AES Panama Investor Presentation

AES in Panama Snapshot

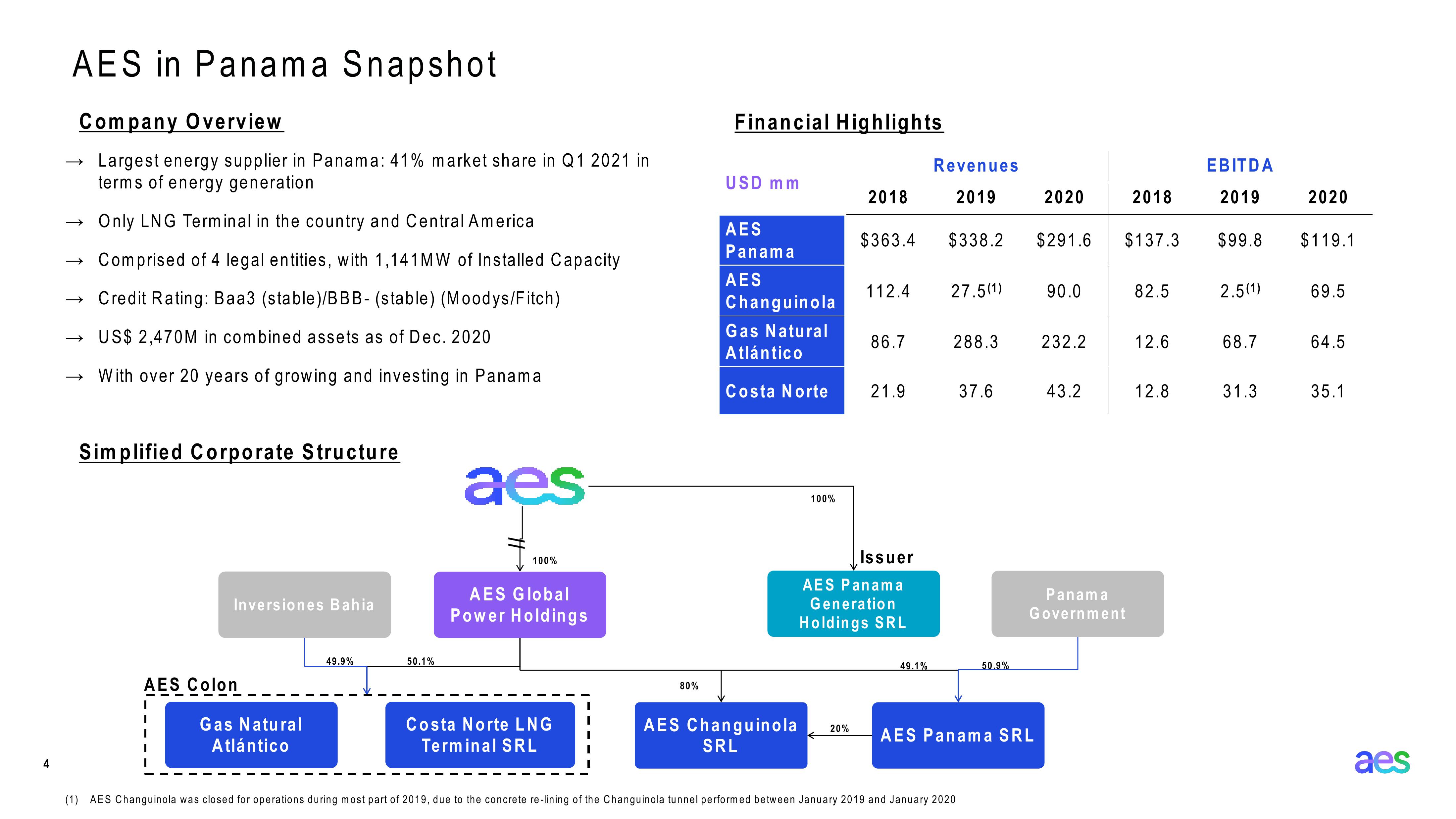

Company Overview

-> Largest energy supplier in Panama: 41% market share in Q1 2021 in

terms of energy generation

Only LNG Terminal in the country and Central America

Financial Highlights

USD mm

2018

Revenues

2019

EBITDA

2020

2018

2019

2020

AES

Panama

$363.4 $338.2 $291.6 $137.3

$99.8 $119.1

→>

Comprised of 4 legal entities, with 1,141 MW of Installed Capacity

AES

→> Credit Rating: Baa3 (stable)/BBB- (stable) (Moodys/Fitch)

112.4

27.5(1)

90.0

82.5

2.5(1)

69.5

Changuinola

->

US$ 2,470M in combined assets as of Dec. 2020

Gas Natural

Atlántico

86.7

288.3

232.2

12.6

68.7

64.5

→>

With over 20 years of growing and investing in Panama

Costa Norte

21.9

37.6

43.2

12.8

31.3

35.1

Simplified Corporate Structure

aes

Inversiones Bahia

AES Colon

Gas Natural

Atlántico

49.9%

50.1%

100%

AES Global

Power Holdings

80%

100%

Issuer

AES Panama

Generation

Holdings SRL

49.1%

50.9%

Costa Norte LNG

Terminal SRL

AES Changuinola

SRL

20%

AES Panama SRL

(1) AES Changuinola was closed for operations during most part of 2019, due to the concrete re-lining of the Changuinola tunnel performed between January 2019 and January 2020

Panama

Government

aesView entire presentation