Codere SPAC Presentation Deck

Comparable Company Benchmarking Detail

(3)

(4)

(5)

Company

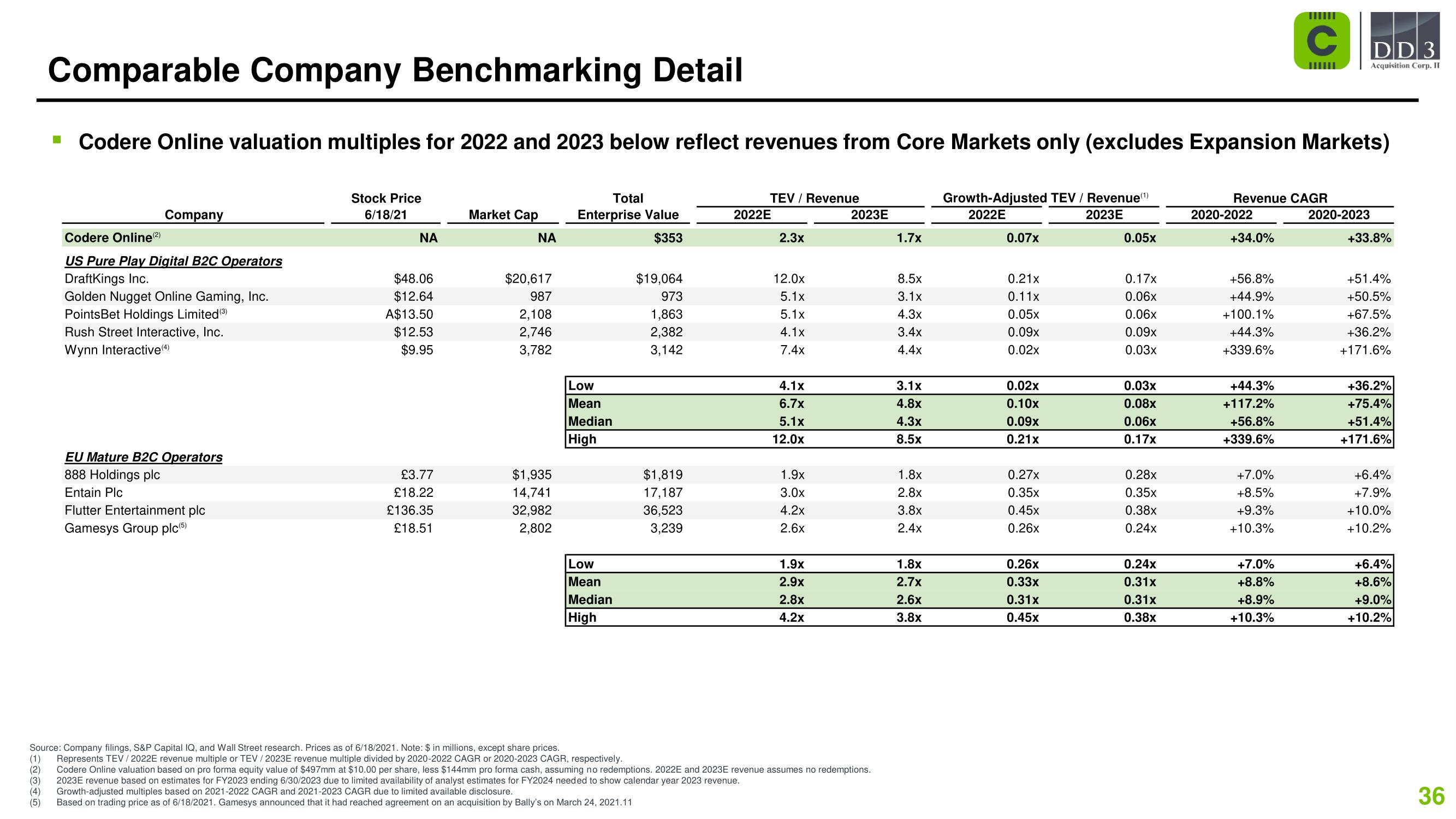

Codere Online valuation multiples for 2022 and 2023 below reflect revenues from Core Markets only (excludes Expansion Markets)

Stock Price

6/18/21

Total

Enterprise Value

$353

Growth-Adjusted TEV / Revenue (¹)

2022E

2023E

Codere Online (²)

US Pure Play Digital B2C Operators

DraftKings Inc.

Golden Nugget Online Gaming, Inc.

PointsBet Holdings Limited (³)

Rush Street Interactive, Inc.

Wynn Interactive (4)

EU Mature B2C Operators

888 Holdings plc

Entain Plc

Flutter Entertainment plc

Gamesys Group plc (5)

ΝΑ

$48.06

$12.64

A$13.50

$12.53

$9.95

£3.77

£18.22

£136.35

£18.51

Market Cap

ΝΑ

$20,617

987

2,108

2,746

3,782

$1,935

14,741

32,982

2,802

Low

Mean

Median

High

Low

Mean

Median

High

$19,064

973

1,863

2,382

3,142

$1,819

17,187

36,523

3,239

TEV / Revenue

2022E

2.3x

12.0x

5.1x

5.1x

4.1x

7.4x

4.1x

6.7x

5.1x

12.0x

1.9x

3.0x

4.2x

2.6x

1.9x

2.9x

2.8x

4.2x

2023E

Source: Company filings, S&P Capital IQ, and Wall Street research. Prices as of 6/18/2021. Note: $ in millions, except share prices.

(1) Represents TEV /2022E revenue multiple or TEV / 2023E revenue multiple divided by 2020-2022 CAGR or 2020-2023 CAGR, respectively.

(2)

Codere Online valuation based on pro forma equity value of $497mm at $10.00 per share, less $144mm pro forma cash, assuming no redemptions. 2022E and 2023E revenue assumes no redemptions.

2023E revenue based on estimates for FY2023 ending 6/30/2023 due to limited availability of analyst estimates for FY2024 needed to show calendar year 2023 revenue.

Growth-adjusted multiples based on 2021-2022 CAGR and 2021-2023 CAGR due to limited available disclosure.

Based on trading price as of 6/18/2021. Gamesys announced that it had reached agreement on an acquisition by Bally's on March 24, 2021.11

1.7x

8.5x

3.1x

4.3x

3.4x

4.4x

3.1x

4.8x

4.3x

8.5x

1.8x

2.8x

3.8x

2.4x

1.8x

2.7x

2.6x

3.8x

0.07x

0.21x

0.11x

0.05x

0.09x

0.02x

0.02x

0.10x

0.09x

0.21x

0.27x

0.35x

0.45x

0.26x

0.26x

0.33x

0.31x

0.45x

0.05x

0.17x

0.06x

0.06x

0.09x

0.03x

0.03x

0.08x

0.06x

0.17x

0.28x

0.35x

0.38x

0.24x

0.24x

0.31x

0.31x

0.38x

Revenue CAGR

2020-2022

+34.0%

+56.8%

+44.9%

+100.1%

+44.3%

+339.6%

+44.3%

+117.2%

+56.8%

+339.6%

C

+7.0%

+8.5%

+9.3%

+10.3%

+7.0%

+8.8%

+8.9%

+10.3%

DD 3

Acquisition Corp. II

2020-2023

+33.8%

+51.4%

+50.5%

+67.5%

+36.2%

+171.6%

+36.2%

+75.4%

+51.4%

+171.6%

+6.4%

+7.9%

+10.0%

+10.2%

+6.4%

+8.6%

+9.0%

+10.2%

36View entire presentation