Antero Midstream Partners Investor Presentation Deck

1

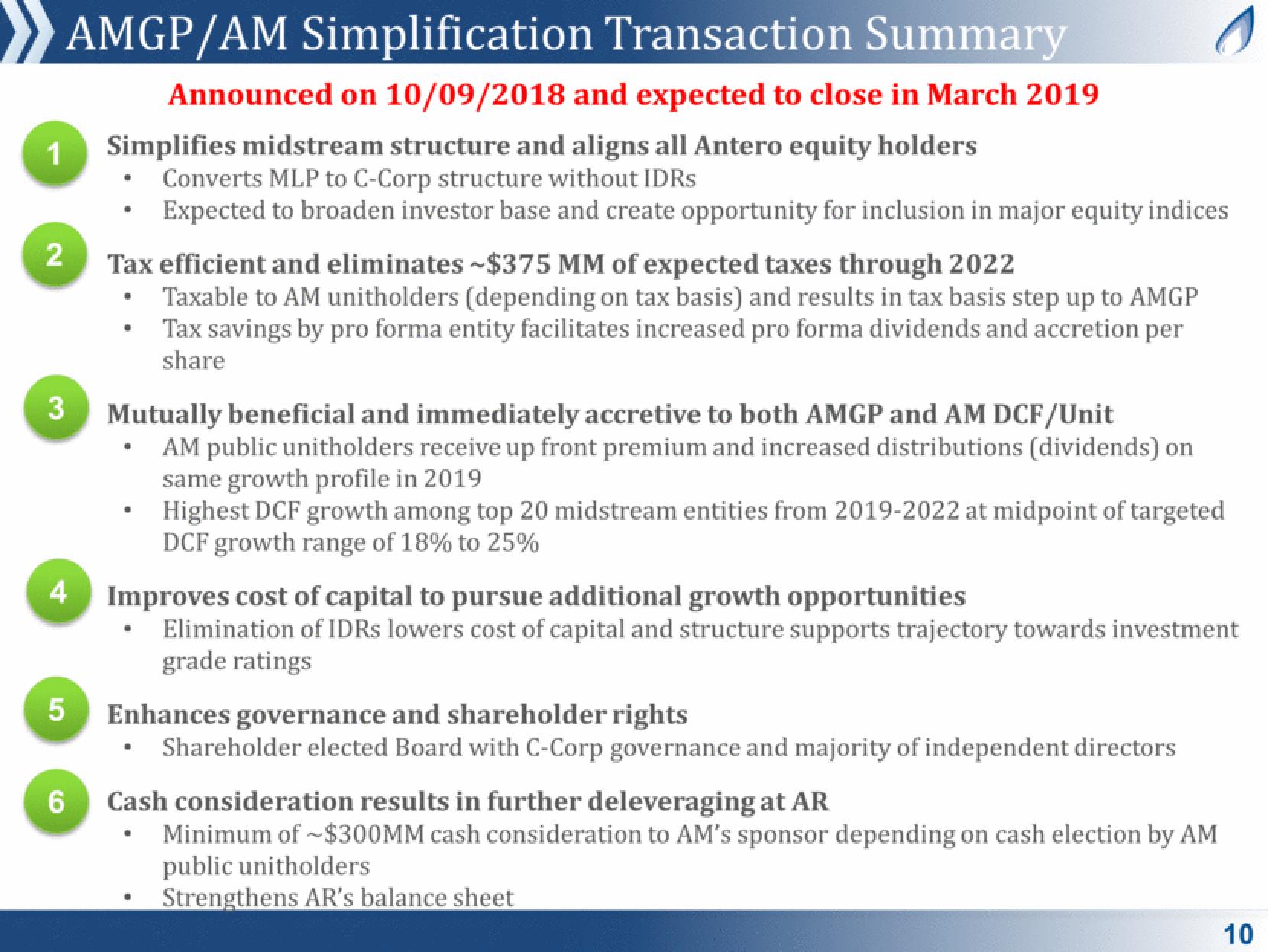

AMGP/AM Simplification Transaction Summary

Announced on 10/09/2018 and expected to close in March 2019

Simplifies midstream structure and aligns all Antero equity holders

Converts MLP to C-Corp structure without IDRS

Expected to broaden investor base and create opportunity for inclusion in major equity indices

2

3

Tax efficient and eliminates ~$375 MM of expected taxes through 2022

Taxable to AM unitholders (depending on tax basis) and results in tax basis step up to AMGP

Tax savings by pro forma entity facilitates increased pro forma dividends and accretion per

share

Mutually beneficial and immediately accretive to both AMGP and AM DCF/Unit

AM public unitholders receive up front premium and increased distributions (dividends) on

same growth profile in 2019

Highest DCF growth among top 20 midstream entities from 2019-2022 at midpoint of targeted

DCF growth range of 18% to 25%

•

·

4 Improves cost of capital to pursue additional growth opportunities

s

Elimination of IDRs lowers cost of capital and structure supports trajectory towards investment

grade ratings

5 Enhances governance and shareholder rights

Shareholder elected Board with C-Corp governance and majority of independent directors

6 Cash consideration results in further deleveraging at AR

Minimum of $300MM cash consideration to AM's sponsor depending on cash election by AM

public unitholders

Strengthens AR's balance sheet

10View entire presentation