Main Street Capital Fixed Income Presentation Deck

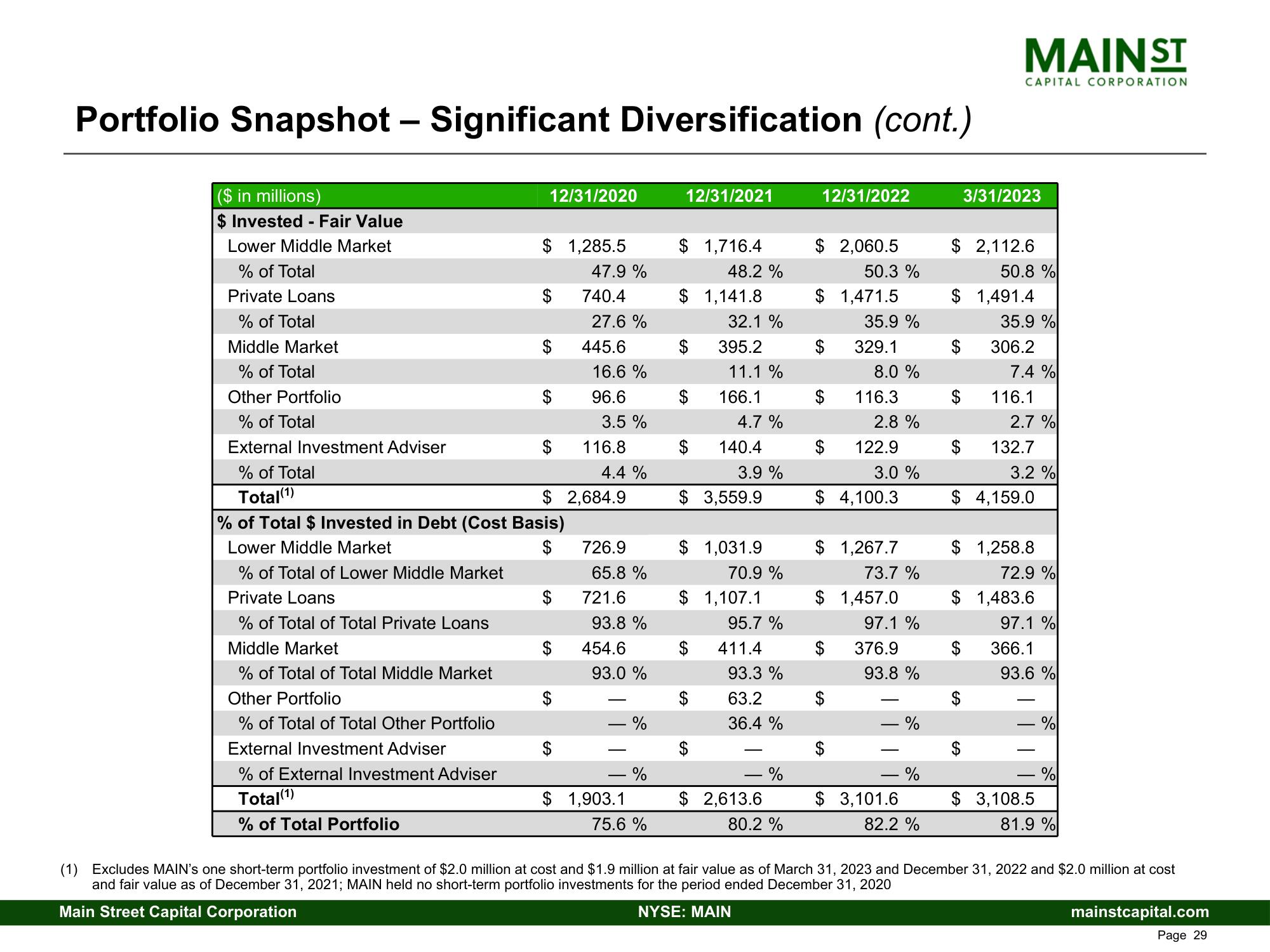

Portfolio Snapshot - Significant Diversification (cont.)

($ in millions)

$ Invested - Fair Value

Lower Middle Market

% of Total

Private Loans

% of Total

Middle Market

% of Total

Other Portfolio

% of Total

External Investment Adviser

% of Total

Total(1)

12/31/2020

$ 1,285.5

$

GA

SA

% of Total $ Invested in Debt (Cost Basis)

Lower Middle Market

$

% of Total of Lower Middle Market

Private Loans

% of Total of Total Private Loans

Middle Market

% of Total of Total Middle Market

Other Portfolio

% of Total of Total Other Portfolio

External Investment Adviser

% of External Investment Adviser

Total(1)

% of Total Portfolio

47.9 %

740.4

27.6%

445.6

16.6%

96.6

$

3.5 %

116.8

$ 2,684.9

4.4 %

726.9

65.8 %

721.6

93.8 %

454.6

93.0 %

- %

- %

$ 1,903.1

75.6 %

12/31/2021

$ 1,716.4

48.2 %

$1,141.8

32.1 %

395.2

11.1 %

166.1

$

$

$

4.7%

140.4

3.9 %

$ 3,559.9

$ 1,031.9

$

70.9 %

$ 1,107.1

95.7 %

411.4

93.3 %

63.2

36.4 %

-

$ 2,613.6

%

80.2 %

12/31/2022

$ 2,060.5

$ 1,471.5

$

$

50.3 %

$4,100.3

$

35.9 %

329.1

8.0 %

116.3

2.8 %

122.9

3.0 %

$1,267.7

73.7 %

$ 1,457.0

$

97.1 %

376.9

93.8 %

- %

- %

-

$ 3,101.6

82.2 %

$ 2,112.6

$

$

MAIN ST

CAPITAL CORPORATION

$ 1,491.4

$

3/31/2023

50.8 %

$

35.9 %

306.2

7.4 %

116.1

2.7 %

132.7

3.2 %

$ 4,159.0

$ 1,258.8

72.9 %

$ 1,483.6

97.1 %

366.1

93.6 %

-

$ 3,108.5

%

%

81.9 %

(1) Excludes MAIN's one short-term portfolio investment of $2.0 million at cost and $1.9 million at fair value as of March 31, 2023 and December 31, 2022 and $2.0 million at cost

and fair value as of December 31, 2021; MAIN held no short-term portfolio investments for the period ended December 31, 2020

Main Street Capital Corporation

NYSE: MAIN

mainstcapital.com

Page 29View entire presentation