PJT Partners Investment Banking Pitch Book

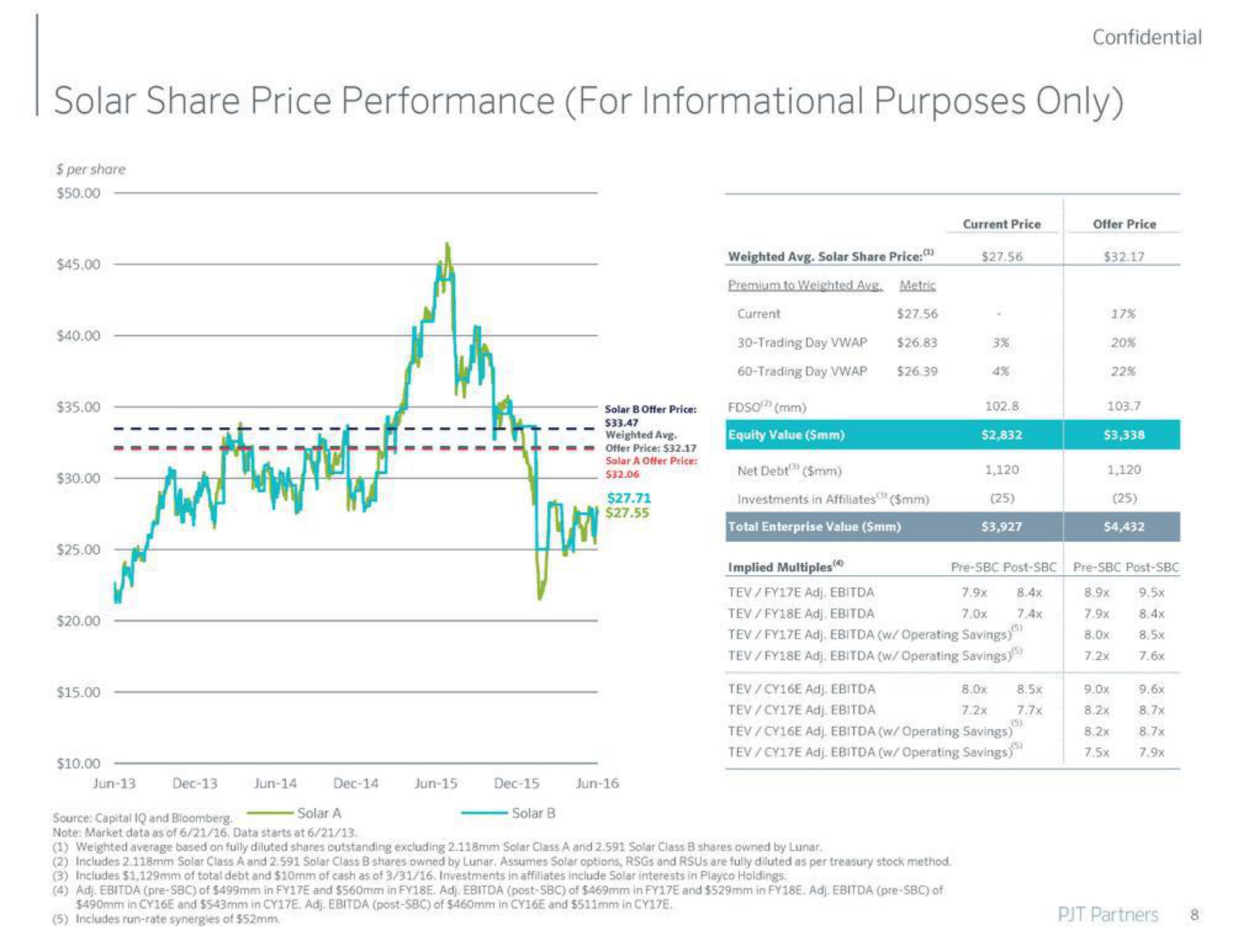

Solar Share Price Performance (For Informational Purposes Only)

$ per share

$50.00

$45.00

$40.00

$35.00

$30.00

$25.00

$20.00

$15.00

$10.00

Jun-13

Dec-13

Jun-14

Dec-14

Jun-15

Dec-15

Solar B

Solar B Offer Price:

$33.47

Weighted Avg.

Offer Price: $32.17

Solar A Offer Price:

$32.06

$27.71

$27.55

Jun-16

Weighted Avg. Solar Share Price: (¹)

Premium to Weighted Avg. Metric

Current

$27.56

$26.83

$26.39

30-Trading Day VWAP

60-Trading Day VWAP

FDSO(2) (mm)

Equity Value (Smm)

Net Debt¹³) ($mm)

Investments in Affiliates ($mm)

Total Enterprise Value ($mm)

Current Price

$27.56

Solar A

Source: Capital IQ and Bloomberg.

Note: Market data as of 6/21/16. Data starts at 6/21/13.

(1) Weighted average based on fully diluted shares outstanding excluding 2.118mm Solar Class A and 2.591 Solar Class B shares owned by Lunar.

(2) Includes 2.118mm Solar Class A and 2.591 Solar Class B shares owned by Lunar. Assumes Solar options, RSGs and RSUS are fully diluted as per treasury stock method.

(3) Includes $1,129mm of total debt and $10mm of cash as of 3/31/16. Investments in affiliates include Solar interests in Playco Holdings.

(4) Ad). EBITDA (pre-SBC) of $499mm in FY17E and $560mm in FY18E. Adj. EBITDA (post-SBC) of $469mm in FY17E and $529mm in FY18E. Adj. EBITDA (pre-SBC) of

$490mm in CY16E and $543mm in CY17E. Adj. EBITDA (post-SBC) of $460mm in CY16E and $511mm in CY17E.

(5) Includes run-rate synergies of $52mm,

3%

102.8

$2,832

1,120

(25)

$3,927

Implied Multiples (4)

TEV/FY17E Adj. EBITDA

TEV/FY18E Adj. EBITDA

TEV / FY17E Adj. EBITDA (w/ Operating Savings)

TEV/FY18E Adj. EBITDA (w/ Operating Savings))

Pre-SBC Post-SBC

7.9x

8.4x

7.0x

7.4x

TEV/CY16E Adj. EBITDA

TEV/CY17E Adj. EBITDA

TEV/CY16E Adj. EBITDA (w/ Operating Savings)

TEV/CY17E Adj. EBITDA (w/ Operating Savings)

8.5x

8.0x

7.2x 7.7x

Confidential

Offer Price

$32.17

17%

20%

22%

103.7

$3,338

1,120

(25)

$4,432

Pre-SBC Post-SBC

9.5x

8.9x

7.9x

8.4x

8.0x

8.5x

7.2x

7.6x

9.0x

8.2x

8.2x

7.5x

9.6x

8.7x

8.7x

7.9x

PJT Partners

8View entire presentation