Alternus Energy SPAC Presentation Deck

TRANSACTION OVERVIEW

.

.

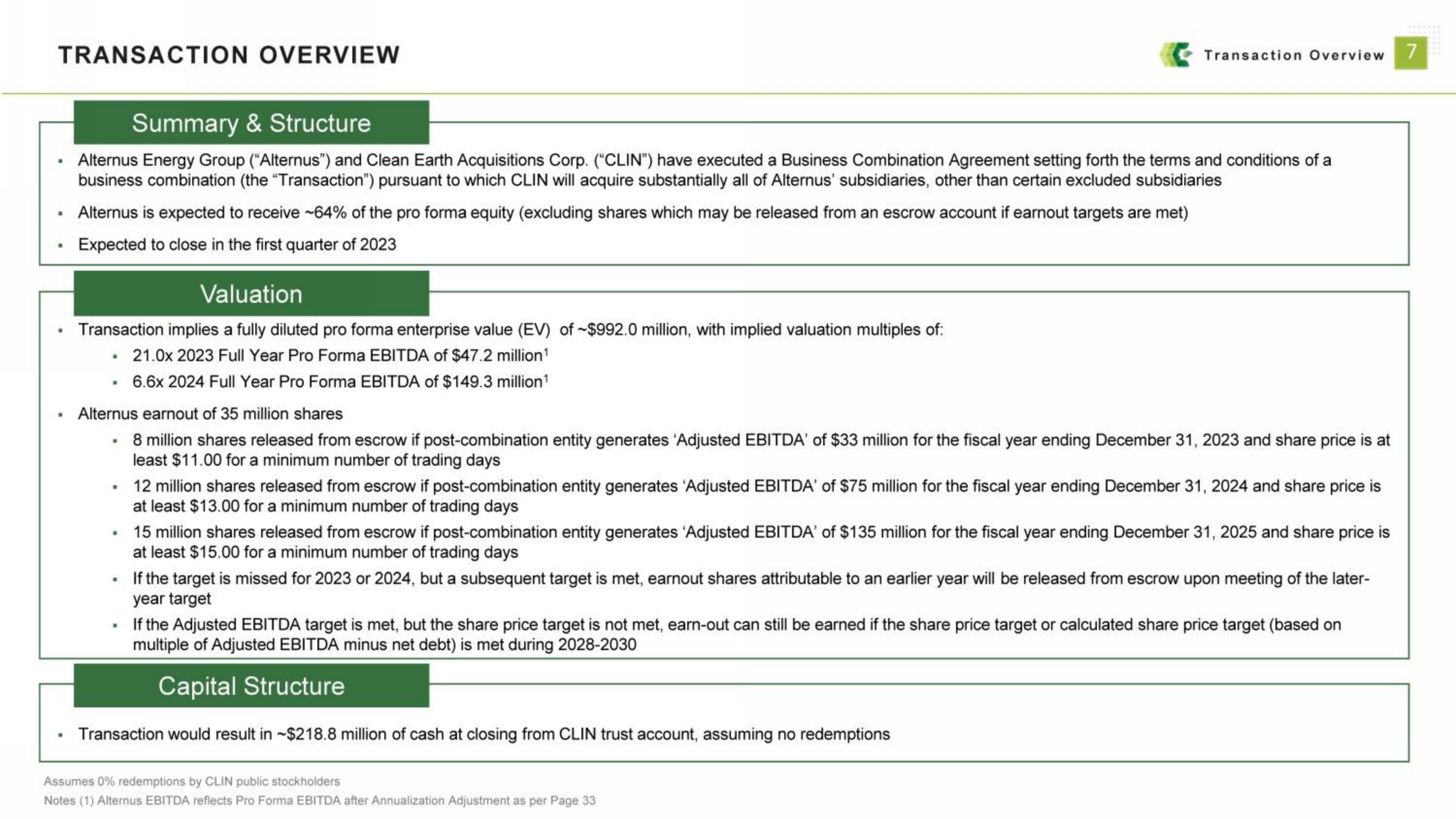

Summary & Structure

Alternus Energy Group ("Alternus") and Clean Earth Acquisitions Corp. ("CLIN") have executed a Business Combination Agreement setting forth the terms and conditions of a

business combination (the "Transaction") pursuant to which CLIN will acquire substantially all of Alternus' subsidiaries, other than certain excluded subsidiaries

Alternus is expected to receive -64% of the pro forma equity (excluding shares which may be released from an escrow account if earnout targets are met)

Expected to close in the first quarter of 2023

Valuation

Transaction implies a fully diluted pro forma enterprise value (EV) of ~$992.0 million, with implied valuation multiples of:

.

• 21.0x 2023 Full Year Pro Forma EBITDA of $47.2 million¹

. 6.6x 2024 Full Year Pro Forma EBITDA of $149.3 million¹

Alternus earnout of 35 million shares

8 million shares released from escrow if post-combination entity generates 'Adjusted EBITDA' of $33 million for the fiscal year ending December 31, 2023 and share price is at

least $11.00 for a minimum number of trading days

.

.

.

Transaction Overview 7

.

12 million shares released from escrow if post-combination entity generates 'Adjusted EBITDA' of $75 million for the fiscal year ending December 31, 2024 and share price is

at least $13.00 for a minimum number of trading days

15 million shares released from escrow if post-combination entity generates 'Adjusted EBITDA' of $135 million for the fiscal year ending December 31, 2025 and share price is

at least $15.00 for a minimum number of trading days

If the Adjusted EBITDA target is met, but the share price target is not met, earn-out can still be earned

multiple of Adjusted EBITDA minus net debt) is met during 2028-2030

Capital Structure

Transaction would result in ~$218.8 million of cash at closing from CLIN trust account, assuming no redemptions

If the target is missed for 2023 or 2024, but a subsequent target is met, earnout shares attributable to an earlier year will be released from escrow upon meeting of the later-

year target

share price target or calculated share price target (based on

Assumes 0% redemptions by CLIN public stockholders

Notes (1) Alternus EBITDA reflects Pro Forma EBITDA after Annualization Adjustment as per Page 33View entire presentation