HSBC Results Presentation Deck

Adjusted revenue drivers

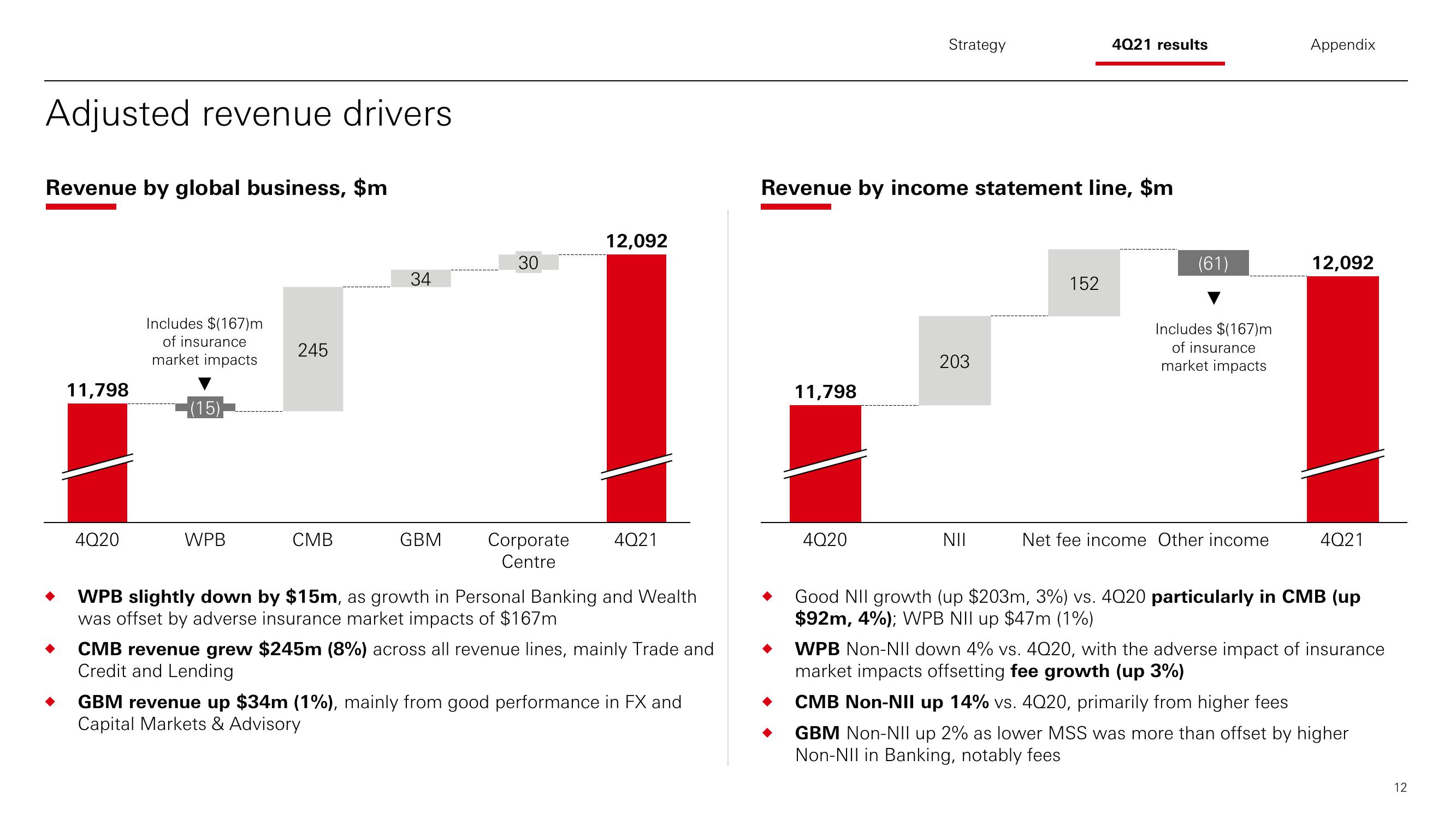

Revenue by global business, $m

11,798

4Q20

Includes $(167)m

of insurance

market impacts

(15)

WPB

245

CMB

34

GBM

30

12,092

Corporate 4Q21

Centre

WPB slightly down by $15m, as growth in Personal Banking and Wealth

was offset by adverse insurance market impacts of $167m

CMB revenue grew $245m (8%) across all revenue lines, mainly Trade and

Credit and Lending

GBM revenue up m (1%), mainly from good performance in FX and

Capital Markets & Advisory

11,798

Strategy

Revenue by income statement line, $m

4020

203

NII

4021 results

152

(61)

Includes $(167)m

of insurance

market impacts

Net fee income Other income

Appendix

12,092

4Q21

Good NII growth (up $203m, 3%) vs. 4020 particularly in CMB (up

$92m, 4%); WPB NII up $47m (1%)

WPB Non-NII down 4% vs. 4020, with the adverse impact of insurance

market impacts offsetting fee growth (up 3%)

CMB Non-NII up 14% vs. 4020, primarily from higher fees

GBM Non-NII up 2% as lower MSS was more than offset by higher

Non-NII in Banking, notably fees

12View entire presentation