Comcast Results Presentation Deck

Cable Communications 4th Quarter 2022 Overview

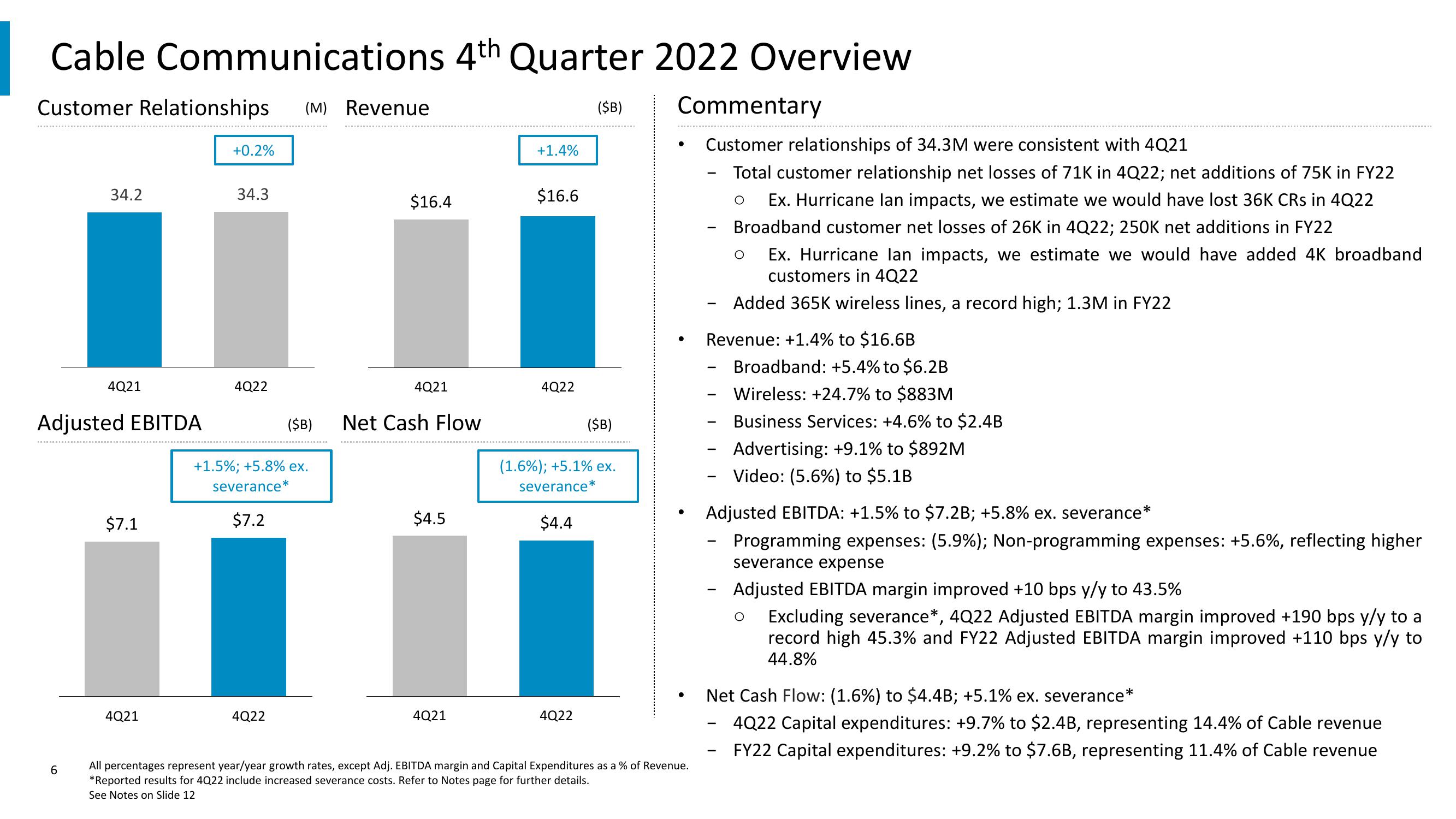

Customer Relationships (M) Revenue

34.2

6

4Q21

Adjusted EBITDA

$7.1

4Q21

+0.2%

34.3

4Q22

+1.5%; +5.8% ex.

severance*

$7.2

4Q22

$16.4

4Q21

($B) Net Cash Flow

$4.5

4Q21

+1.4%

$16.6

4Q22

$4.4

($B)

(1.6%) ; +5.1% ex.

severance*

4Q22

($B)

Commentary

Customer relationships of 34.3M were consistent with 4Q21

Total customer relationship net losses of 71K in 4Q22; net additions of 75K in FY22

O

Ex. Hurricane lan impacts, we estimate we would have lost 36K CRs in 4Q22

Broadband customer net losses of 26K in 4Q22; 250K net additions in FY22

Ex. Hurricane lan impacts, we estimate we would have added 4K broadband

customers in 4Q22

Added 365K wireless lines, a record high; 1.3M in FY22

●

All percentages represent year/year growth rates, except Adj. EBITDA margin and Capital Expenditures as a % of Revenue.

*Reported results for 4Q22 include increased severance costs. Refer to Notes page for further details.

See Notes on Slide 12

Revenue: +1.4% to $16.6B

-

O

-

Broadband: +5.4% to $6.2B

Wireless: +24.7% to $883M

Business Services: +4.6% to $2.4B

Advertising: +9.1% to $892M

Video: (5.6%) to $5.1B

Adjusted EBITDA: +1.5% to $7.2B; +5.8% ex. severance*

Programming expenses: (5.9%); Non-programming expenses: +5.6%, reflecting higher

severance expense

Adjusted EBITDA margin improved +10 bps y/y to 43.5%

O Excluding severance*, 4Q22 Adjusted EBITDA margin improved +190 bps y/y to a

record high 45.3% and FY22 Adjusted EBITDA margin improved +110 bps y/y to

44.8%

Net Cash Flow: (1.6%) to $4.4B; +5.1% ex. severance*

4Q22 Capital expenditures: +9.7% to $2.4B, representing 14.4% of Cable revenue

FY22 Capital expenditures: +9.2% to $7.6B, representing 11.4% of Cable revenueView entire presentation