Zegna Investor Presentation Deck

1.3 What makes Ermenegildo Zegna Group different

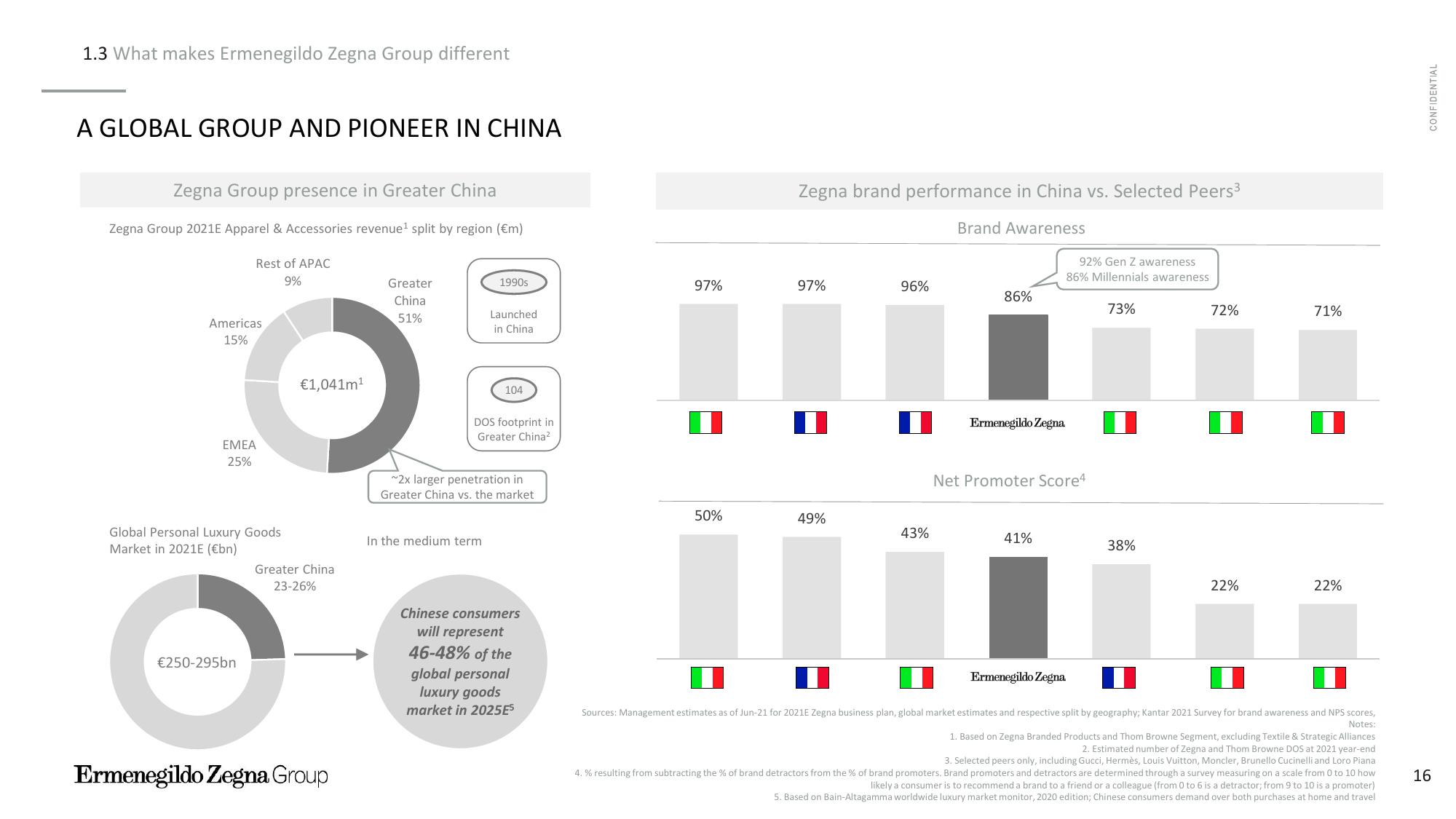

A GLOBAL GROUP AND PIONEER IN CHINA

Zegna Group presence in Greater China

Zegna Group 2021E Apparel & Accessories revenue¹ split by region (€m)

Rest of APAC

9%

Americas

15%

EMEA

25%

Global Personal Luxury Goods

Market in 2021E (€bn)

€250-295bn

€1,041m¹

Greater China

23-26%

Ermenegildo Zegna Group

Greater

China

51%

1990s

Launched

in China

In the medium term

104

DOS footprint in

Greater China²

~2x larger penetration in

Greater China vs. the market

Chinese consumers

will represent

46-48% of the

global personal

luxury goods

market in 2025E5

97%

50%

Zegna brand performance in China vs. Selected Peers³

Brand Awareness

97%

49%

96%

43%

86%

Ermenegildo Zegna

92% Gen Z awareness

86% Millennials awareness

73%

Net Promoter Score4

41%

Ermenegildo Zegna

38%

72%

22%

71%

22%

Notes:

Sources: Management estimates as of Jun-21 for 2021E Zegna business plan, global market estimates and respective split by geography; Kantar 2021 Survey for brand awareness and NPS scores,

1. Based on Zegna Branded Products and Thom Browne Segment, excluding Textile & Strategic Alliances

2. Estimated number of Zegna and Thom Browne DOS at 2021 year-end

3. Selected peers only, including Gucci, Hermès, Louis Vuitton, Moncler, Brunello Cucinelli and Loro Piana

4. % resulting from subtracting the % of brand detractors from the % of brand promoters. Brand promoters and detractors are determined through a survey measuring on a scale from 0 to 10 how

likely a consumer is to recommend a brand to a friend or a colleague (from 0 to 6 is a detractor; from 9 to 10 is a promoter)

5. Based on Bain-Altagamma worldwide luxury market monitor, 2020 edition; Chinese consumers demand over both purchases at home and travel

CONFIDENTIAL

16View entire presentation