Bakkt Results Presentation Deck

NOTES

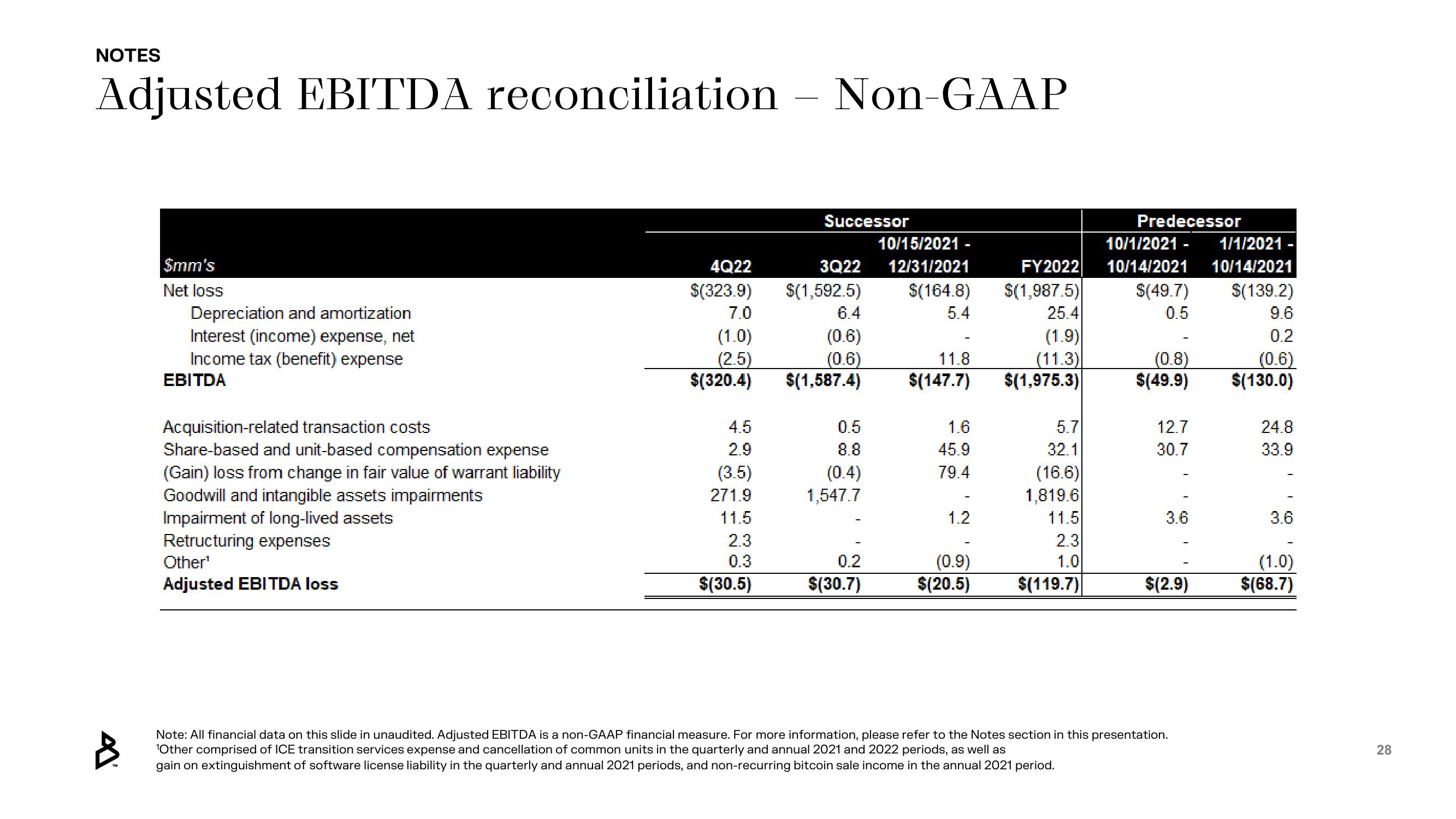

Adjusted EBITDA reconciliation.

$mm's

Net loss

Depreciation and amortization

Interest (income) expense, net

Income tax (benefit) expense

EBITDA

Acquisition-related transaction costs

Share-based and unit-based compensation expense

(Gain) loss from change in fair value of warrant liability

Goodwill and intangible assets impairments

Impairment of long-lived assets

Retructuring expenses

Other¹

Adjusted EBITDA loss

4Q22

$(323.9)

Non-GAAP

4.5

2.9

(3.5)

271.9

11.5

2.3

0.3

$(30.5)

Successor

10/15/2021 -

3Q22 12/31/2021

$(164.8)

5.4

$(1,592.5)

7.0

6.4

(1.0)

(0.6)

(0.6)

$(320.4) $(1,587.4)

(2.5)

0.5

8.8

(0.4)

1,547.7

0.2

$(30.7)

FY2022

$(1,987.5)

25.4

(1.9)

11.8

(11.3)

$(147.7) $(1,975.3)

1.6

45.9

79.4

1.2

(0.9)

$(20.5)

5.7

32.1

(16.6)

1,819.6

11.5

2.3

1.0

$(119.7)

Predecessor

10/1/2021 -

1/1/2021-

10/14/2021 10/14/2021

$(139.2)

$(49.7)

0.5

(0.8)

$(49.9)

12.7

30.7

3.6

$(2.9)

Note: All financial data on this slide in unaudited. Adjusted EBITDA is a non-GAAP financial measure. For more information, please refer to the Notes section in this presentation.

¹Other comprised of ICE transition services expense and cancellation of common units in the quarterly and annual 2021 and 2022 periods, as well as

gain on extinguishment of software license liability in the quarterly and annual 2021 periods, and non-recurring bitcoin sale income in the annual 2021 period.

9.6

0.2

(0.6)

$(130.0)

24.8

33.9

3.6

(1.0)

$(68.7)

28View entire presentation