Paysafe Results Presentation Deck

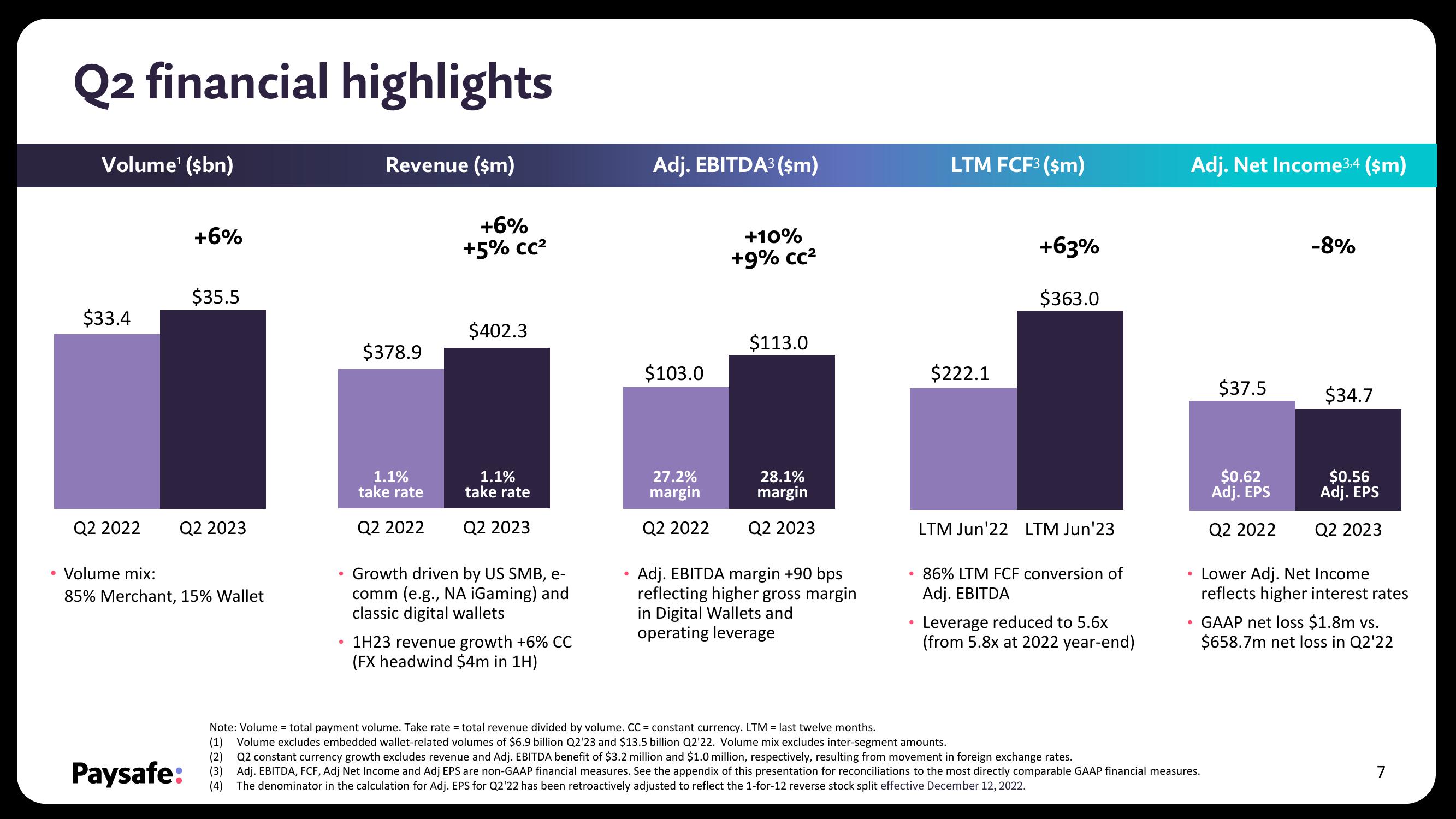

Q2 financial highlights

Volume¹ (sbn)

$33.4

Q2 2022

+6%

$35.5

Q2 2023

Paysafe:

• Volume mix:

85% Merchant, 15% Wallet

Revenue ($m)

(2)

(3)

(4)

$378.9

1.1%

take rate

Q2 2022

+6%

+5% CC²

$402.3

1.1%

take rate

Q2 2023

Growth driven by US SMB, e-

comm (e.g., NA iGaming) and

classic digital wallets

1H23 revenue growth +6% CC

(FX headwind $4m in 1H)

●

Adj. EBITDA³ (sm)

$103.0

27.2%

margin

Q2 2022

+10%

+9% cc²

$113.0

28.1%

margin

Q2 2023

Adj. EBITDA margin +90 bps

reflecting higher gross margin

in Digital Wallets and

operating leverage

LTM FCF3 ($m)

$222.1

+63%

$363.0

LTM Jun'22 LTM Jun 23

Note: Volume = total payment volume. Take rate= total revenue divided by volume. CC = constant currency. LTM = last twelve months.

(1) Volume excludes embedded wallet-related volumes of $6.9 billion Q2'23 and $13.5 billion Q2'22. Volume mix excludes inter-segment amounts.

86% LTM FCF conversion of

Adj. EBITDA

Leverage reduced to 5.6x

(from 5.8x at 2022 year-end)

Adj. Net Income³4 ($m)

●

●

$37.5

Q2 constant currency growth excludes revenue and Adj. EBITDA benefit of $3.2 million and $1.0 million, respectively, resulting from movement in foreign exchange rates.

Adj. EBITDA, FCF, Adj Net Income and Adj EPS are non-GAAP financial measures. See the appendix of this presentation for reconciliations to the most directly comparable GAAP financial measures.

The denominator in the calculation for Adj. EPS for Q2'22 has been retroactively adjusted to reflect the 1-for-12 reverse stock split effective December 12, 2022.

$0.62

Adj. EPS

Q2 2022

-8%

$34.7

$0.56

Adj. EPS

Q2 2023

Lower Adj. Net Income

reflects higher interest rates

GAAP net loss $1.8m vs.

$658.7m net loss in Q2'22

7View entire presentation