Spring 2023 Solar Industry Update

New Guidance on the Low-Income Communities Bonus

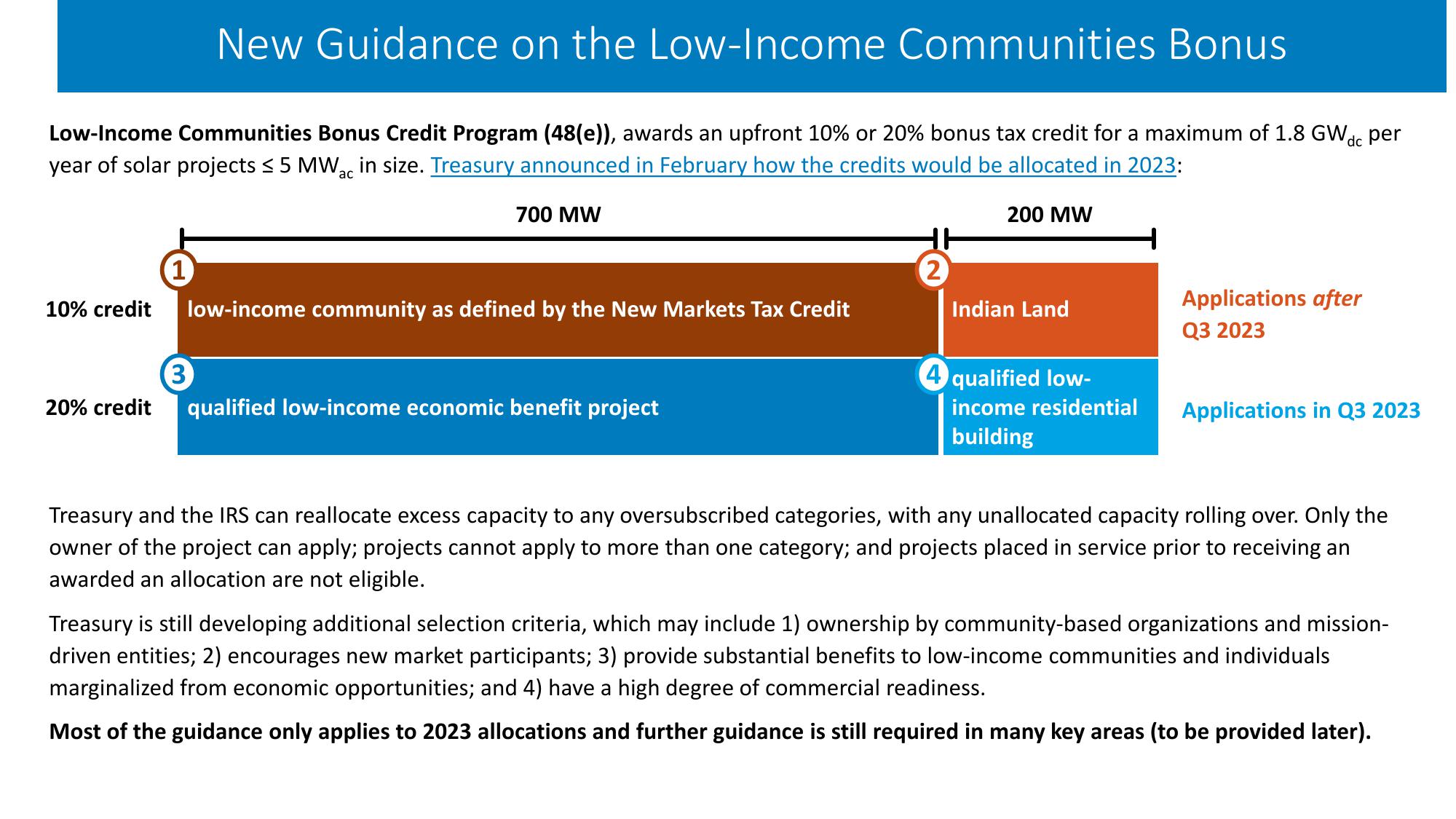

Low-Income Communities Bonus Credit Program (48(e)), awards an upfront 10% or 20% bonus tax credit for a maximum of 1.8 GWdc per

year of solar projects ≤ 5 MW ac in size. Treasury announced in February how the credits would be allocated in 2023:

700 MW

200 MW

1

2

10% credit

low-income community as defined by the New Markets Tax Credit

Indian Land

Applications after

Q3 2023

3

4 qualified low-

20% credit

qualified low-income economic benefit project

income residential

building

Applications in Q3 2023

Treasury and the IRS can reallocate excess capacity to any oversubscribed categories, with any unallocated capacity rolling over. Only the

owner of the project can apply; projects cannot apply to more than one category; and projects placed in service prior to receiving an

awarded an allocation are not eligible.

Treasury is still developing additional selection criteria, which may include 1) ownership by community-based organizations and mission-

driven entities; 2) encourages new market participants; 3) provide substantial benefits to low-income communities and individuals

marginalized from economic opportunities; and 4) have a high degree of commercial readiness.

Most of the guidance only applies to 2023 allocations and further guidance is still required in many key areas (to be provided later).View entire presentation