Cadre Holdings IPO Presentation Deck

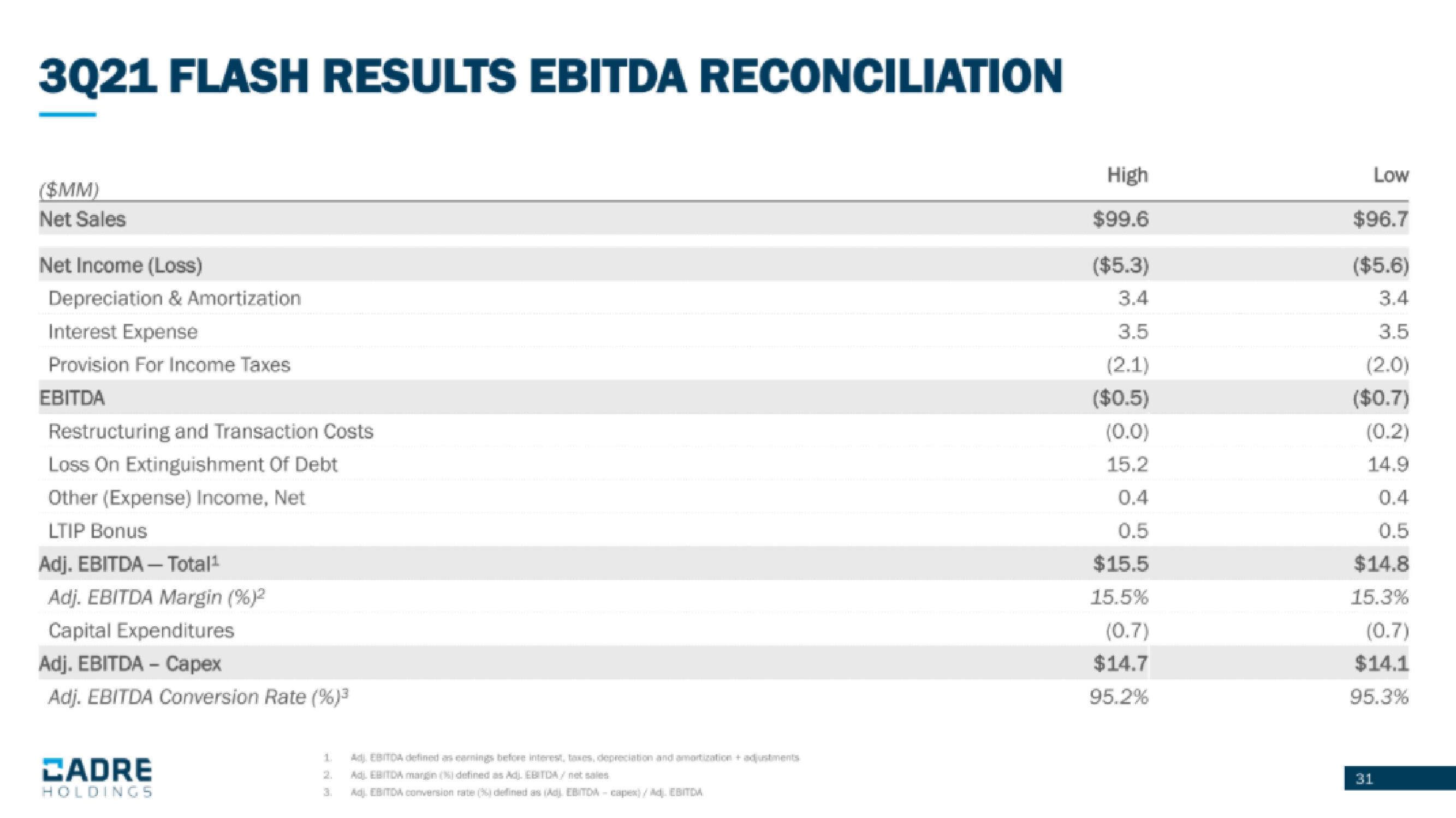

3021 FLASH RESULTS EBITDA RECONCILIATION

($MM)

Net Sales

Net Income (Loss)

Depreciation & Amortization

Interest Expense

Provision For Income Taxes

EBITDA

Restructuring and Transaction Costs

Loss On Extinguishment Of Debt

Other (Expense) Income, Net

LTIP Bonus

Adj. EBITDA - Total¹

Adj. EBITDA Margin (%)²

Capital Expenditures

Adj. EBITDA - Capex

Adj. EBITDA Conversion Rate (%)³

CADRE

HOLDINGS

1.

3.

Ad. EBITDA defined as earnings before interest, taxes, depreciation and amortization+ adjustments.

ADLEBITDA margin (X) defined as Adj. EBITDA / net sales

Adj. EBITDA conversion rate (6) defined as (Adj. EBITDA - capex) / Ad EBITDA

High

$99.6

($5.3)

3.4

3.5

(2.1)

($0.5)

(0.0)

15.2

0.4

0.5

$15.5

15.5%

(0.7)

$14.7

95.2%

Low

$96.7

($5.6)

3.4

3.5

(2.0)

($0.7)

(0.2)

14.9

0.4

0.5

$14.8

15.3%

(0.7)

$14.1

95.3%

31View entire presentation