BlackRock Global Long/Short Credit Absolute Return Credit

The Outcome: Protection Against Credit Market Volatility

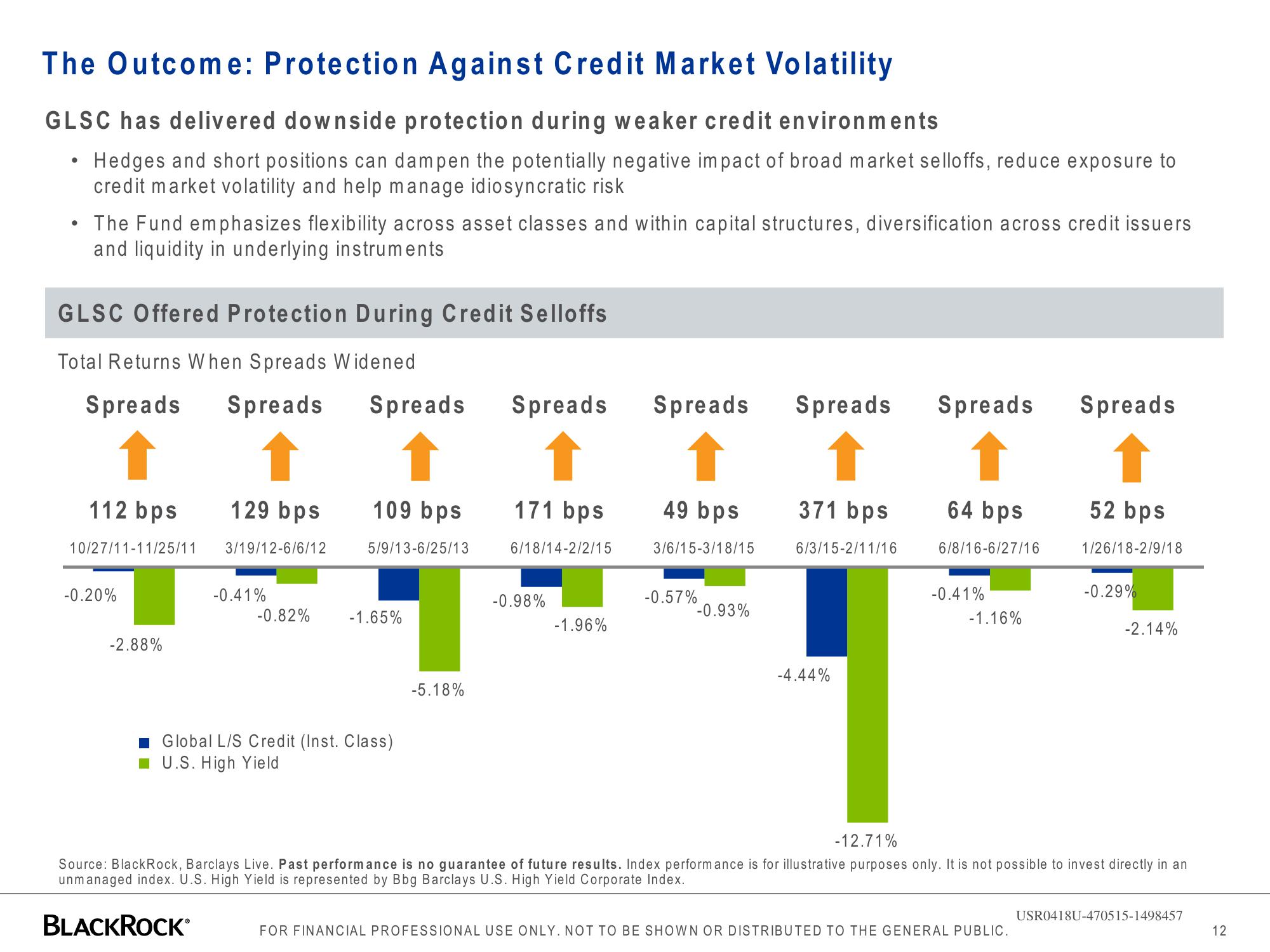

GLSC has delivered downside protection during weaker credit environments

Hedges and short positions can dampen the potentially negative impact of broad market selloffs, reduce exposure to

credit market volatility and help manage idiosyncratic risk

• The Fund emphasizes flexibility across asset classes and within capital structures, diversification across credit issuers

and liquidity in underlying instruments

GLSC Offered Protection During Credit Selloffs

Total Returns When Spreads Widened

Spreads Spreads

↑

112 bps

10/27/11-11/25/11

-0.20%

-2.88%

129 bps

3/19/12-6/6/12

-0.41%

-0.82%

Spreads

109 bps

5/9/13-6/25/13

-1.65%

Global L/S Credit (Inst. Class)

U.S. High Yield

-5.18%

Spreads

171 bps

6/18/14-2/2/15

-0.98%

-1.96%

Spreads

↑

49 bps

3/6/15-3/18/15

-0.57%

-0.93%

Spreads

371 bps

6/3/15-2/11/16

-4.44%

Spreads

↑

64 bps

6/8/16-6/27/16

-0.41%

-1.16%

Spreads

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT TO BE SHOWN OR DISTRIBUTED TO THE GENERAL PUBLIC.

52 bps

1/26/18-2/9/18

-0.29%

-2.14%

-12.71%

Source: BlackRock, Barclays Live. Past performance is no guarantee of future results. Index performance is for illustrative purposes only. It is not possible to invest directly in an

unmanaged index. U.S. High Yield is represented by Bbg Barclays U.S. High Yield Corporate Index.

BLACKROCK®

USR0418U-470515-1498457

12View entire presentation