Informatica Investor Presentation Deck

31

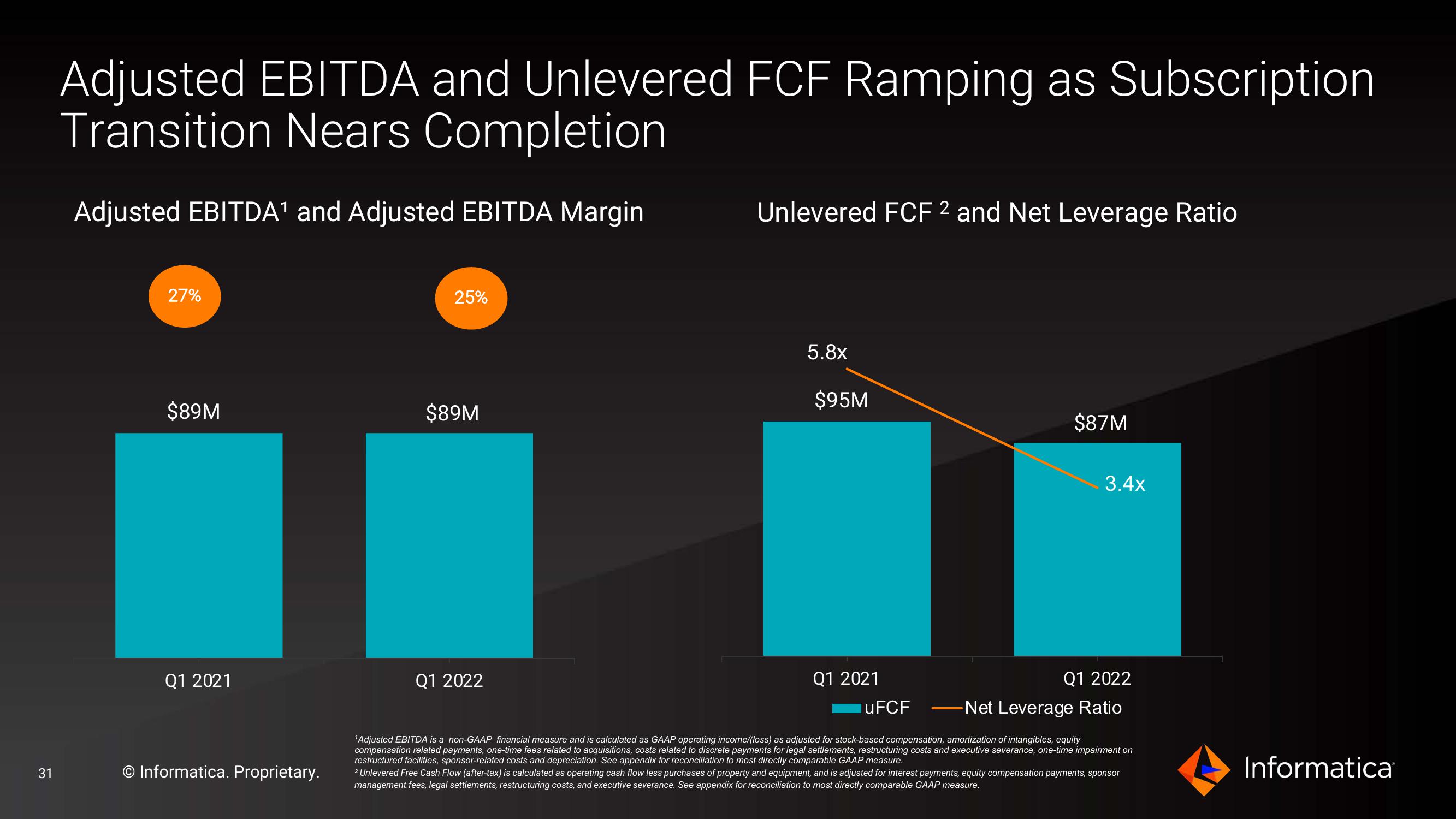

Adjusted EBITDA and Unlevered FCF Ramping as Subscription

Transition Nears Completion

Adjusted EBITDA¹ and Adjusted EBITDA Margin

27%

$89M

Q1 2021

O Informatica. Proprietary.

25%

$89M

Q1 2022

Unlevered FCF 2 and Net Leverage Ratio

5.8x

$95M

Q1 2021

uFCF

$87M

3.4x

Q1 2022

-Net Leverage Ratio

¹Adjusted EBITDA is a non-GAAP financial measure and is calculated as GAAP operating income/(loss) as adjusted for stock-based compensation, amortization of intangibles, equity

compensation related payments, one-time fees related to acquisitions, costs related to discrete payments for legal settlements, restructuring costs and executive severance, one-time impairment on

restructured facilities, sponsor-related costs and depreciation. See appendix for reconciliation to most directly comparable GAAP measure.

2 Unlevered Free Cash Flow (after-tax) is calculated as operating cash flow less purchases of property and equipment, and is adjusted for interest payments, equity compensation payments, sponsor

management fees, legal settlements, restructuring costs, and executive severance. See appendix for reconciliation to most directly comparable GAAP measure.

InformaticaView entire presentation