Zegna Results Presentation Deck

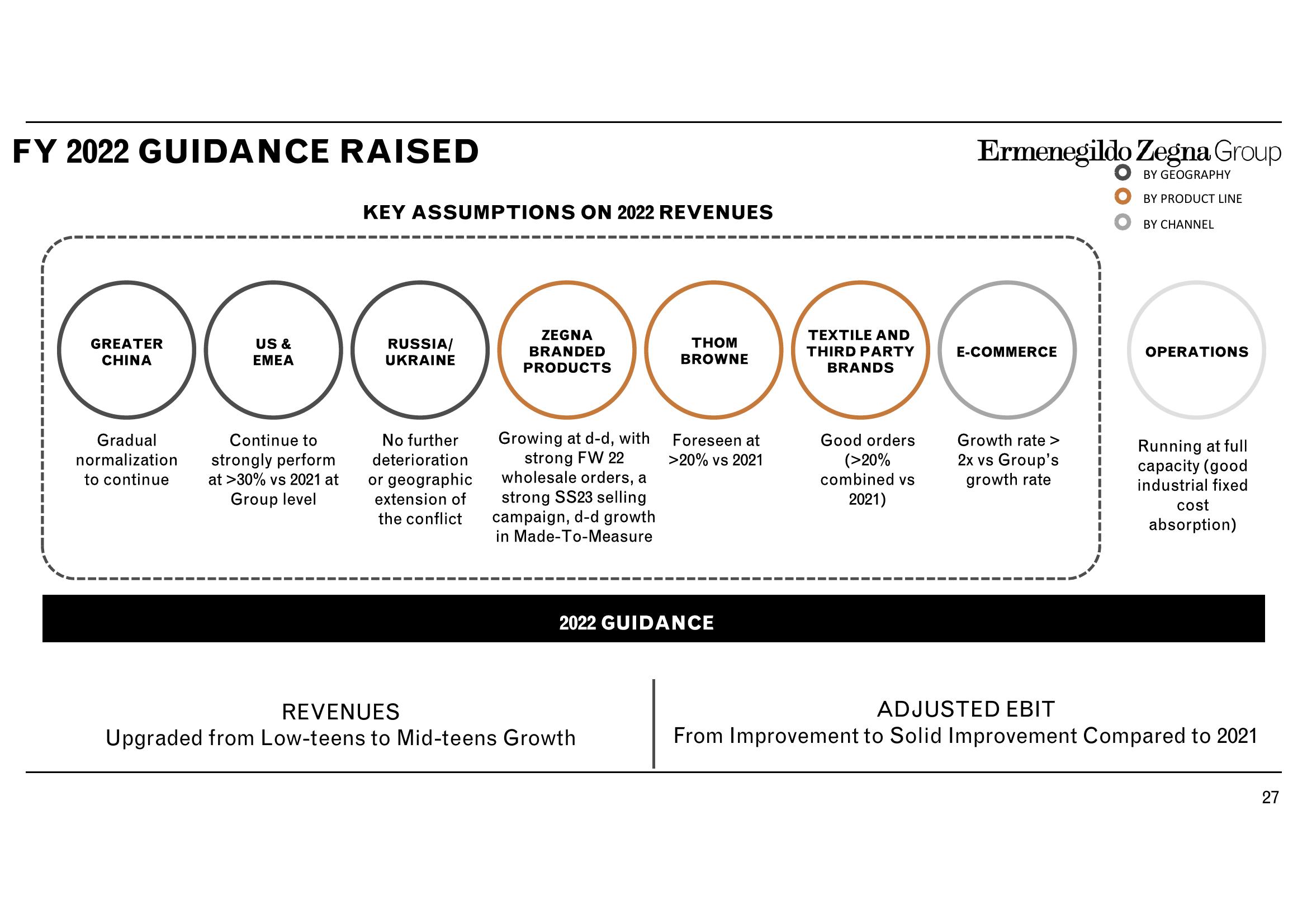

FY 2022 GUIDANCE RAISED

GREATER

CHINA

Gradual

normalization

to continue

US &

EMEA

Continue to

strongly perform

at >30% vs 2021 at

Group level

KEY ASSUMPTIONS ON 2022 REVENUES

RUSSIA/

UKRAINE

No further

deterioration

or geographic

extension of

the conflict

ZEGNA

BRANDED

PRODUCTS

Growing at d-d, with

strong FW 22

wholesale orders, a

strong SS23 selling

campaign, d-d growth

in Made-To-Measure

THOM

BROWNE

REVENUES

Upgraded from Low-teens to Mid-teens Growth

Foreseen at

>20% vs 2021

2022 GUIDANCE

TEXTILE AND

THIRD PARTY

BRANDS

Good orders

(>20%

combined vs

2021)

Ermenegildo Zegna Group

BY GEOGRAPHY

BY PRODUCT LINE

BY CHANNEL

E-COMMERCE

Growth rate >

2x vs Group's

growth rate

OPERATIONS

Running at full

capacity (good

industrial fixed

cost

absorption)

ADJUSTED EBIT

From Improvement to Solid Improvement Compared to 2021

27View entire presentation