BlackSky SPAC Presentation Deck

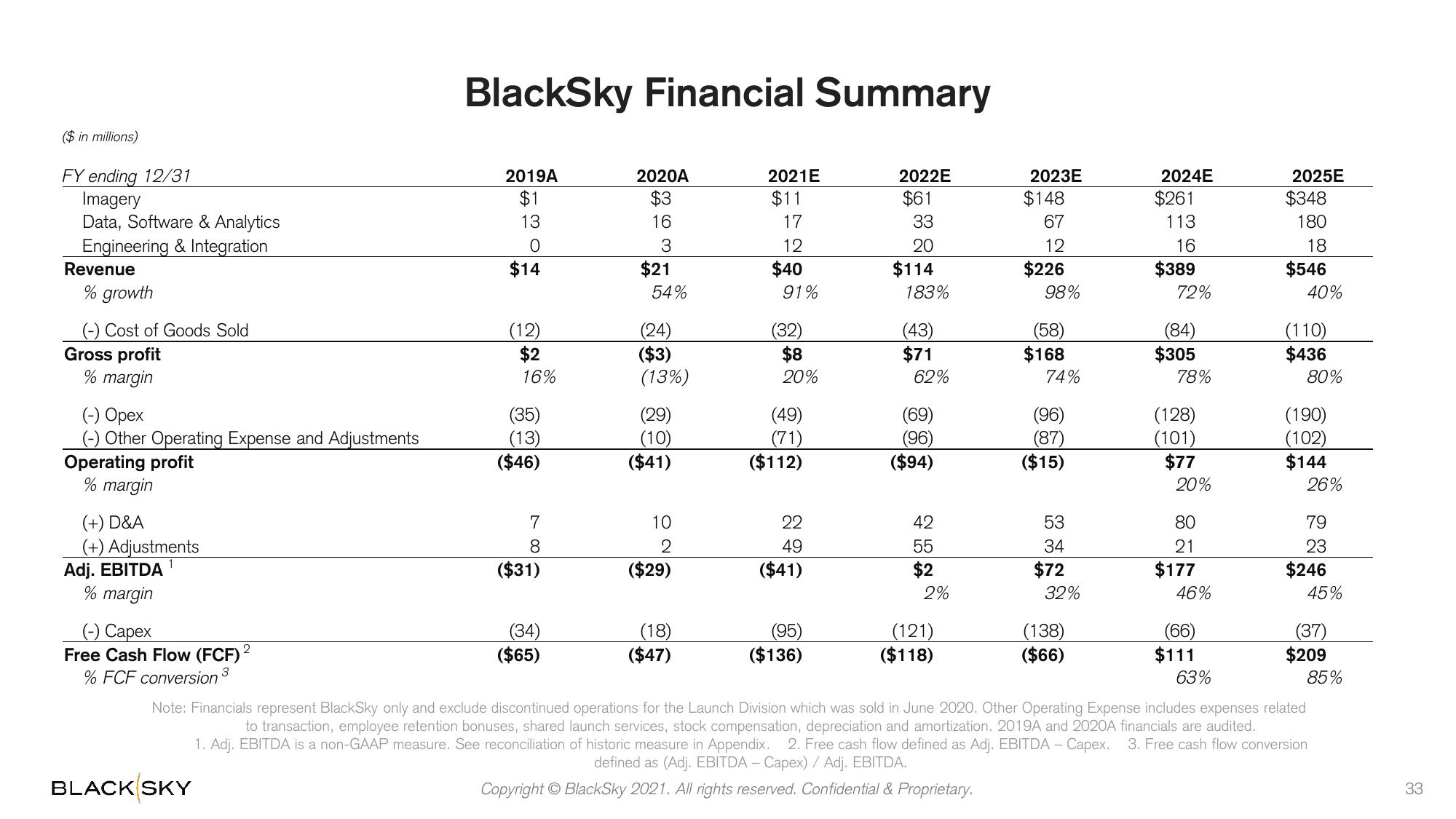

($ in millions)

FY ending 12/31

Imagery

Data, Software & Analytics

Engineering & Integration

Revenue

% growth

(-) Cost of Goods Sold

Gross profit

% margin

(-) Opex

(-) Other Operating Expense and Adjustments

Operating profit

% margin

(+) D&A

(+) Adjustments

Adj. EBITDA

% margin

(-) Capex

2

Free Cash Flow (FCF) ²

3

BlackSky Financial Summary

BLACK SKY

2019A

$1

13

0

$14

(12)

$2

16%

(35)

(13)

($46)

7

8

($31)

(34)

($65)

2020A

$3

16

3

$21

54%

(24)

($3)

(13%)

(29)

(10)

($41)

10

2

($29)

(18)

($47)

2021E

$11

17

12

$40

91%

(32)

$8

20%

(49)

(71)

($112)

22

49

($41)

(95)

($136)

2022E

$61

33

20

$114

183%

(43)

$71

62%

(69)

(96)

($94)

42

55

$2

2%

(121)

($118)

2023E

$148

67

12

$226

98%

(58)

$168

74%

(96)

(87)

($15)

53

34

$72

32%

(138)

($66)

2024E

$261

113

16

$389

72%

(84)

$305

78%

(128)

(101)

$77

20%

80

21

$177

46%

(66)

$111

2025E

63%

$348

180

18

$546

40%

(110)

$436

80%

(190)

(102)

$144

26%

79

23

$246

45%

% FCF conversion

Note: Financials represent BlackSky only and exclude discontinued operations for the Launch Division which was sold in June 2020. Other Operating Expense includes expenses related

to transaction, employee retention bonuses, shared launch services, stock compensation, depreciation and amortization. 2019A and 2020A financials are audited.

1. Adj. EBITDA is a non-GAAP measure. See reconciliation of historic measure in Appendix. 2. Free cash flow defined as Adj. EBITDA - Capex. 3. Free cash flow conversion

defined as (Adj. EBITDA - Capex) / Adj. EBITDA.

Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary.

(37)

$209

85%

33View entire presentation