Allwyn SPAC

Positive Tailwinds

Allwyn is one of the

largest multi-market

lottery operators

●

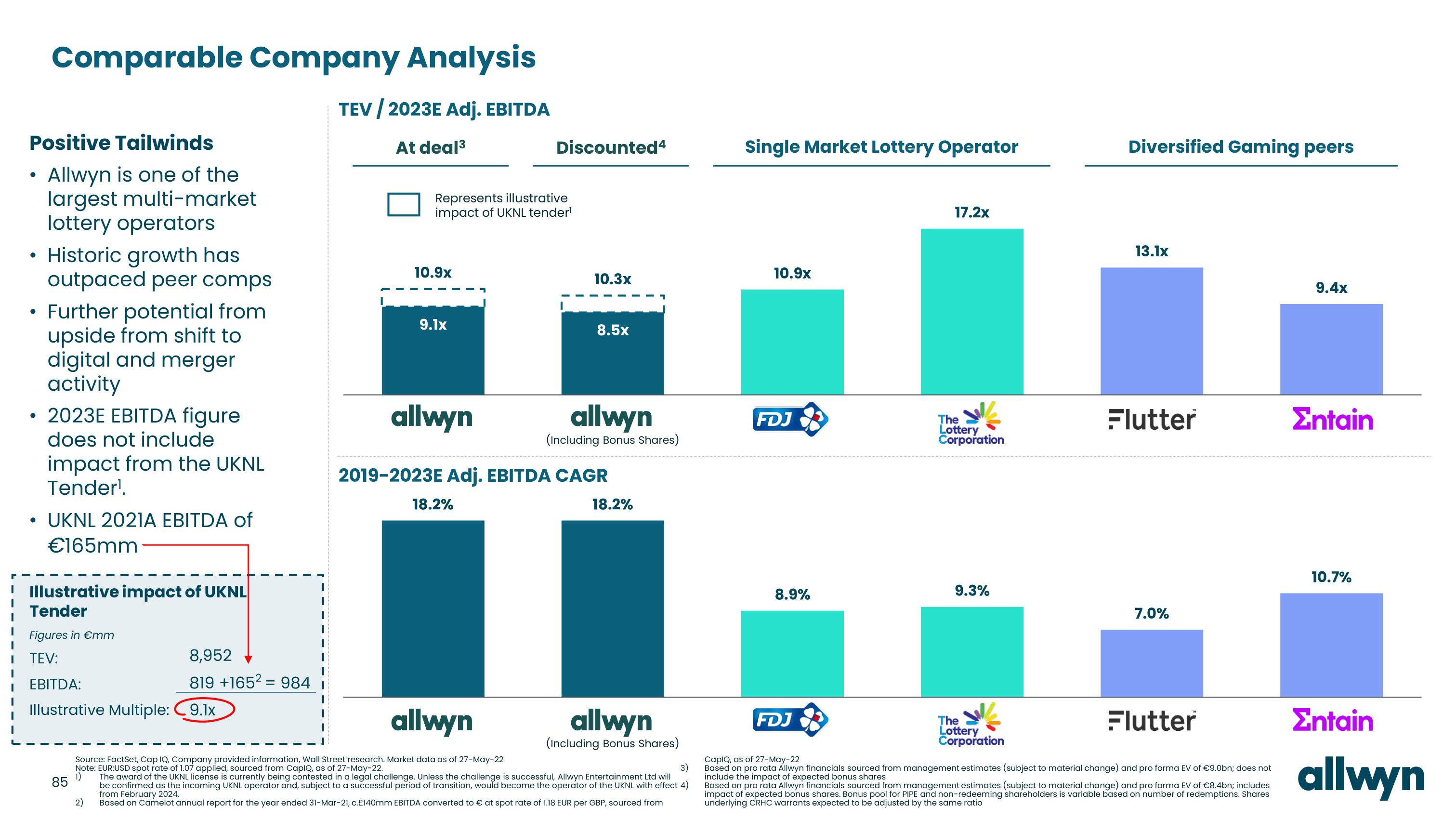

Comparable Company Analysis

TEV / 2023E Adj. EBITDA

At deal³

• Historic growth has

●

outpaced peer comps

• Further potential from

upside from shift to

digital and merger

activity

• 2023E EBITDA figure

does not include

impact from the UKNL

Tender¹.

●

UKNL 2021A EBITDA of

€165mm

Illustrative impact of UKNL

Tender

Figures in €mm

TEV:

EBITDA:

Illustrative Multiple: 9.1x

85

8,952

819 +1652 984

2)

Represents illustrative

impact of UKNL tender¹

10.9x

9.1x

allwyn

Discounted 4

18.2%

10.3x

8.5x

allwyn

(Including Bonus Shares)

2019-2023E Adj. EBITDA CAGR

18.2%

allwyn

(Including Bonus Shares)

allwyn

Source: FactSet, Cap IQ, Company provided information, Wall Street research. Market data as of 27-May-22

Note: EUR:USD spot rate of 1.07 applied, sourced from CapIQ, as of 27-May-22.

3)

1)

The award of the UKNL license is currently being contested in a legal challenge. Unless the challenge is successful, Allwyn Entertainment Ltd will

be confirmed as the incoming UKNL operator and, subject to a successful period of transition, would become the operator of the UKNL with effect 4)

from February 2024.

Based on Camelot annual report for the year ended 31-Mar-21, c.£140mm EBITDA converted to € at spot rate of 1.18 EUR per GBP, sourced from

Single Market Lottery Operator

10.9x

FDJ

8.9%

17.2x

FDJ

The

Lottery

Corporation

9.3%

Diversified Gaming peers

The

Lottery

Corporation

13.1x

Flutter

Flutter

CapIQ, as of 27-May-22

Based on pro rata Allwyn financials sourced from management estimates (subject to material change) and pro forma EV of €9.0bn; does not

include the impact of expected bonus shares

Based on pro rata Allwyn financials sourced from management estimates (subject to material change) and pro forma EV of €8.4bn; includes

impact of expected bonus shares. Bonus pool for PIPE and non-redeeming shareholders is variable based on number of redemptions. Shares

underlying CRHC warrants expected to be adjusted by the same ratio

7.0%

9.4x

Entain

10.7%

Σntain

allwynView entire presentation