Better Results Presentation Deck

Reconciliation of Non-GAAP Measures

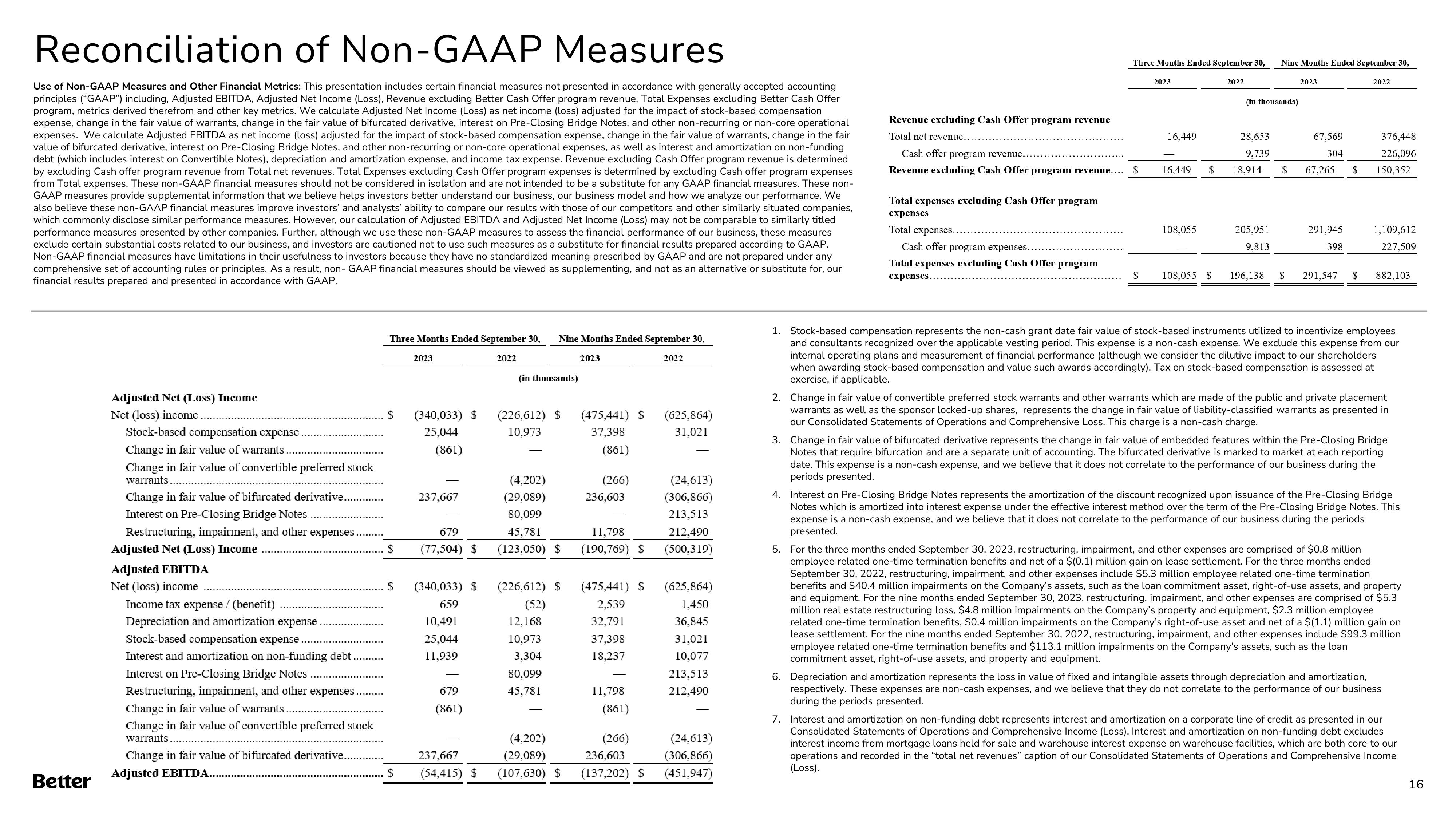

Use of Non-GAAP Measures and Other Financial Metrics: This presentation includes certain financial measures not presented in accordance with generally accepted accounting

principles ("GAAP") including, Adjusted EBITDA, Adjusted Net Income (Loss), Revenue excluding Better Cash Offer program revenue, Total Expenses excluding Better Cash Offer

program, metrics derived therefrom and other key metrics. We calculate Adjusted Net Income (Loss) as net income (loss) adjusted for the impact of stock-based compensation

expense, change in the fair value of warrants, change in the fair value of bifurcated derivative, interest on Pre-Closing Bridge Notes, and other non-recurring or non-core operational

expenses. We calculate Adjusted EBITDA as net income (loss) adjusted for the impact of stock-based compensation expense, change in the fair value of warrants, change in the fair

value of bifurcated derivative, interest on Pre-Closing Bridge Notes, and other non-recurring or non-core operational expenses, as well as interest and amortization on non-funding

debt (which includes interest on Convertible Notes), depreciation and amortization expense, and income tax expense. Revenue excluding Cash Offer program revenue is determined

by excluding Cash offer program revenue from Total net revenues. Total Expenses excluding Cash Offer program expenses is determined by excluding Cash offer program expenses

from Total expenses. These non-GAAP financial measures should not be considered in isolation and are not intended to be a substitute for any GAAP financial measures. These non-

GAAP measures provide supplemental information that we believe helps investors better understand our business, our business model and how we analyze our performance. We

also believe these non-GAAP financial measures improve investors' and analysts' ability to compare our results with those of our competitors and other similarly situated companies,

which commonly disclose similar performance measures. However, our calculation of Adjusted EBITDA and Adjusted Net Income (Loss) may not be comparable to similarly titled

performance measures presented by other companies. Further, although we use these non-GAAP measures to assess the financial performance of our business, these measures

exclude certain substantial costs related to our business, and investors are cautioned not to use such measures as a substitute for financial results prepared according to GAAP.

