Deutsche Telekom Investor Day Presentation Deck

(UNAUDITED)

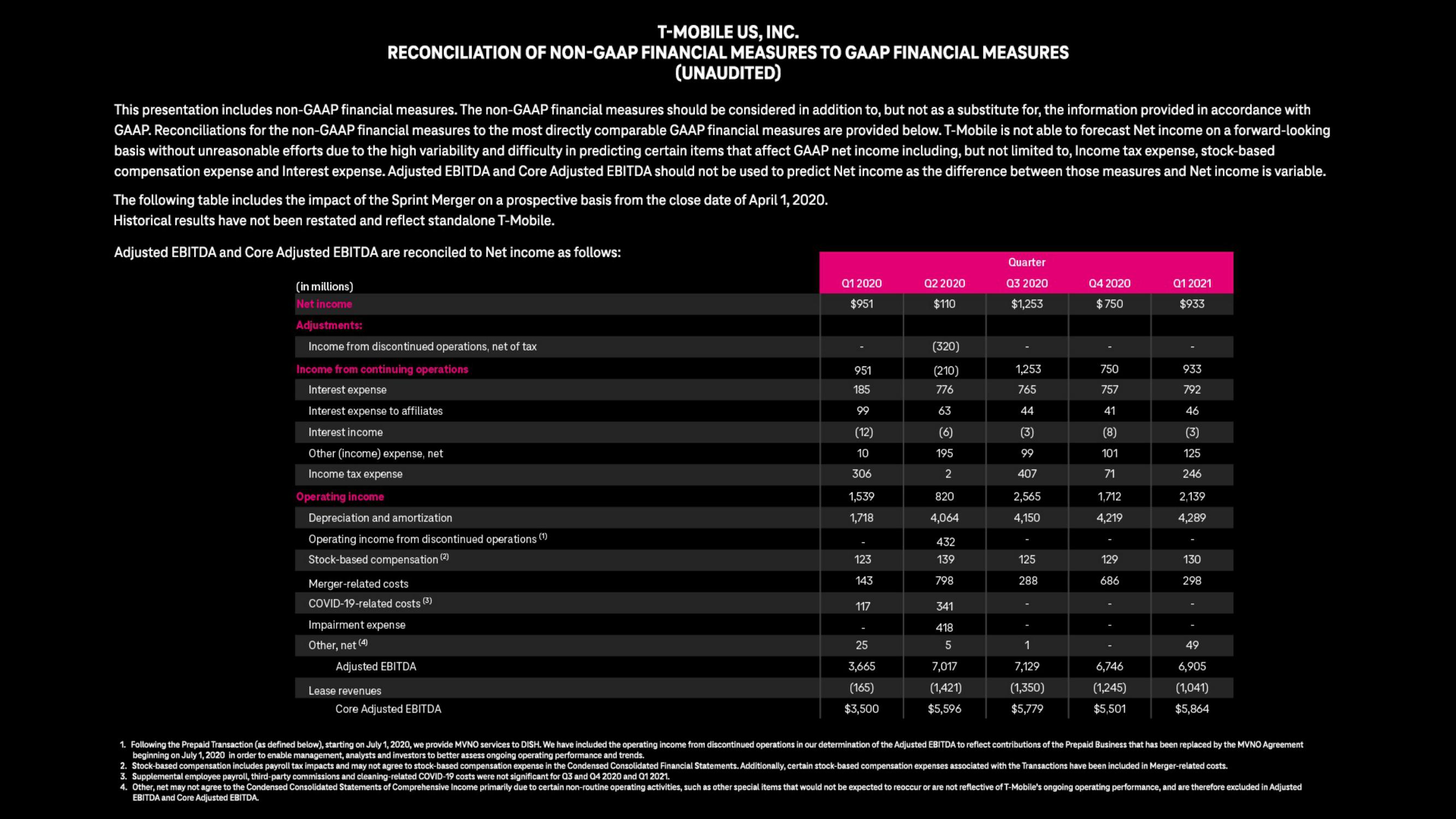

This presentation includes non-GAAP financial measures. The non-GAAP financial measures should be considered in addition to, but not as a substitute for, the information provided in accordance with

GAAP. Reconciliations for the non-GAAP financial measures to the most directly comparable GAAP financial measures are provided below. T-Mobile is not able to forecast Net income on a forward-looking

basis without unreasonable efforts due to the high variability and difficulty in predicting certain items that affect GAAP net income including, but not limited to, Income tax expense, stock-based

compensation expense and Interest expense. Adjusted EBITDA and Core Adjusted EBITDA should not be used to predict Net income as the difference between those measures and Net income is variable.

T-MOBILE US, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO GAAP FINANCIAL MEASURES

The following table includes the impact of the Sprint Merger on a prospective basis from the close date of April 1, 2020.

Historical results have not been restated and reflect standalone T-Mobile.

Adjusted EBITDA and Core Adjusted EBITDA are reconciled to Net income as follows:

(in millions)

Net income

Adjustments:

Income from discontinued operations, net of tax

Income from continuing operations

Interest expense

Interest expense to affiliates

Interest income

Other (income) expense, net

Income tax expense

Operating income

Depreciation and amortization

Operating income from discontinued operations (1)

Stock-based compensation (2)

Merger-related costs

COVID-19-related costs (3)

Impairment expense

Other, net (4)

Adjusted EBITDA

Lease revenues

Core Adjusted EBITDA

Q1 2020

$951

951

185

99

(12)

10

306

1,539

1,718

123

143

117

25

3,665

(165)

$3,500

Q2 2020

$110

(320)

(210)

776

63

(6)

195

2

820

4,064

432

139

798

341

418

5

7,017

(1,421)

$5,596

Quarter

Q3 2020

$1,253

1,253

765

44

(3)

99

407

2,565

4,150

125

288

1

7,129

(1,350)

$5,779

Q4 2020

$750

750

757

41

(8)

101

71

1,712

4,219

129

686

6,746

(1,245)

$5,501

Q1 2021

$933

933

792

46

(3)

125

246

2,139

4,289

130

298

49

6,905

(1,041)

$5,864

1. Following the Prepaid Transaction (as defined below), starting on July 1, 2020, we provide MVNO services to DISH. We have included the operating income from discontinued operations in our determination of the Adjusted EBITDA to reflect contributions of the Prepaid Business that has been replaced by the MVNO Agreement

beginning on July 1, 2020 in order to enable management, analysts and investors to better assess ongoing operating performance and trends.

2. Stock-based compensation includes payroll tax impacts and may not agree to stock-based compensation expense in the Condensed Consolidated Financial Statements. Additionally, certain stock-based compensation expenses associated with the Transactions have been included in Merger-related costs.

3. Supplemental employee payroll, third-party commissions and cleaning-related COVID-19 costs were not significant for Q3 and Q4 2020 and Q1 2021.

4. Other, net may not agree to the Condensed Consolidated Statements of Comprehensive Income primarily due to certain non-routine operating activities, such as other special items that would not be expected to reoccur or are not reflective of T-Mobile's ongoing operating performance, and are therefore excluded in Adjusted

EBITDA and Core Adjusted EBITDA.View entire presentation