Embark SPAC Presentation Deck

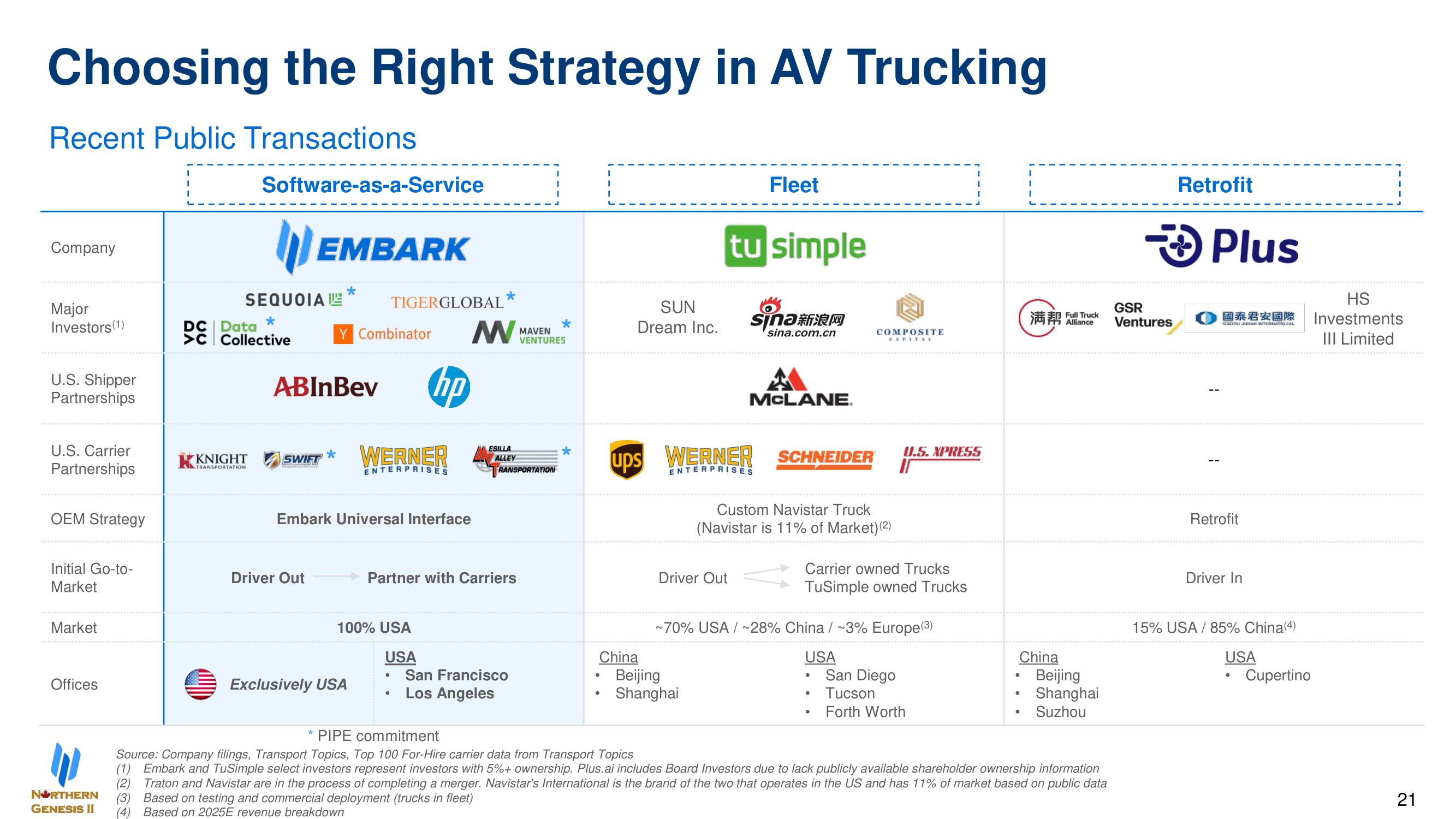

Choosing the Right Strategy in AV Trucking

Recent Public Transactions

Company

Major

Investors (1)

U.S. Shipper

Partnerships

U.S. Carrier

Partnerships

OEM Strategy

Initial Go-to-

Market

Market

Offices

W

NORTHERN

GENESIS II

DC Data

Software-as-a-Service

SEQUOIA

*

Collective

KNIGHT

TRANSPORTATION

EMBARK

*

Driver Out

ABInBev hp

*

SWIFT WERNER

TRANSPORTATARN

ENTERPRISES

Y Combinator M

TIGERGLOBAL

Embark Universal Interface

Exclusively USA

100% USA

USA

●

*

●

Partner with Carriers

ESILLA

ALLEY

RANSPORTATION

San Francisco

Los Angeles

*

MAVEN

VENTURES

*

I

I

SUN

Dream Inc.

ups

China

tu simple

Fleet

WERNER

ENTERPRISES

Driver Out

Beijing

Shanghai

sna新浪网

sina.com.cn

McLANE.

SCHNEIDER

Custom Navistar Truck

(Navistar is 11% of Market) (2)

COMPOSITE

CAPITAL

●

Carrier owned Trucks

TuSimple owned Trucks

~70% USA /~28% China / ~3% Europe(3)

USA

●

U.S.XPRESS

●

I

San Diego

Tucson

Forth Worth

Full Truck

China

Beijing

Shanghai

Suzhou

*PIPE commitment

Source: Company filings, Transport Topics, Top 100 For-Hire carrier data from Transport Topics

(1) Embark and TuSimple select investors represent investors with 5%+ ownership. Plus.ai includes Board Investors due to lack publicly available shareholder ownership information

(2) Traton and Navistar are in the process of completing a merger. Navistar's International is the brand of the two that operates in the US and has 11% of market based on public data

(3) Based on testing and commercial deployment (trucks in fleet)

(4) Based on 2025E revenue breakdown

Retrofit

→→Plus

GSR

Ventures

國泰君安國際

GUOTAL JUNAN INTERNATIONAL

Retrofit

Driver In

15% USA / 85% China(4)

USA

Cupertino

HS

Investments

III Limited

21View entire presentation