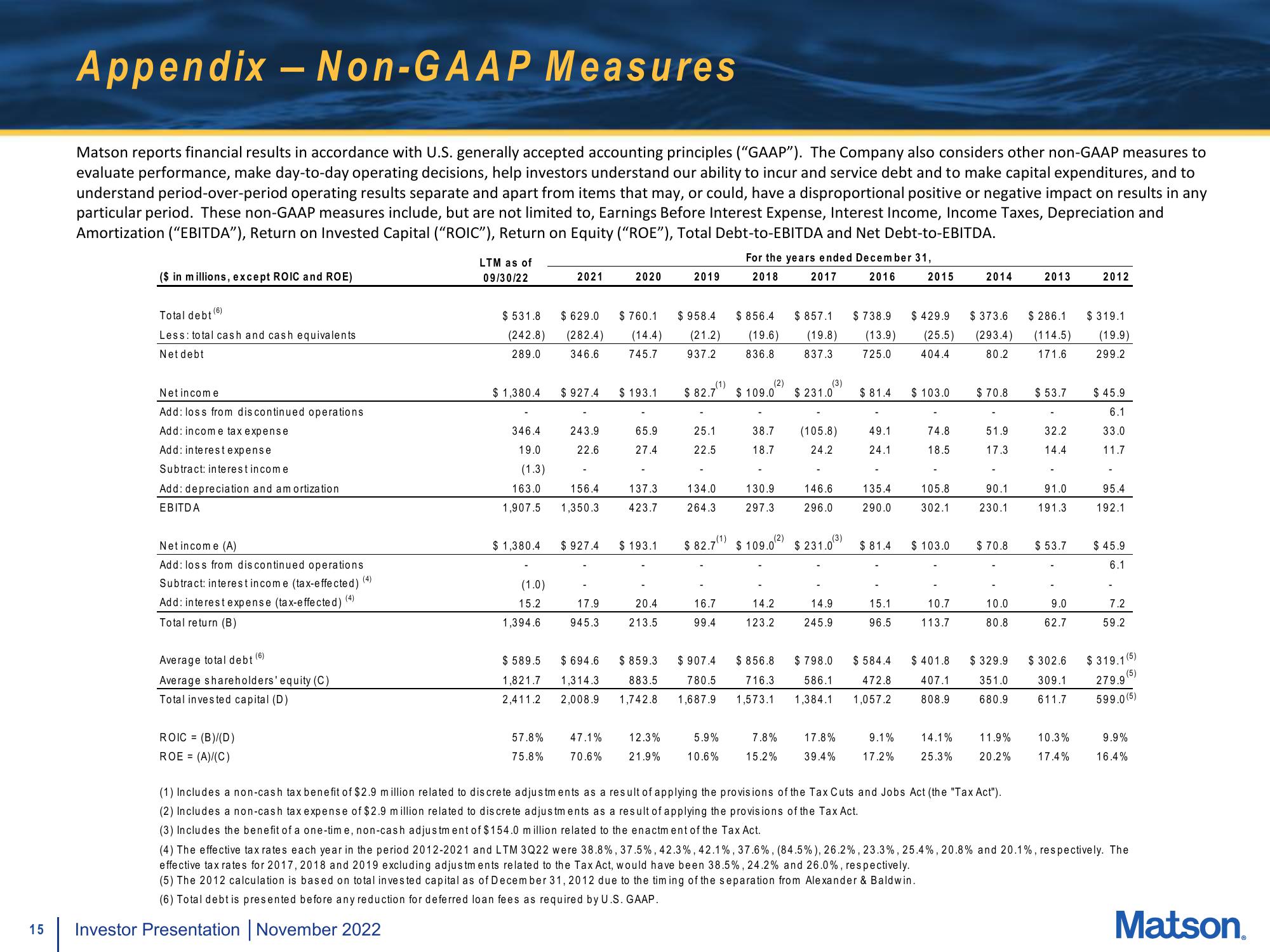

Appendix -Non-GAAP Measures

Matson reports financial results in accordance with U.S. generally accepted accounting principles ("GAAP"). The Company also considers other non-GAAP measures to

evaluate performance, make day-to-day operating decisions, help investors understand our ability to incur and service debt and to make capital expenditures, and to

understand period-over-period operating results separate and apart from items that may, or could, have a disproportional positive or negative impact on results in any

particular period. These non-GAAP measures include, but are not limited to, Earnings Before Interest Expense, Interest Income, Income Taxes, Depreciation and

Amortization ("EBITDA"), Return on Invested Capital ("ROIC"), Return on Equity ("ROE"), Total Debt-to-EBITDA and Net Debt-to-EBITDA.

