Baird Investment Banking Pitch Book

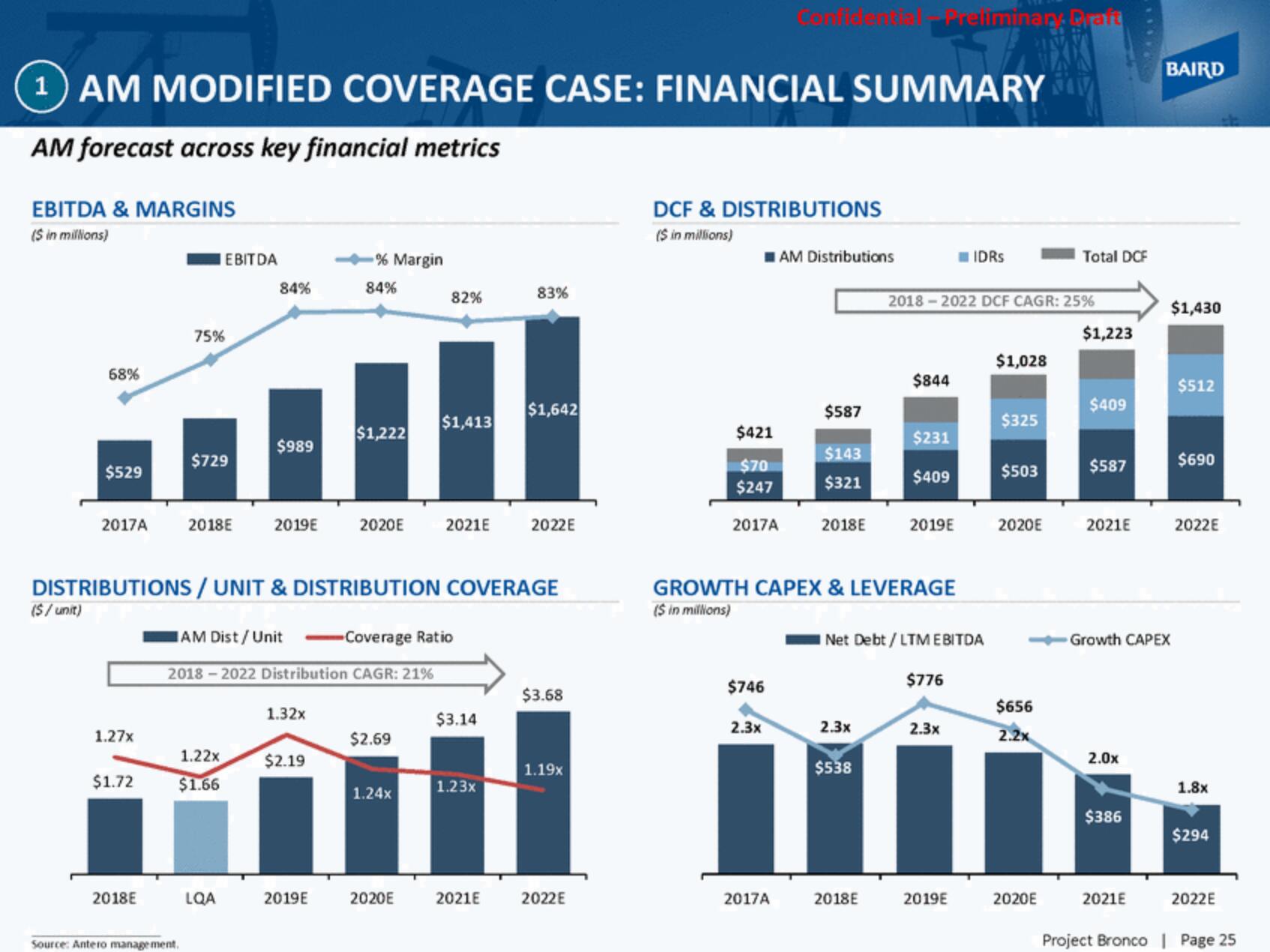

1 AM MODIFIED COVERAGE CASE: FINANCIAL SUMMARY

AM forecast across key financial metrics

EBITDA & MARGINS

($ in millions)

68%

($ / unit)

$529

1.27x

$1.72

75%

2018E

$729

EBITDA

2017A 2018E 2019€ 2020E

Source: Antero management.

84%

1.22x

$1.66

$989

AM Dist/Unit

LQA

DISTRIBUTIONS / UNIT & DISTRIBUTION COVERAGE

-% Margin

84%

1.32x

$1,222

-Coverage Ratio

2018-2022 Distribution CAGR: 21%

$2.19

2019E

$2.69

82%

1.24x

$1,413

2020E

2021E 2022E

$3.14

83%

1.23x

$1,642

2021E

$3.68

1.19x

2022E

DCF & DISTRIBUTIONS

($ in millions)

$421

$70

$247

2017A

$746

AM Distributions

2.3x

2017A

$587

$143

$321

2018E

GROWTH CAPEX & LEVERAGE

($ in millions)

2.3x

$538

reliminar Draft

2018E

$844

2018-2022 DCF CAGR: 25%

$231

$409

2019E

Net Debt / LTM EBITDA

$776

2.3x

IDRS

2019E

$1,028

$325

$503

2020E

$656

2.2x

Total DCF

2020E

$1,223

$409

$587

2021E

2.0x

Growth CAPEX

$386

BAIRD

2021E

$1,430

$512

$690

2022E

1.8x

$294

2022E

Project Bronco | Page 25View entire presentation