Blackwells Capital Activist Presentation Deck

EXECUTIVE SUMMARY

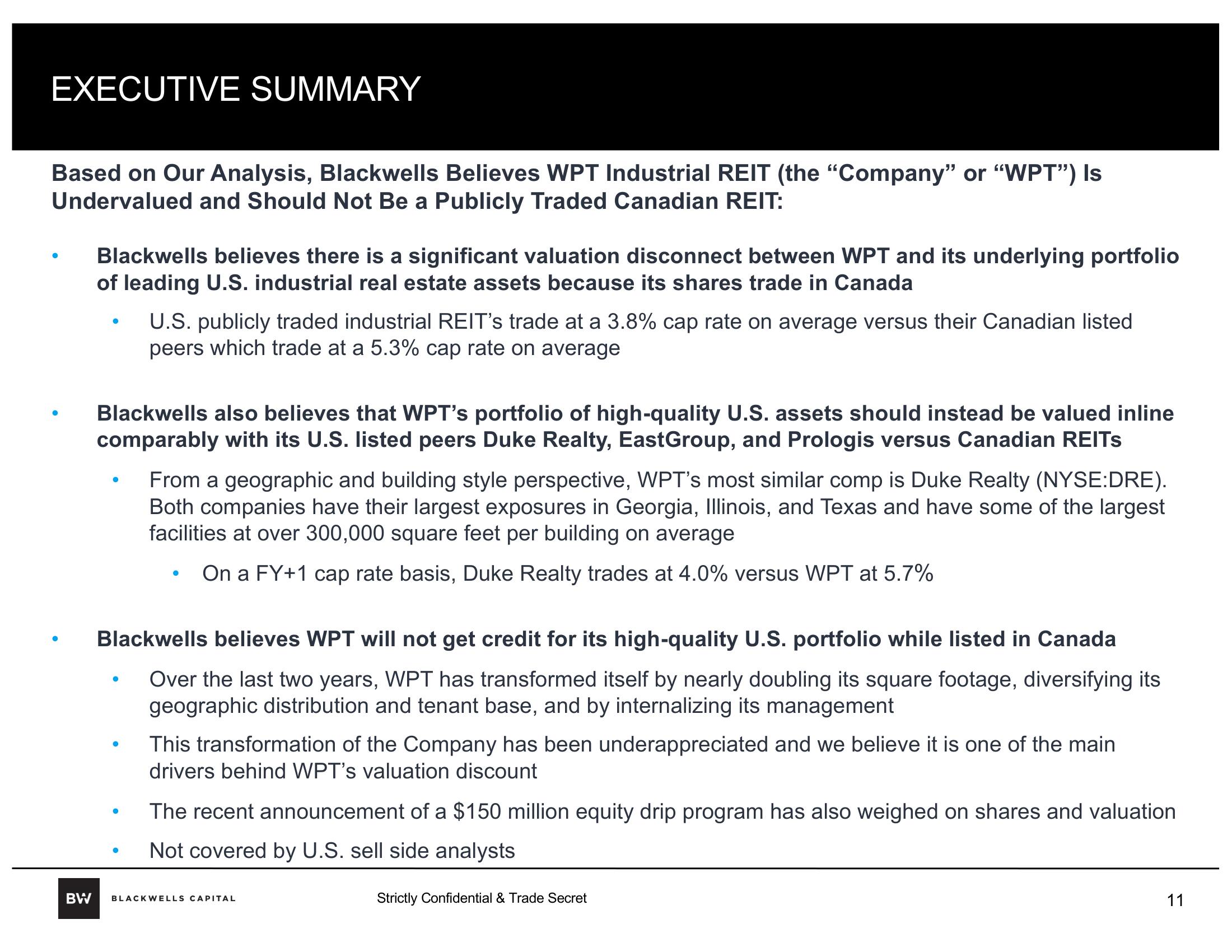

Based on Our Analysis, Blackwells Believes WPT Industrial REIT (the "Company" or "WPT") Is

Undervalued and Should Not Be a Publicly Traded Canadian REIT:

BW

Blackwells believes there is a significant valuation disconnect between WPT and its underlying portfolio

of leading U.S. industrial real estate assets because its shares trade in Canada

Blackwells also believes that WPT's portfolio of high-quality U.S. assets should instead be valued inline

comparably with its U.S. listed peers Duke Realty, EastGroup, and Prologis versus Canadian REITS

●

U.S. publicly traded industrial REIT's trade at a 3.8% cap rate on average versus their Canadian listed

peers which trade at a 5.3% cap rate on average

●

Blackwells believes WPT will not get credit for its high-quality U.S. portfolio while listed in Canada

Over the last two years, WPT has transformed itself by nearly doubling its square footage, diversifying its

geographic distribution and tenant base, and by internalizing its management

●

From a geographic and building style perspective, WPT's most similar comp is Duke Realty (NYSE:DRE).

Both companies have their largest exposures in Georgia, Illinois, and Texas and have some of the largest

facilities at over 300,000 square feet per building on average

On a FY+1 cap rate basis, Duke Realty trades at 4.0% versus WPT at 5.7%

●

This transformation of the Company has been underappreciated and we believe it is one of the main

drivers behind WPT's valuation discount

The recent announcement of a $150 million equity drip program has also weighed on shares and valuation

Not covered by U.S. sell side analysts

BLACKWELLS CAPITAL

Strictly Confidential & Trade Secret

11View entire presentation