HSBC Results Presentation Deck

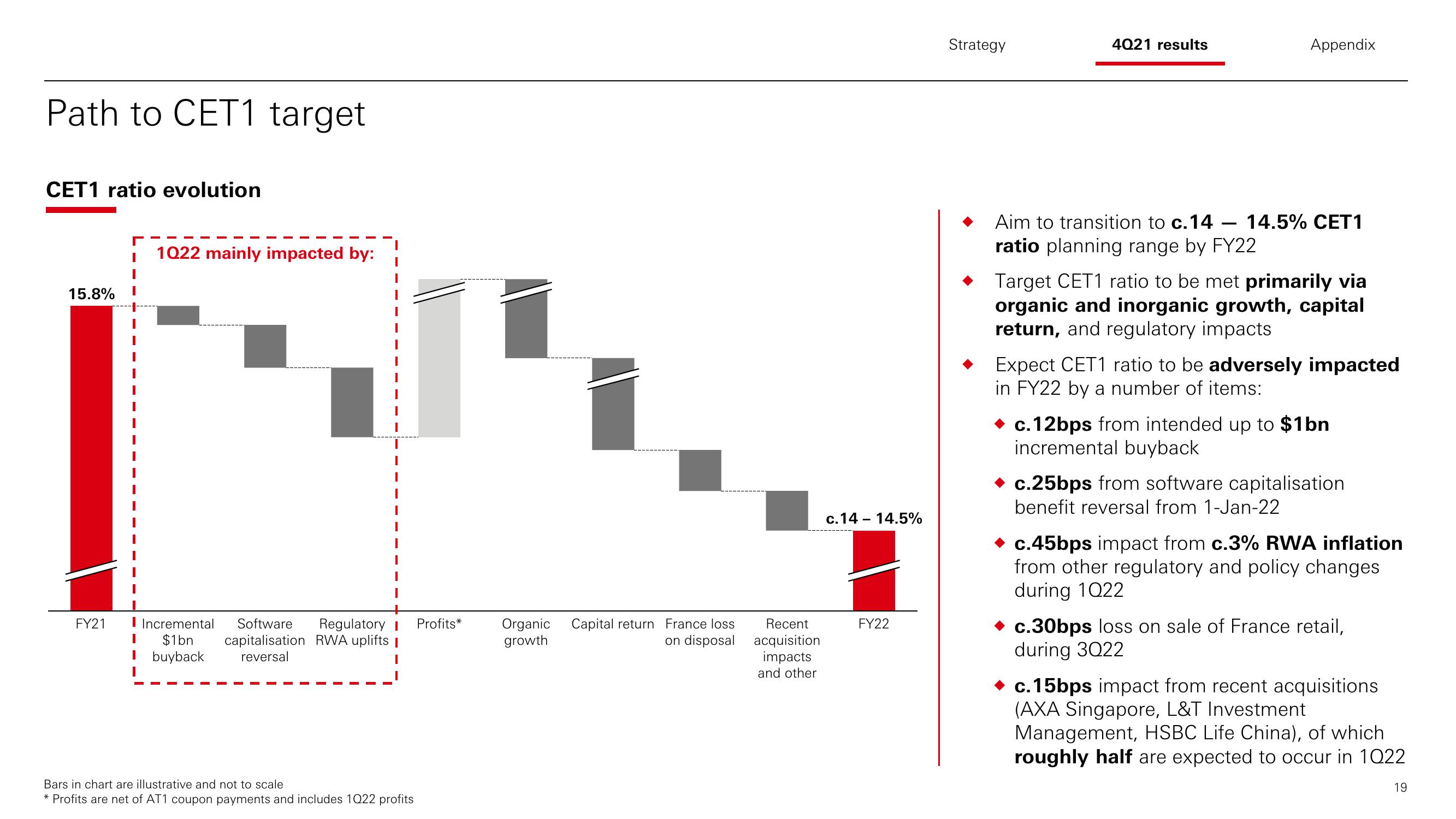

Path to CET1 target

CET1 ratio evolution

15.8%

FY21

1022 mainly impacted by:

I Incremental Software Regulatory I

$1bn capitalisation RWA uplifts I

buyback reversal

I

I

Bars in chart are illustrative and not to scale

* Profits are net of AT1 coupon payments and includes 1022 profits

Profits*

Organic Capital return France loss

growth

on disposal

Recent

acquisition

impacts

and other

c.14 - 14.5%

FY22

Strategy

4021 results

Appendix

Aim to transition to c.14 14.5% CET1

ratio planning range by FY22

Target CET1 ratio to be met primarily via

organic and inorganic growth, capital

return, and regulatory impacts

Expect CET1 ratio to be adversely impacted

in FY22 by a number of items:

c.12bps from intended up to $1bn

incremental buyback

c.25bps from software capitalisation

benefit reversal from 1-Jan-22

c.45bps impact from c.3% RWA inflation

from other regulatory and policy changes

during 1022

c.30bps loss on sale of France retail,

during 3022

c.15bps impact from recent acquisitions

(AXA Singapore, L&T Investment

Management, HSBC Life China), of which

roughly half are expected to occur in 1022

19View entire presentation