Baird Investment Banking Pitch Book

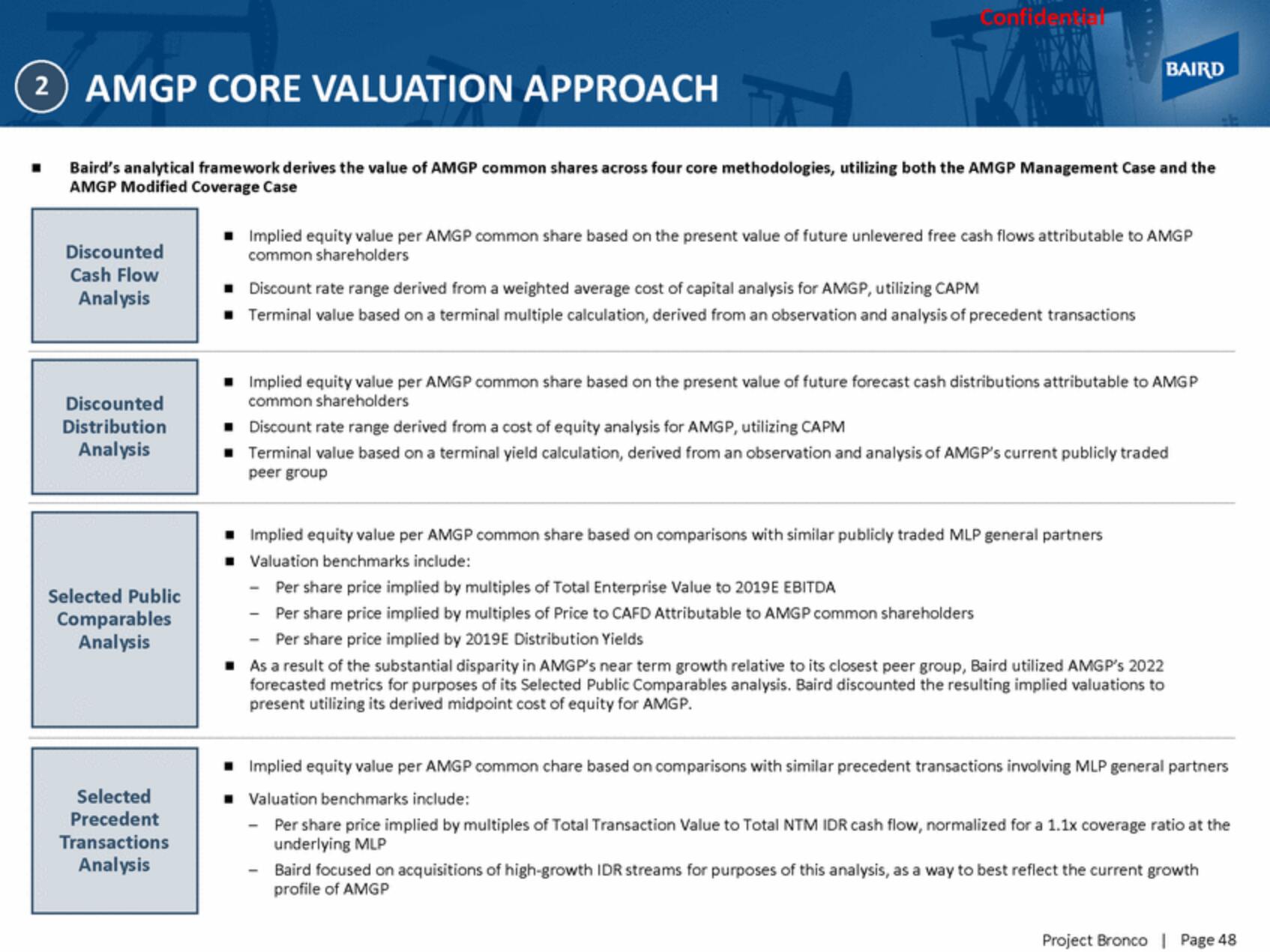

2) AMGP CORE VALUATION APPROACH

Discounted

Cash Flow

Analysis

Baird's analytical framework derives the value of AMGP common shares across four core methodologies, utilizing both the AMGP Management Case and the

AMGP Modified Coverage Case

Discounted

Distribution

Analysis

Selected Public

Comparables

Analysis

Selected

Precedent

Transactions

Analysis

Confidential

■ Implied equity value per AMGP common share based on the present value of future unlevered free cash flows attributable to AMGP

common shareholders

Discount rate range derived from a weighted average cost of capital analysis for AMGP, utilizing CAPM

■ Terminal value based on a terminal multiple calculation, derived from an observation and analysis of precedent transactions

BAIRD

Implied equity value per AMGP common share based on the present value of future forecast cash distributions attributable to AMGP

common shareholders

■ Discount rate range derived from a cost of equity analysis for AMGP, utilizing CAPM

■ Terminal value based on a terminal yield calculation, derived from an observation and analysis of AMGP's current publicly traded

peer group

Implied equity value per AMGP common share based on comparisons with similar publicly traded MLP general partners

Valuation benchmarks include:

- Per share price implied by multiples of Total Enterprise Value to 2019E EBITDA

- Per share price implied by multiples of Price to CAFD Attributable to AMGP common shareholders

- Per share price implied by 2019E Distribution Yields

As a result of the substantial disparity in AMGP's near term growth relative to its closest peer group, Baird utilized AMGP's 2022

forecasted metrics for purposes of its Selected Public Comparables analysis. Baird discounted the resulting implied valuations to

present utilizing its derived midpoint cost of equity for AMGP.

■ Implied equity value per AMGP common chare based on comparisons with similar precedent transactions involving MLP general partners

Valuation benchmarks include:

- Per share price implied by multiples of Total Transaction Value to Total NTM IDR cash flow, normalized for a 1.1x coverage ratio at the

underlying MLP

Baird focused on acquisitions of high-growth IDR streams for purposes of this analysis, as a way to best reflect the current growth

profile of AMGP

Project Bronco | Page 48View entire presentation