Bausch+Lomb Results Presentation Deck

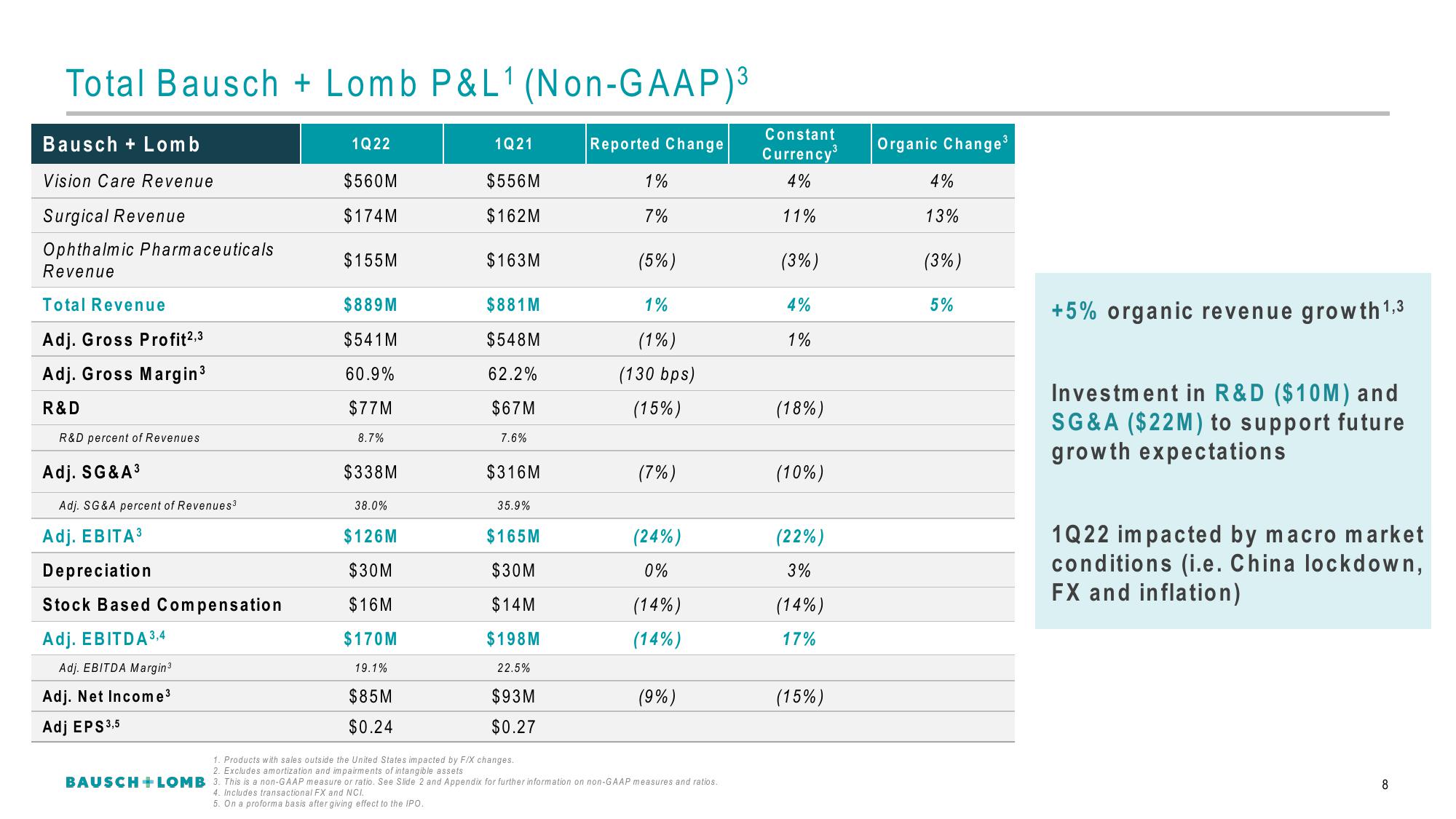

Total Bausch+Lomb P&L¹ (Non-GAAP)³

Bausch + Lomb

Vision Care Revenue

Surgical Revenue

Ophthalmic Pharmaceuticals

Revenue

Total Revenue

Adj. Gross Profit²,3

Adj. Gross Margin ³

R&D

R&D percent of Revenues

Adj. SG&A³

Adj. SG&A percent of Revenues³

Adj. EBITA 3

Depreciation

Stock Based Compensation

Adj. EBITDA 3,4

Adj. EBITDA Margin ³

Adj. Net Income ³

Adj EPS 3,5

1Q22

$560M

$174M

$155M

$889M

$541M

60.9%

$77M

8.7%

$338M

38.0%

$126M

$30M

$16M

$170M

19.1%

$85M

$0.24

1Q21

$556M

$162M

$163M

$881M

$548M

62.2%

$67M

7.6%

$316M

35.9%

$165M

$30M

$14M

$198M

22.5%

$93M

$0.27

Reported Change

1%

7%

(5%)

1%

(1%)

(130 bps)

(15%)

(7%)

(24%)

0%

(14%)

(14%)

(9%)

1. Products with sales outside the United States impacted by F/X changes..

2. Excludes amortization and impairments of intangible assets

BAUSCH+LOMB 3. This is a non-GAAP measure or ratio. See Slide 2 and Appendix for further information on non-GAAP measures and ratios.

4. Includes transactional FX and NCI.

5. On a proforma basis after giving effect to the IPO.

Constant

Currency³

4%

11%

(3%)

4%

1%

(18%)

(10%)

(22%)

3%

(14%)

17%

(15%)

Organic Change³

4%

13%

(3%)

5%

+5% organic revenue growth ¹,3

Investment in R&D ($10M) and

SG&A ($22M) to support future

growth expectations

1Q22 impacted by macro market

conditions (i.e. China lockdown,

FX and inflation)

8View entire presentation