VICI Investor Presentation

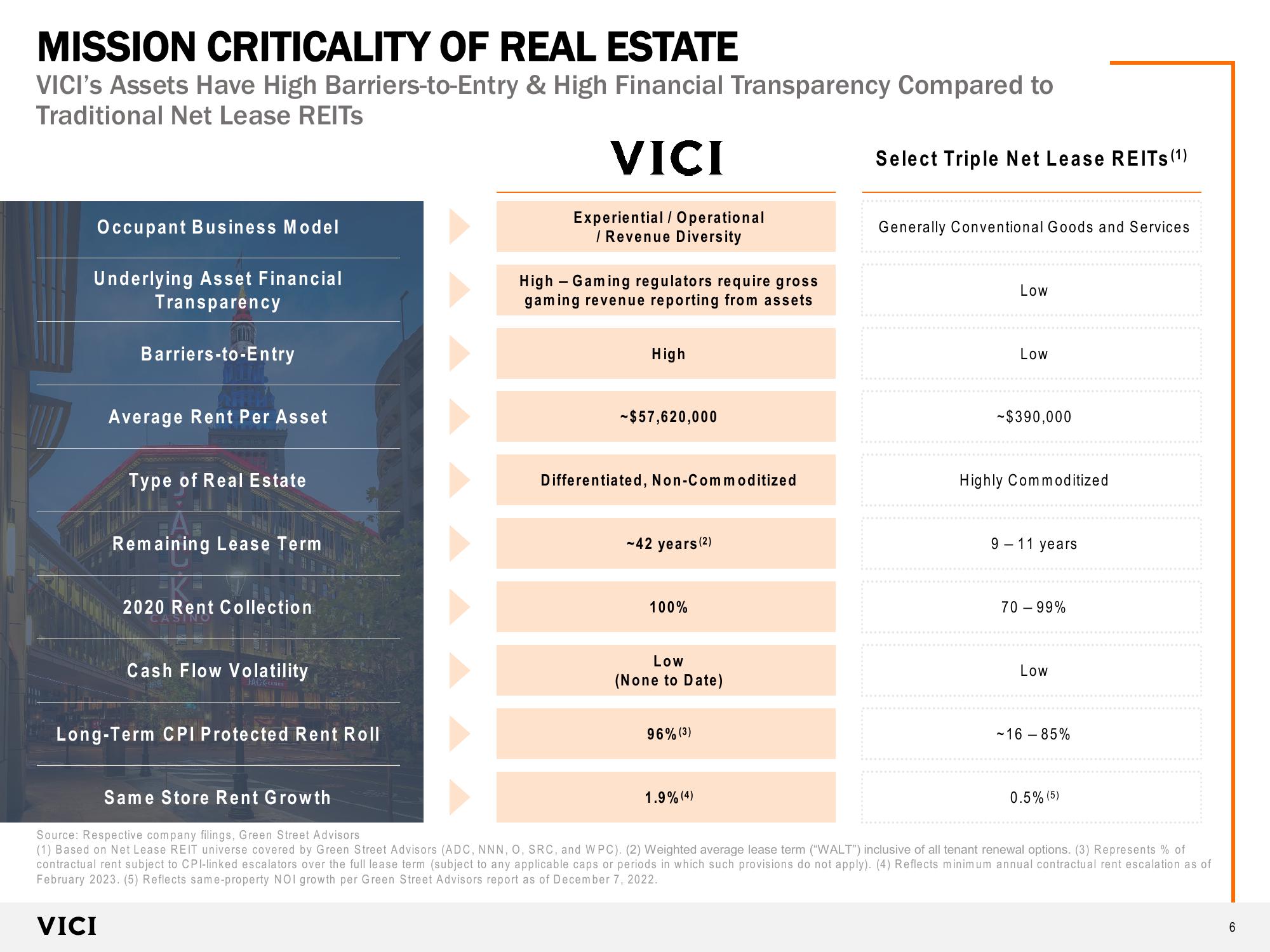

MISSION CRITICALITY OF REAL ESTATE

VICI's Assets Have High Barriers-to-Entry & High Financial Transparency Compared to

Traditional Net Lease REITS

Occupant Business Model

Underlying Asset Financial

Transparency

Barriers-to-Entry

Average Rent Per Asset

Type of Real Estate

Remaining Lease Term

2020 Rent Collection

CASINO

Cash Flow Volatility

P

Long-Term CPI Protected Rent Roll

VICI

Experiential / Operational

/ Revenue Diversity

High Gaming regulators require gross

gaming revenue reporting from assets

High

-$57,620,000

Differentiated, Non-Commoditized

-42 years (²)

100%

Low

(None to Date)

96% (3)

Select Triple Net Lease REITs (1)

1.9% (4)

Generally Conventional Goods and Services

Low

Low

-$390,000

Highly Commoditized

9-11 years

70 - 99%

Low

-16-85%

Same Store Rent Growth

Source: Respective company filings, Green Street Advisors

(1) Based on Net Lease REIT universe covered by Green Street Advisors (ADC, NNN, O, SRC, and WPC). (2) Weighted average lease term ("WALT") inclusive of all tenant renewal options. (3) Represents % of

contractual rent subject to CPI-linked escalators over the full lease term (subject to any applicable caps or periods in which such provisions do not apply). (4) Reflects minimum annual contractual rent escalation as of

February 2023. (5) Reflects same-property NOI growth per Green Street Advisors report as of December 7, 2022.

VICI

0.5% (5)

6View entire presentation