($ in millions, except ROIC and ROE)

(6)

Total debt

Less: total cash and cash equivalents

Net debt.

Net income

Add: loss from discontinued operations

Add: income tax expense

Add: interestexpense

Subtract: interest income

Add: depreciation and amortization

EBITDA

Net income (A)

Add: loss from discontinued operations

Subtract: interest income (tax-effected)

Add: interest expense (tax-effected)

Total return (B)

Average total debt

+ (6)

Average shareholders' equity (C)

Total invested capital (D)

ROIC = (B)/(D)

ROE = (A)/(C)

(4)

(4)

LTM as of

09/30/22

Investor Presentation | November 2022

$531.8 $ 629.0

(242.8) (282.4)

289.0 346.6

$ 1,380.4

346.4

19.0

(1.3)

163.0

1,907.5

$ 1,380.4

(1.0)

15.2

1,394.6

2021

57.8%

75.8%

$927.4

243.9

22.6

156.4

1,350.3

17.9

945.3

2020

$ 760.1

(14.4)

745.7

47.1%

70.6%

$ 193.1

65.9

27.4

$927.4 $ 193.1

137.3

423.7

20.4

213.5

2019

12.3%

21.9%

$958.4 $856.4

(21.2) (19.6)

937.2 836.8

25.1

22.5

(1)

$ 82.7 $ 109.0

134.0

264.3

For the years ended December 31,

2018 2017

2016

16.7

99.4

(2)

5.9%

10.6%

38.7

18.7

130.9

297.3

14.2

123.2

$857.1 $ 738.9 $ 429.9

(19.8) (13.9) (25.5)

837.3 725.0 404.4

(3)

$ 82.7¹) $109.02) $231.0(3)

7.8%

15.2%

$231.0

(105.8)

24.2

146.6

296.0

14.9

245.9

$81.4

17.8%

39.4%

49.1

24.1

135.4

290.0

$81.4

2015

15.1

96.5

$ 589.5 $694.6 $859.3 $907.4 $856.8 $798.0 $584.4 $401.8

1,821.7 1,314.3 883.5 780.5 716.3 586.1 472.8 407.1

2,411.2 2,008.9 1,742.8 1,687.9 1,573.1 1,384.1 1,057.2 808.9

$ 103.0

74.8

18.5

105.8

302.1

$103.0

10.7

113.7

2014

$ 373.6

(293.4)

80.2

$70.8

51.9

17.3

90.1

230.1

$70.8

10.0

80.8

$329.9

351.0

680.9

9.1%

14.1%

11.9%

17.2% 25.3% 20.2%

2013

$286.1 $319.1

(114.5) (19.9)

171.6 299.2

$53.7

32.2

14.4

91.0

191.3

$53.7

9.0

62.7

$302.6

309.1

611.7

2012

10.3%

17.4%

$45.9

6.1

33.0

11.7

95.4

192.1

$45.9

6.1

7.2

59.2

$319.1 (5)

(5)

279.9

599.0 (5)

9.9%

16.4%

(1) Includes a non-cash tax benefit of $2.9 million related to discrete adjustments as a result of applying the provisions of the Tax Cuts and Jobs Act (the "Tax Act").

(2) Includes a non-cash tax expense of $2.9 million related to discrete adjustments as a result of applying the provisions of the Tax Act.

(3) Includes the benefit of a one-time, non-cash adjustment of $154.0 million related to the enactment of the Tax Act.

(4) The effective tax rates each year in the period 2012-2021 and LTM 3Q22 were 38.8%, 37.5%, 42.3%, 42.1%, 37.6%, (84.5%), 26.2%, 23.3%, 25.4%, 20.8% and 20.1%, respectively. The

effective tax rates for 2017, 2018 and 2019 excluding adjustments related to the Tax Act, would have been 38.5%, 24.2% and 26.0%, respectively.

(5) The 2012 calculation is based on total invested capital as of December 31, 2012 due to the timing of the separation from Alexander & Baldwin.

(6) Total debt is presented before any reduction for deferred loan fees as required by U.S. GAAP.

Matson.View entire presentation