Credit Suisse Investment Banking Pitch Book

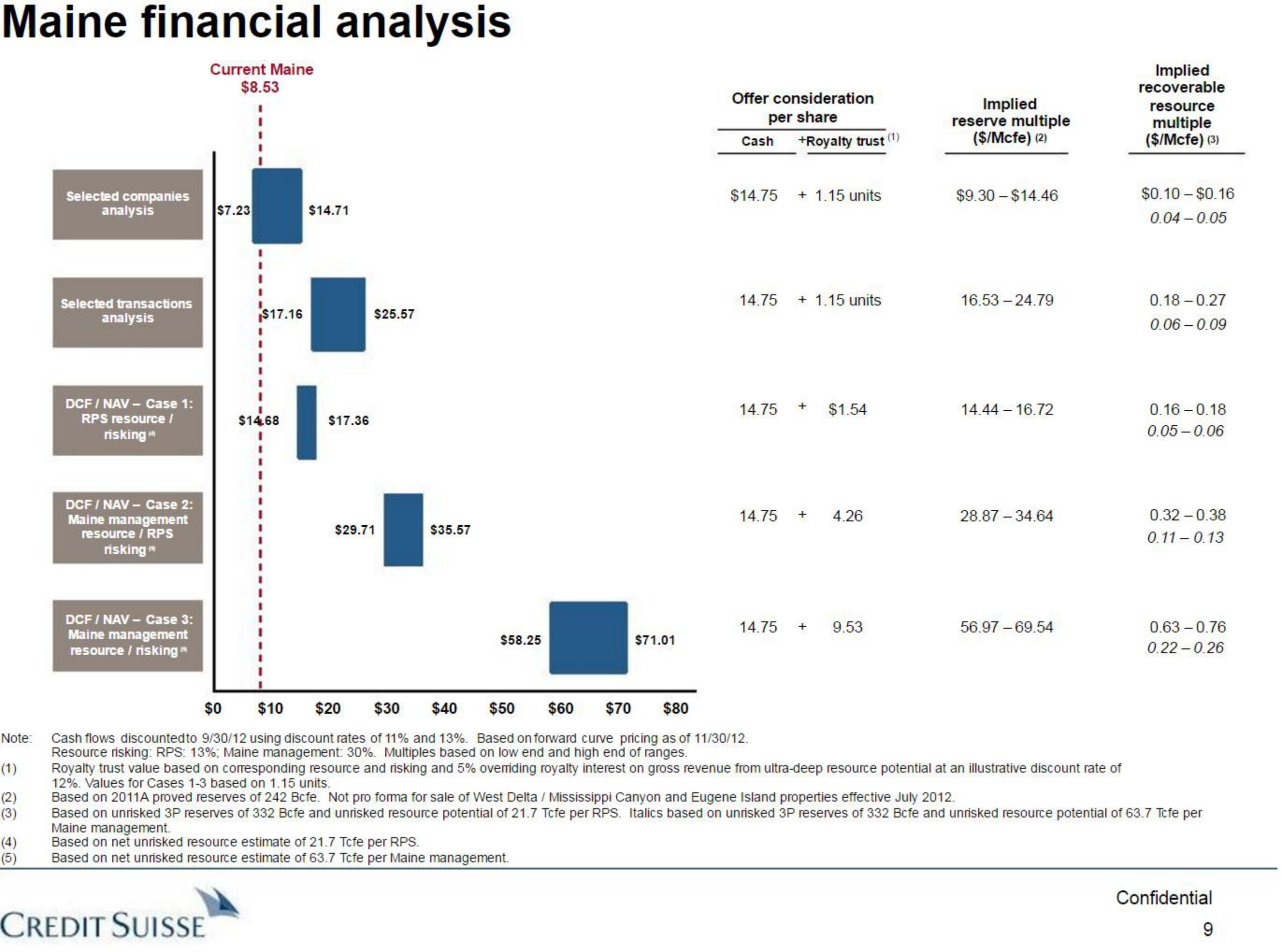

Maine financial analysis

Current Maine

$8.53

Note:

(1)

(2)

(3)

(5)

Selected companies

analysis

Selected transactions

analysis

DCF / NAV-Case 1:

RPS resource/

risking

DCF/NAV-Case 2:

Maine management

resource / RPS

risking

DCF/NAV - Case 3:

Maine management

resource / risking

$7.23

CREDIT SUISSE

$17.16

I

$14.68

I

$14.71

$17.36

$25.57

$29.71

$35.57

$58.25

$71.01

Offer consideration

per share

Cash

+Royalty trust (1)

$14.75 + 1.15 units

14.75 + 1.15 units

14.75

+

14.75 +

$1.54

4.26

14.75 + 9.53

Implied

reserve multiple

($/Mcfe) (2)

$9.30-$14.46

16.53-24.79

14.44-16.72

28.87-34.64

56.97 - 69.54

Implied

recoverable

resource

multiple

($/Mcfe) (3)

$0.10-$0.16

0.04 -0.05

0.18-0.27

0.06 -0.09

0.16 0.18

0.05-0.06

0.32 -0.38

0.11 -0.13

0.63-0.76

0.22-0.26

$0 $10 $20 $30 $40 $50 $60

$70

$80

Cash flows discounted to 9/30/12 using discount rates of 11% and 13%. Based on forward curve pricing as of 11/30/12.

Resource risking: RPS: 13%; Maine management: 30%. Multiples based on low end and high end of ranges.

Royalty trust value based on corresponding resource and risking and 5% overriding royalty interest on gross revenue from ultra-deep resource potential at an illustrative discount rate of

12%. Values for Cases 1-3 based on 1.15 units.

Based on 2011A proved reserves of 242 Bcfe. Not pro forma for sale of West Delta / Mississippi Canyon and Eugene Island properties effective July 2012.

Based on unrisked 3P reserves of 332 Bcfe and unrisked resource potential of 21.7 Tcfe per RPS. Italics based on unrisked 3P reserves of 332 Bcfe and unrisked resource potential of 63.7 Tcfe per

Maine management.

Based on net unrisked resource estimate of 21.7 Tcfe per RPS.

Based on net unrisked resource estimate of 63.7 Tcfe per Maine management.

Confidential

9View entire presentation