Bausch+Lomb Results Presentation Deck

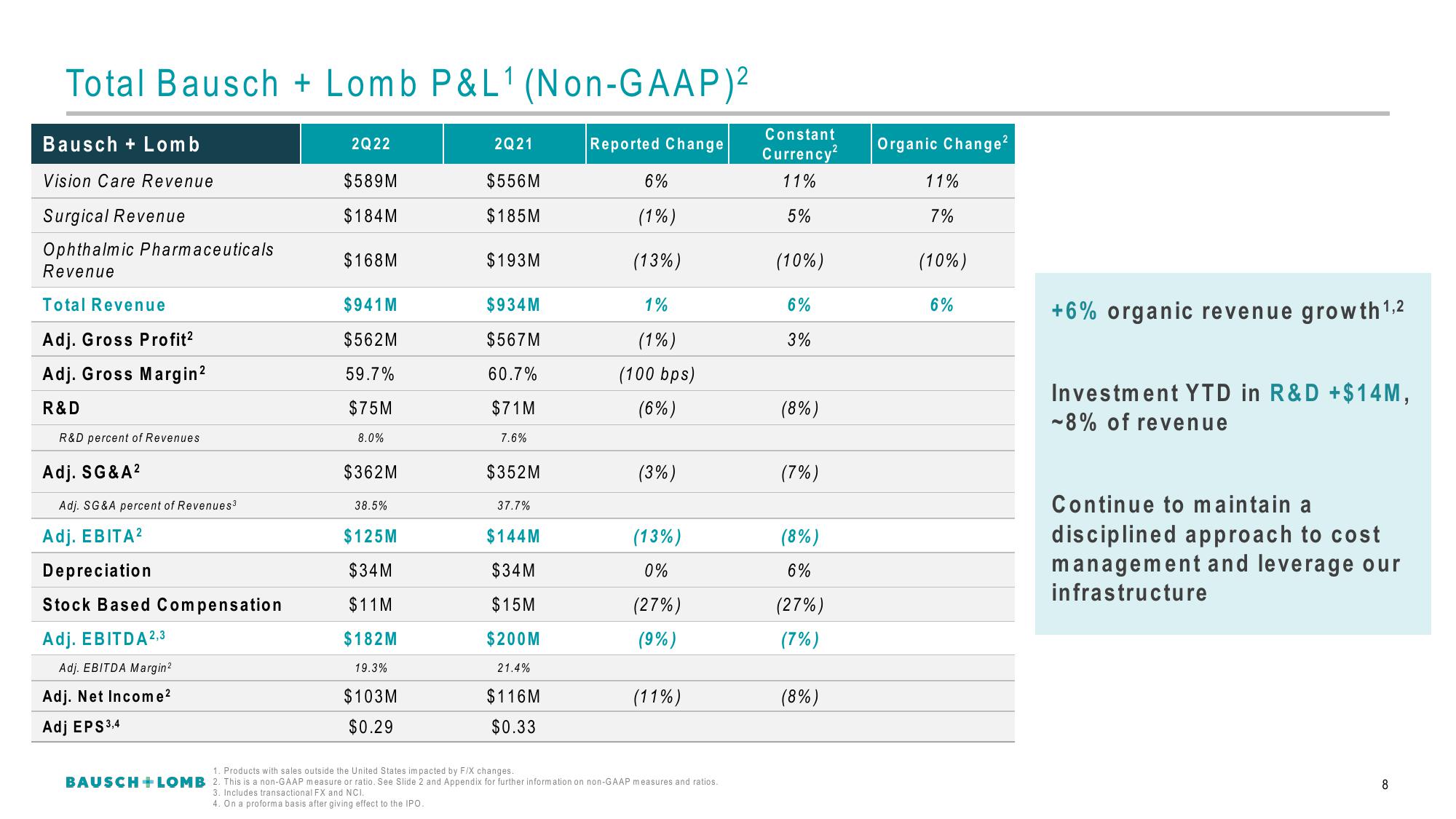

Total Bausch+Lomb P&L¹ (Non-GAAP)²

Bausch + Lomb

Vision Care Revenue

Surgical Revenue

Ophthalmic Pharmaceuticals

Revenue

Total Revenue

Adj. Gross Profit²

Adj. Gross Margin ²

R&D

R&D percent of Revenues

Adj. SG&A²

Adj. SG&A percent of Revenues³

Adj. EBITA²

Depreciation

Stock Based Compensation

Adj. EBITDA 2,3

Adj. EBITDA Margin²

Adj. Net Income²

Adj EPS 3,4

2Q22

$589M

$184 M

$168M

$941 M

$562M

59.7%

$75M

8.0%

$362M

38.5%

$125M

$34M

$11M

$182M

19.3%

$103M

$0.29

2Q21

$556M

$185M

$193M

$934M

$567M

60.7%

$71M

7.6%

$352M

37.7%

$144M

$34M

$15M

$200M

21.4%

$116M

$0.33

Reported Change

6%

(1%)

(13%)

1%

(1%)

(100 bps)

(6%)

(3%)

(13%)

0%

(27%)

(9%)

(11%)

1. Products with sales outside the United States impacted by F/X changes.

BAUSCH + LOMB 2. This is a non-GAAP measure or ratio. See Slide 2 and Appendix for further information on non-GAAP measures and ratios.

3. Includes transactional FX and NCI.

4. On a proforma basis after giving effect to the IPO.

Constant

Currency²

11%

5%

(10%)

6%

3%

(8%)

(7%)

(8%)

6%

(27%)

(7%)

(8%)

Organic Change²

11%

7%

(10%)

6%

+6% organic revenue growth ¹,2

Investment YTD in R&D +$14M,

~8% of revenue

Continue to maintain a

disciplined approach to cost

management and leverage our

infrastructure

8View entire presentation