Maersk Investor Presentation Deck

Key statements

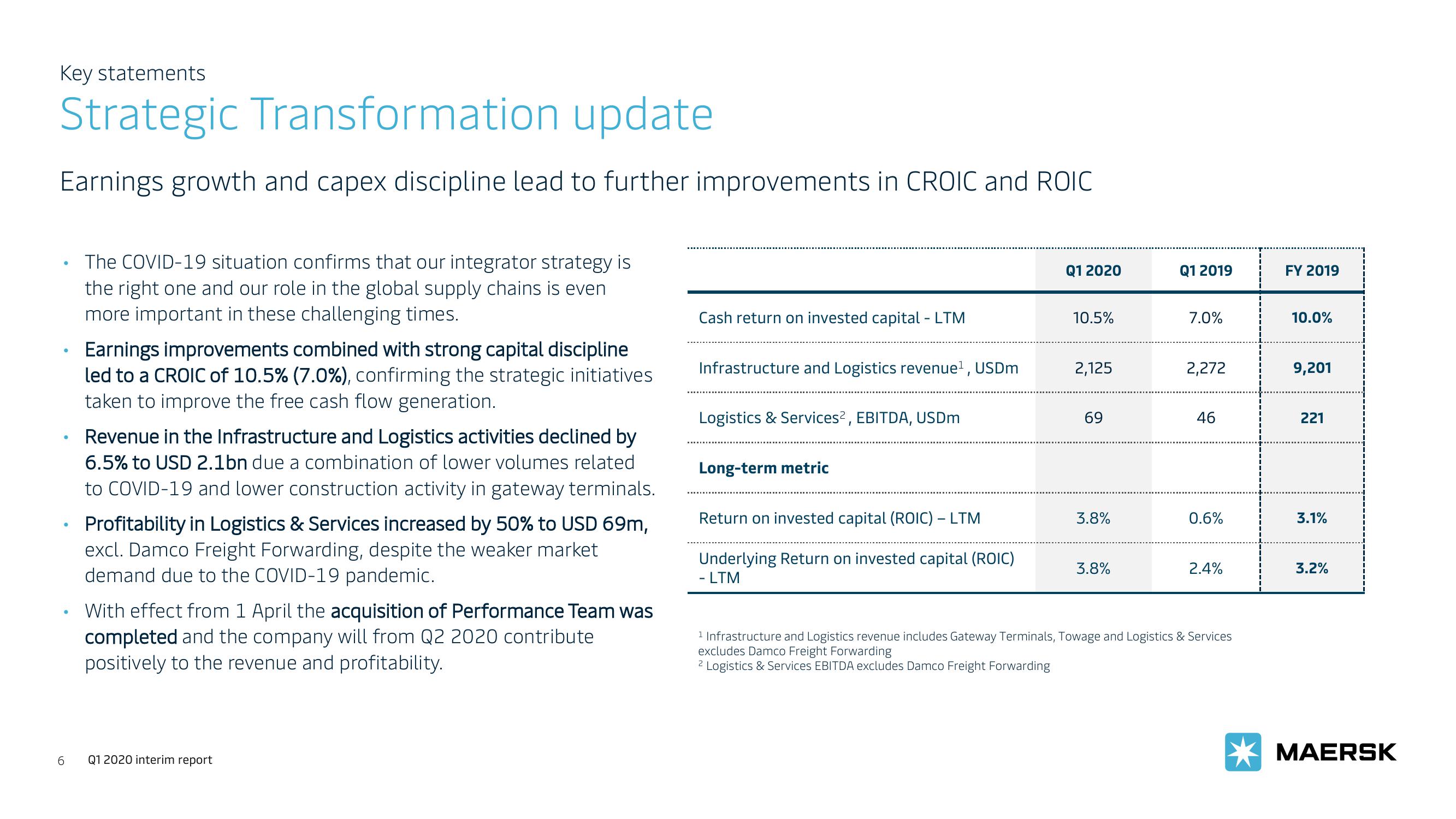

Strategic Transformation update

Earnings growth and capex discipline lead to further improvements in CROIC and ROIC

6

The COVID-19 situation confirms that our integrator strategy is

the right one and our role in the global supply chains is even

more important in these challenging times.

Earnings improvements combined with strong capital discipline

led to a CROIC of 10.5% (7.0%), confirming the strategic initiatives

taken to improve the free cash flow generation.

Revenue in the Infrastructure and Logistics activities declined by

6.5% to USD 2.1bn due a combination of lower volumes related

to COVID-19 and lower construction activity in gateway terminals.

Profitability in Logistics & Services increased by 50% to USD 69m,

excl. Damco Freight Forwarding, despite the weaker market

demand due to the COVID-19 pandemic.

With effect from 1 April the acquisition of Performance Team was

completed and the company will from Q2 2020 contribute

positively to the revenue and profitability.

Q1 2020 interim report

Cash return on invested capital - LTM

Infrastructure and Logistics revenue¹, USDm

Logistics & Services², EBITDA, USDm

Long-term metric

Return on invested capital (ROIC) - LTM

Underlying Return on invested capital (ROIC)

- LTM

Q1 2020

10.5%

2,125

69

3.8%

3.8%

Q1 2019

7.0%

2,272

46

0.6%

2.4%

¹ Infrastructure and Logistics revenue includes Gateway Terminals, Towage and Logistics & Services

excludes Damco Freight Forwarding

² Logistics & Services EBITDA excludes Damco Freight Forwarding

FY 2019

10.0%

9,201

221

3.1%

3.2%

MAERSKView entire presentation