LSE Mergers and Acquisitions Presentation Deck

Delivers attractive financial returns

for shareholders

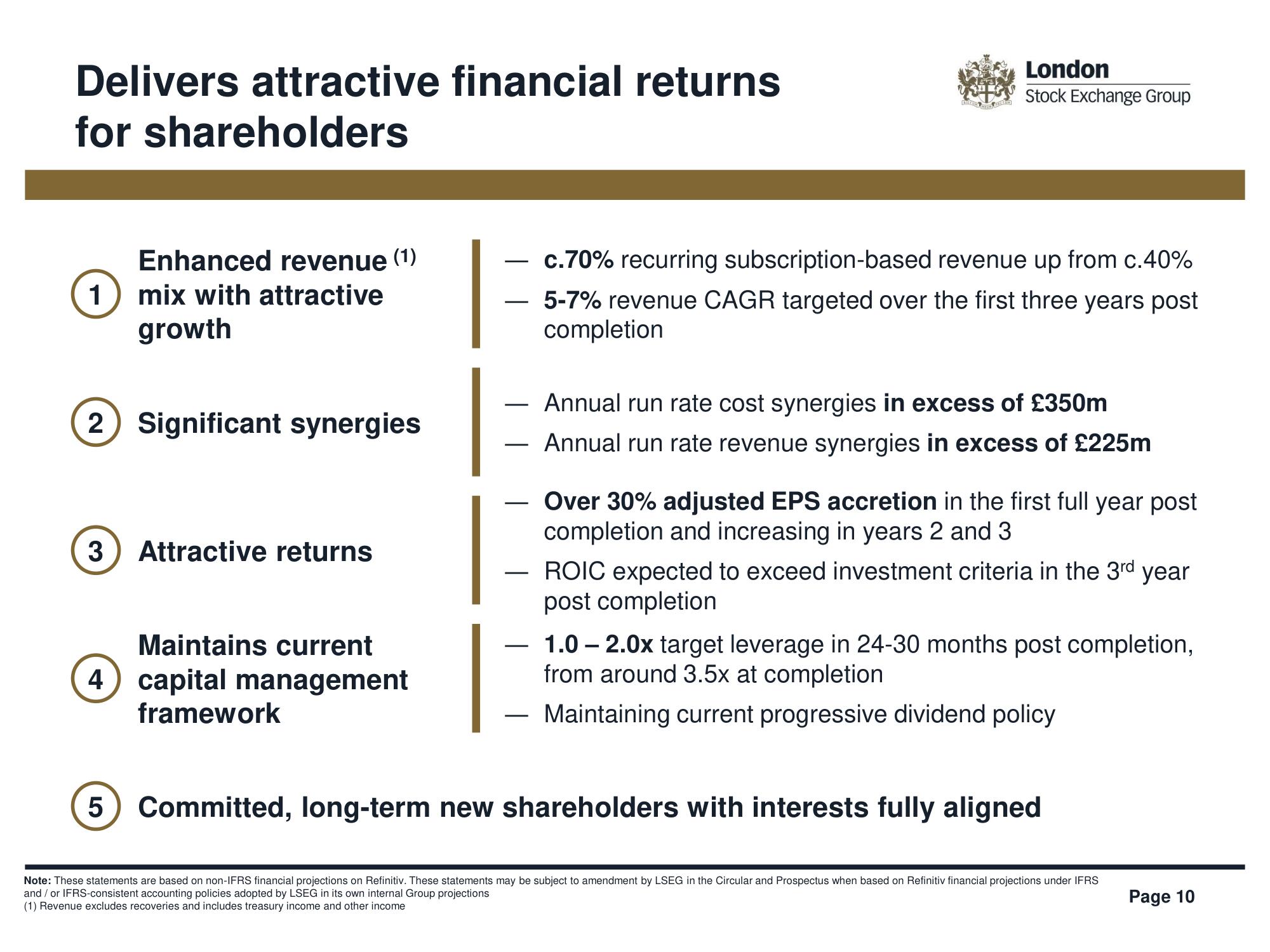

1

Enhanced revenue (1)

mix with attractive

growth

2) Significant synergies

3 Attractive returns

Maintains current

4) capital management

framework

—

buksaim

London

Stock Exchange Group

c.70% recurring subscription-based revenue up from c.40%

5-7% revenue CAGR targeted over the first three years post

completion

Annual run rate cost synergies in excess of £350m

Annual run rate revenue synergies in excess of £225m

Over 30% adjusted EPS accretion in the first full year post

completion and increasing in years 2 and 3

ROIC expected to exceed investment criteria in the 3rd year

post completion

1.0 - 2.0x target leverage in 24-30 months post completion,

from around 3.5x at completion

- Maintaining current progressive dividend policy

5) Committed, long-term new shareholders with interests fully aligned

Note: These statements are based on non-IFRS financial projections on Refinitiv. These statements may be subject to amendment by LSEG in the Circular and Prospectus when based on Refinitiv financial projections under IFRS

and / or IFRS-consistent accounting policies adopted by LSEG in its own internal Group projections

(1) Revenue excludes recoveries and includes treasury income and other income

Page 10View entire presentation