Tao Overview Presentation to State of Connecticut Retirement Plans and Trust Funds

TAO GLOBAL CURRENT PORTFOLIO

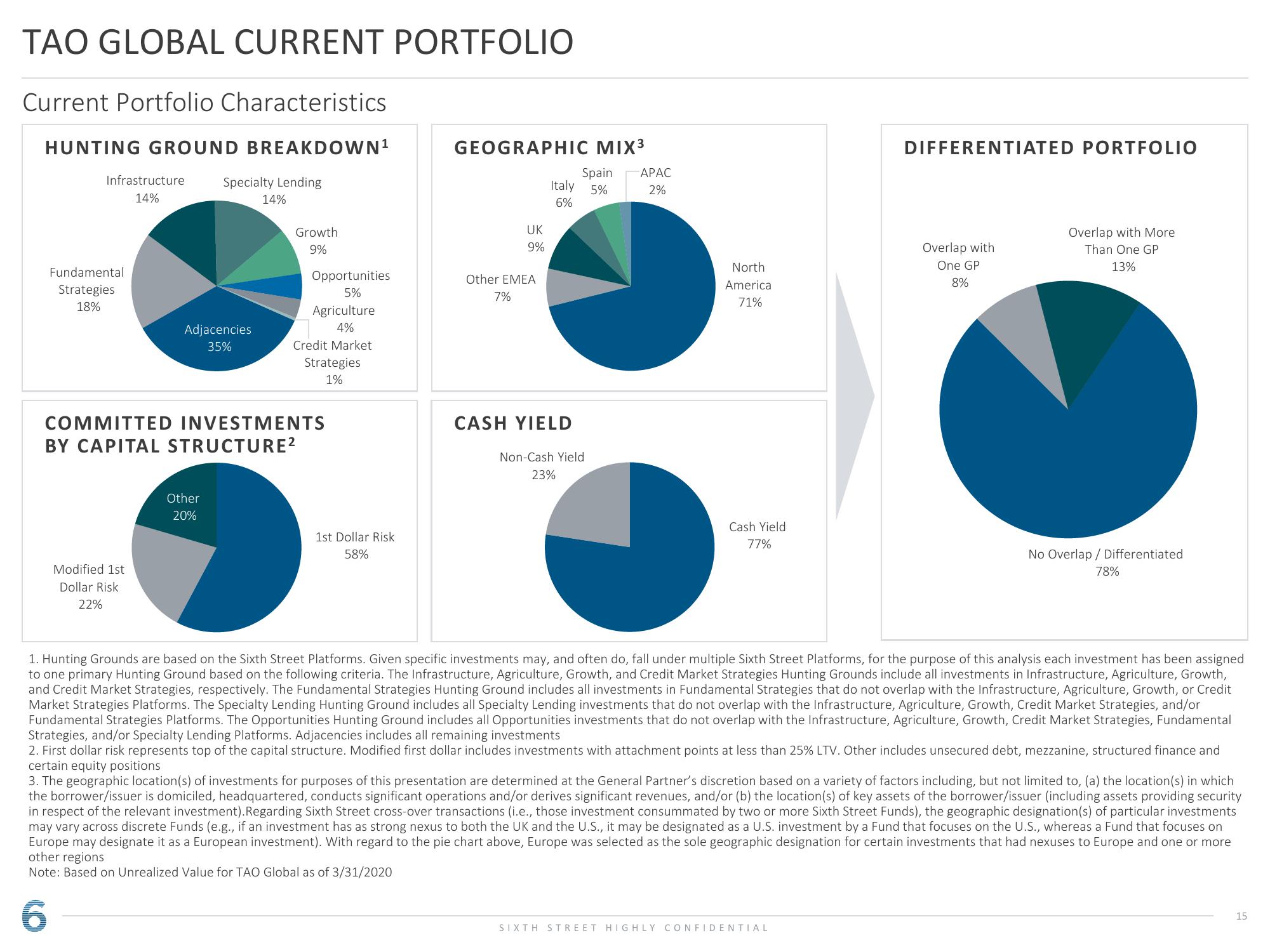

Current Portfolio Characteristics

HUNTING GROUND BREAKDOWN¹

Infrastructure

14%

Fundamental

Strategies

18%

Modified 1st

Dollar Risk

22%

Specialty Lending

Adjacencies

35%

Other

20%

14%

Growth

9%

Opportunities

5%

Agriculture

4%

Credit Market

COMMITTED INVESTMENTS

BY CAPITAL STRUCTURE²

Strategies

1%

1st Dollar Risk

58%

GEOGRAPHIC MIX³

UK

9%

Other EMEA

7%

Spain -APAC

2%

Italy 5%

6%

CASH YIELD

Non-Cash Yield

23%

North

America

71%

O Cash Yield

77%

DIFFERENTIATED PORTFOLIO

SIXTH STREET HIGHLY CONFIDENTIAL

Overlap with

One GP

8%

Overlap with More

Than One GP

13%

No Overlap / Differentiated

78%

1. Hunting Grounds are based on the Sixth Street Platforms. Given specific investments may, and often do, fall under multiple Sixth Street Platforms, for the purpose of this analysis each investment has been assigned

to one primary Hunting Ground based on the following criteria. The Infrastructure, Agriculture, Growth, and Credit Market Strategies Hunting Grounds include all investments in Infrastructure, Agriculture, Growth,

and Credit Market Strategies, respectively. The Fundamental Strategies Hunting Ground includes all investments in Fundamental Strategies that do not overlap with the Infrastructure, Agriculture, Growth, or Credit

Market Strategies Platforms. The Specialty Lending Hunting Ground includes all Specialty Lending investments that do not overlap with the Infrastructure, Agriculture, Growth, Credit Market Strategies, and/or

Fundamental Strategies Platforms. The Opportunities Hunting Ground includes all Opportunities investments that do not overlap with the Infrastructure, Agriculture, Growth, Credit Market Strategies, Fundamental

Strategies, and/or Specialty Lending Platforms. Adjacencies includes all remaining investments

2. First dollar risk represents top of the capital structure. Modified first dollar includes investments with attachment points at less than 25% LTV. Other includes unsecured debt, mezzanine, structured finance and

certain equity positions

3. The geographic location(s) of investments for purposes of this presentation are determined at the General Partner's discretion based on a variety of factors including, but not limited to, (a) the location(s) in which

the borrower/issuer is domiciled, headquartered, conducts significant operations and/or derives significant revenues, and/or (b) the location(s) of key assets of the borrower/issuer (including assets providing security

in respect of the relevant investment). Regarding Sixth Street cross-over transactions (i.e., those investment consummated by two or more Sixth Street Funds), the geographic designation(s) of particular investments

may vary across discrete Funds (e.g., if an investment has as strong nexus to both the UK and the U.S., it may be designated as a U.S. investment by a Fund that focuses on the U.S., whereas a Fund that focuses on

Europe may designate it as a European investment). With regard to the pie chart above, Europe was selected as the sole geographic designation for certain investments that had nexuses to Europe and one or more

other regions

Note: Based on Unrealized Value for TAO Global as of 3/31/2020

6

15View entire presentation