Trian Partners Activist Presentation Deck

Consumer Companies with Nelson on the Board Have Consistently

Outperformed P&G

P&G Spin

"Since the CEO transition on November 1, 2015, our team has delivered total shareholder return ("TSR") of 27%...the

weighted average return of the companies where Mr. Peltz serves as a Board member has been only 8%"

- Letter From David Taylor to Shareholders, 8/14/17

Reality

Companies where Nelson serves as a director have meaningfully higher TSR than P&G's. Mr. Taylor's letter and

methodology are highly misleading for the following reasons:

1) Arbitrary Time Frame: Why is David Taylor's tenure the right time frame for evaluating companies Nelson has been

involved with? Wouldn't it be far more logical to look at the time frame that Nelson has been involved at those companies?

"Market Value Weighted Average" TSR Methodology: P&G uses a market value weighted TSR metric to measure

Nelson's performance. This methodology is inherently misleading. For example, P&G's methodology weights Mondelēz's

TSR performance at ~30x that of Wendy's, based on relative market values! What's more, P&G uses a simple average as

opposed to a weighted average to measure its own peers' performance, making its results look more favorable

2)

3)

P&G Has Underperformed Under This Board's Watch: The reality is that a significant majority of P&G's directors have

seen the Company underperform both the S&P 500 and peers since they were appointed

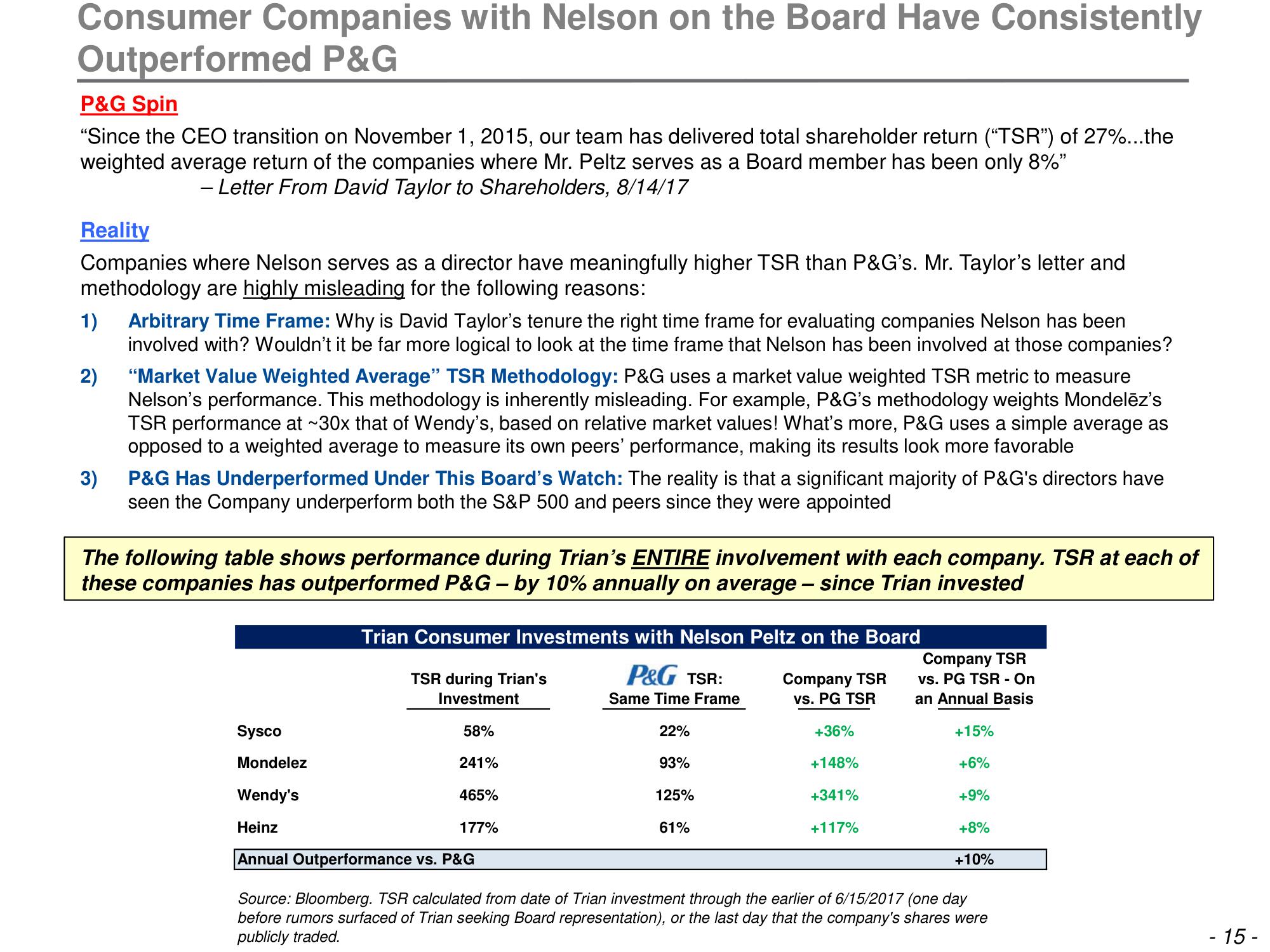

The following table shows performance during Trian's ENTIRE involvement with each company. TSR at each of

these companies has outperformed P&G - by 10% annually on average - since Trian invested

Trian Consumer Investments with Nelson Peltz on the Board

P&G TSR:

Same Time Frame

22%

93%

TSR during Trian's

Investment

58%

Sysco

Mondelez

Wendy's

Heinz

Annual Outperformance vs. P&G

241%

465%

177%

125%

61%

Company TSR

vs. PG TSR

+36%

+148%

+341%

+117%

Company TSR

vs. PG TSR - On

an Annual Basis

+15%

+6%

+9%

+8%

+10%

Source: Bloomberg. TSR calculated from date of Trian investment through the earlier of 6/15/2017 (one day

before rumors surfaced of Trian seeking Board representation), or the last day that the company's shares were

publicly traded.

- 15 -View entire presentation