Nuvei Results Presentation Deck

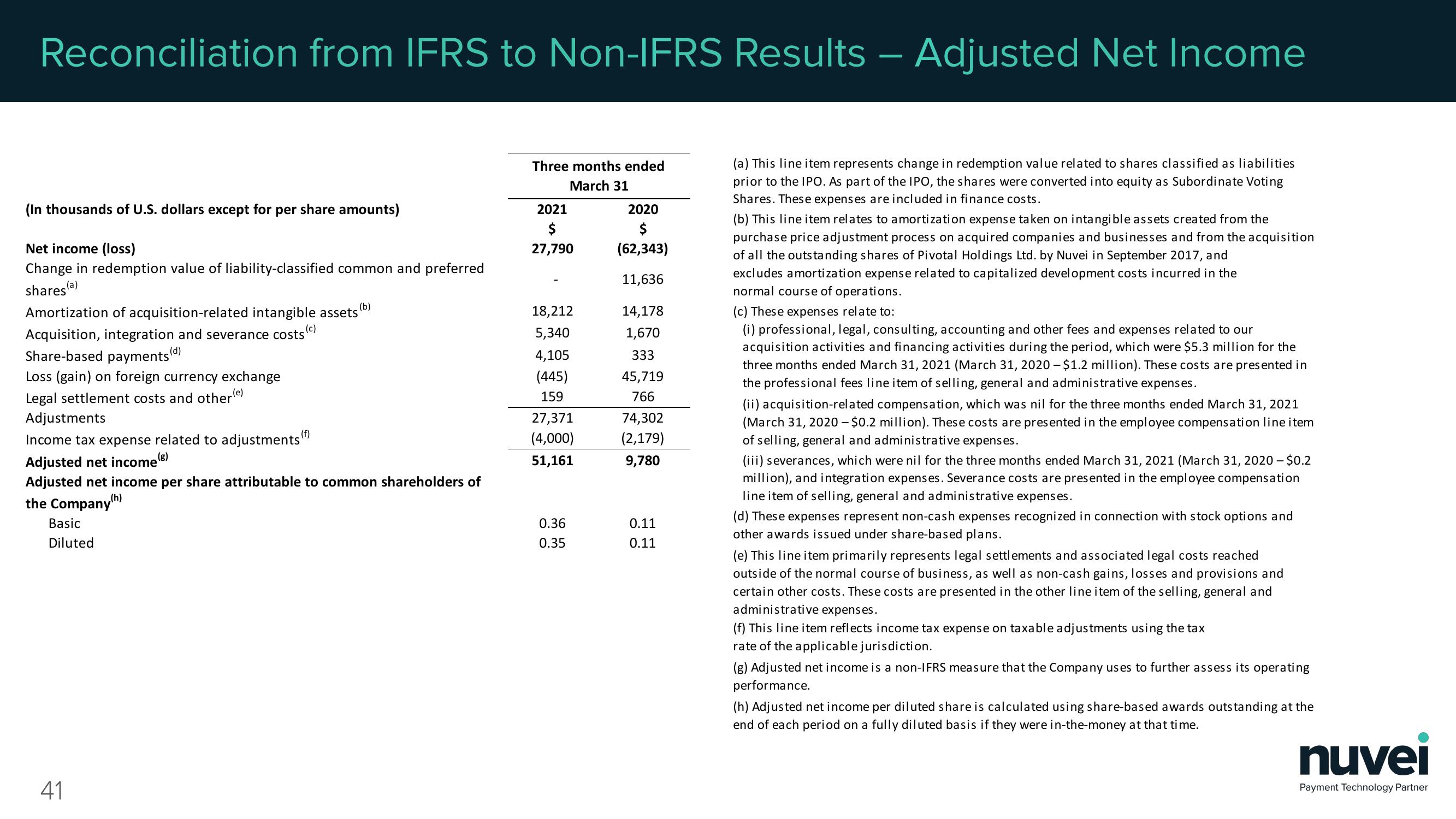

Reconciliation from IFRS to Non-IFRS Results – Adjusted Net Income

(In thousands of U.S. dollars except for per share amounts)

Net income (loss)

Change in redemption value of liability-classified common and preferred

sharesla

(a)

(b)

Amortization of acquisition-related intangible assets

Acquisition, integration and severance costs (c)

Share-based payments(d)

Loss (gain) on foreign currency exchange

Legal settlement costs and other(e)

Adjustments

Income tax expense related to adjustments()

Adjusted net income (8)

Adjusted net income per share attributable to common shareholders of

(h)

the Company"

Basic

Diluted

41

Three months ended

March 31

2021

$

27,790

18,212

5,340

4,105

(445)

159

27,371

(4,000)

51,161

0.36

0.35

2020

$

(62,343)

11,636

14,178

1,670

333

45,719

766

74,302

(2,179)

9,780

0.11

0.11

(a) This line item represents change in redemption value related to shares classified as liabilities

prior to the IPO. As part of the IPO, the shares were converted into equity as Subordinate Voting

Shares. These expenses are included in finance costs.

(b) This line item relates to amortization expense taken on intangible assets created from the

purchase price adjustment process on acquired companies and businesses and from the acquisition

of all the outstanding shares of Pivotal Holdings Ltd. by Nuvei in September 2017, and

excludes amortization expense related to capitalized development costs incurred in the

normal course of operations.

(c) These expenses relate to:

(i) professional, legal, consulting, accounting and other fees and expenses related to our

acquisition activities and financing activities during the period, which were $5.3 million for the

three months ended March 31, 2021 (March 31, 2020 - $1.2 million). These costs are presented in

the professional fees line item of selling, general and administrative expenses.

(ii) acquisition-related compensation, which was nil for the three months ended March 31, 2021

(March 31, 2020 - $0.2 million). These costs are presented in the employee compensation line item

of selling, general and administrative expenses.

(iii) severances, which were nil for the three months ended March 31, 2021 (March 31, 2020 - $0.2

million), and integration expenses. Severance costs are presented in the employee compensation

line item of selling, general and administrative expenses.

(d) These expenses represent non-cash expenses recognized in connection with stock options and

other awards issued under share-based plans.

(e) This line item primarily represents legal settlements and associated legal costs reached

outside of the normal course of business, as well as non-cash gains, losses and provisions and

certain other costs. These costs are presented in the other line item of the selling, general and

administrative expenses.

(f) This line item reflects income tax expense on taxable adjustments using the tax

rate of the applicable jurisdiction.

(g) Adjusted net income is a non-IFRS measure that the Company uses to further assess its operating

performance.

(h) Adjusted net income per diluted share is calculated using share-based awards outstanding at the

end of each period on a fully diluted basis if they were in-the-money at that time.

nuvei

Payment Technology PartnerView entire presentation