Maersk Investor Presentation Deck

Highlights Q4 2020

Ocean

●

●

●

13

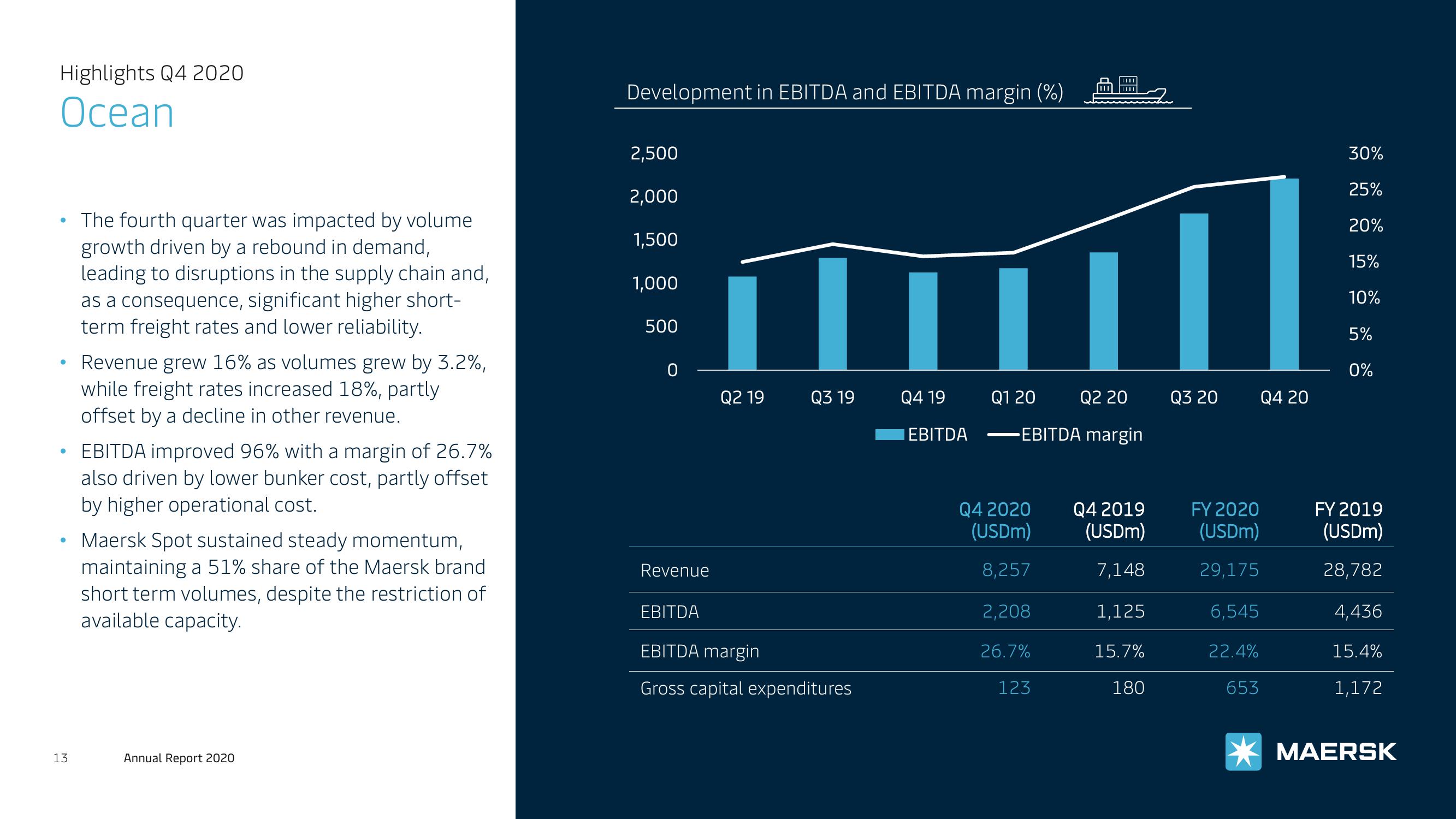

The fourth quarter was impacted by volume

growth driven by a rebound in demand,

leading to disruptions in the supply chain and,

as a consequence, significant higher short-

term freight rates and lower reliability.

Revenue grew 16% as volumes grew by 3.2%,

while freight rates increased 18%, partly

offset by a decline in other revenue.

EBITDA improved 96% with a margin of 26.7%

also driven by lower bunker cost, partly offset

by higher operational cost.

Maersk Spot sustained steady momentum,

maintaining a 51% share of the Maersk brand

short term volumes, despite the restriction of

available capacity.

Annual Report 2020

Development in EBITDA and EBITDA margin (%)

2,500

2,000

1,500

1,000

500

0

Revenue

Q2 19

Q3 19

EBITDA

EBITDA margin

Gross capital expenditures

||

Q4 19

EBITDA

Q2 20

EBITDA margin

Q1 20

Q4 2020

(USDM)

8,257

2,208

26.7%

123

Q4 2019

(USDm)

7,148

1,125

15.7%

180

Q3 20

FY 2020

(USDM)

29,175

6,545

22.4%

653

Q4 20

30%

25%

20%

15%

10%

5%

0%

FY 2019

(USDm)

28,782

4,436

15.4%

1,172

MAERSKView entire presentation