Endeavour Mining Investor Presentation Deck

Q1-2022 vs Q4-2021 INSIGHTS

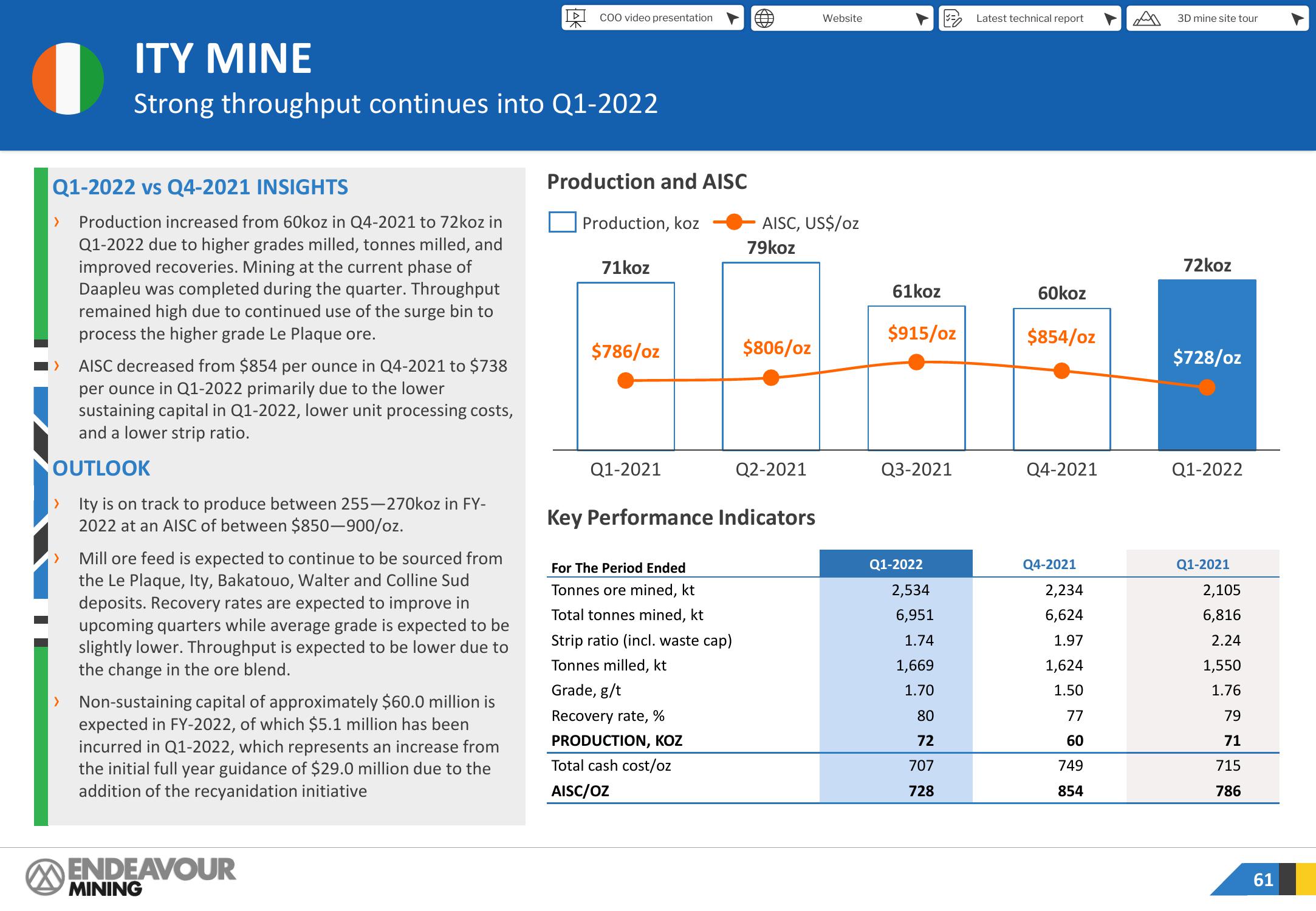

> Production increased from 60koz in Q4-2021 to 72koz in

Q1-2022 due to higher grades milled, tonnes milled, and

improved recoveries. Mining at the current phase of

Daapleu was completed during the quarter. Throughput

remained high due to continued use of the surge bin to

process the higher grade Le Plaque ore.

>

AISC decreased from $854 per ounce in Q4-2021 to $738

per ounce in Q1-2022 primarily due to the lower

sustaining capital in Q1-2022, lower unit processing costs,

and a lower strip ratio.

OUTLOOK

Ity is on track to produce between 255-270koz in FY-

2022 at an AISC of between $850-900/oz.

>

ITY MINE

Strong throughput continues into Q1-2022

Mill ore feed is expected to continue to be sourced from

the Le Plaque, Ity, Bakatouo, Walter and Colline Sud

deposits. Recovery rates are expected to improve in

upcoming quarters while average grade is expected to be

slightly lower. Throughput is expected to be lower due to

the change in the ore blend.

Non-sustaining capital of approximately $60.0 million is

expected in FY-2022, of which $5.1 million has been

incurred in Q1-2022, which represents an increase from

the initial full year guidance of $29.0 million due to the

addition of the recyanidation initiative

ENDEAVOUR

A

MINING

COO video presentation

Production and AISC

Production, koz

71koz

$786/oz

H

Q1-2021

61koz

$915/oz

8000

$806/oz

Q2-2021

Q3-2021

Website

AISC, US$/oz

79koz

Key Performance Indicators

For The Period Ended

Tonnes ore mined, kt

Total tonnes mined, kt

Strip ratio (incl. waste cap)

Tonnes milled, kt

Grade, g/t

Recovery rate, %

PRODUCTION, KOZ

Total cash cost/oz

AISC/OZ

Q1-2022

2,534

6,951

1.74

1,669

1.70

Latest technical report

80

72

707

728

60koz

$854/oz

Q4-2021

Q4-2021

2,234

6,624

1.97

1,624

1.50

77

60

749

854

3D mine site tour

72koz

$728/oz

Q1-2022

Q1-2021

2,105

6,816

2.24

1,550

1.76

79

71

715

786

61View entire presentation