Non-GAAP financial measures have limitations in their usefulness to investors because they have no standardized meaning prescribed by GAAP and are not prepared under any

comprehensive set of accounting rules or principles. As a result, non- GAAP financial measures should be viewed as supplementing, and not as an alternative or substitute for, our

financial results prepared and presented in accordance with GAAP.

Better

Adjusted Net (Loss) Income

Net (loss) income.

Stock-based compensation expense.

Change in fair value of warrants.

Change in fair value of convertible preferred stock

warrants

Change in fair value of bifurcated derivative...

Interest on Pre-Closing Bridge Notes

Restructuring, impairment, and other expenses.

Adjusted Net (Loss) Income

Adjusted EBITDA

Net (loss) income

Income tax expense / (benefit)

Depreciation and amortization expense.

Stock-based compensation expense.

Interest and amortization on non-funding debt.......

Interest on Pre-Closing Bridge Notes

Restructuring, impairment, and other expenses......

Change in fair value of warrants.

Change in fair value of convertible preferred stock

warrants.

Change in fair value of bifurcated derivative.

Adjusted EBITDA.....

Three Months Ended September 30,

2022

$

$

S

$

2023

(340,033) $

25,044

(861)

237,667

679

(77,504) $

(340,033) $

659

10,491

25,044

11,939

679

(861)

237,667

(54,415) $

(in thousands)

Nine Months Ended September 30,

2023

2022

(226,612) $ (475,441) $

10,973

37,398

(4,202)

(29,089)

80,099

45,781

(123,050) S

(226,612) S

(52)

12,168

10,973

3,304

80,099

45,781

(4,202)

(29,089)

(107,630) $

(861)

(266)

236,603

11.798

(190,769) $

(475,441) $

2,539

32,791

37,398

18,237

11,798

(861)

(266)

236,603

(137,202) $

(625,864)

31,021

(24,613)

(306,866)

213,513

212,490

(500,319)

(625,864)

1,450

36,845

31,021

10,077

213,513

212,490

(24,613)

(306,866)

(451,947)

Revenue excluding Cash Offer program revenue

Total net revenue..

Cash offer program revenue..

Revenue excluding Cash Offer program revenue.... S

Total expenses excluding Cash Offer program

expenses

Three Months Ended September 30,

Total expenses.

Cash offer program expenses...

Total expenses excluding Cash Offer program

expenses.....

2023

16,449

16,449

108,055

$

2022

(in thousands)

28.653

9,739

18.914

Nine Months Ended September 30,

205,951

9,813

$

$ 108,055 $ 196,138 $

2023

67,569

304

67,265

291,945

398

291,547

2022

376,448

226,096

$ 150,352

$

1,109,612

227,509

882,103

1. Stock-based compensation represents the non-cash grant date fair value of stock-based instruments utilized to incentivize employees

and consultants recognized over the applicable vesting period. This expense is a non-cash expense. We exclude this expense from our

internal operating plans and measurement of financial performance (although we consider the dilutive impact to our shareholders

when awarding stock-based compensation and value such awards accordingly). Tax on stock-based compensation is assessed at

exercise, if applicable.

2. Change in fair value of convertible preferred stock warrants and other warrants which are made of the public and private placement

warrants as well as the sponsor locked-up shares, represents the change in fair value of liability-classified warrants as presented in

our Consolidated Statements of Operations and Comprehensive Loss. This charge is a non-cash charge.

3. Change in fair value of bifurcated derivative represents the change in fair value of embedded features within the Pre-Closing Bridge

Notes that require bifurcation and are a separate unit of accounting. The bifurcated derivative is marked to market at each reporting

date. This expense is a non-cash expense, and we believe that it does not correlate to the performance of our business during the

periods presented.

4. Interest on Pre-Closing Bridge Notes represents the amortization of the discount recognized upon issuance of the Pre-Closing Bridge

Notes which is amortized into interest expense under the effective interest method over the term of the Pre-Closing Bridge Notes. This

expense is a non-cash expense, and we believe that it does not correlate to the performance of our business during the periods

presented.

5. For the three months ended September 30, 2023, restructuring, impairment, and other expenses are comprised of $0.8 million

employee related one-time termination benefits and net of a $(0.1) million gain on lease settlement. For the three months ended

September 30, 2022, restructuring, impairment, and other expenses include $5.3 million employee related one-time termination

benefits and $40.4 million impairments on the Company's assets, such as the loan commitment asset, right-of-use assets, and property

and equipment. For the nine months ended September 30, 2023, restructuring, impairment, and other expenses are comprised of $5.3

million real estate restructuring loss, $4.8 million impairments on the Company's property and equipment, $2.3 million employee

related one-time termination benefits, $0.4 million impairments on the Company's right-of-use asset and net of a $(1.1) million gain on

lease settlement. For the nine months ended September 30, 2022, restructuring, impairment, and other expenses include $99.3 million

employee related one-time termination benefits and $113.1 million impairments on the Company's assets, such as the loan

commitment asset, right-of-use assets, and property and equipment.

6. Depreciation and amortization represents the loss in value of fixed and intangible assets through depreciation and amortization,

respectively. These expenses are non-cash expenses, and we believe that they do not correlate to the performance of our business

during the periods presented.

7. Interest and amortization on non-funding debt represents interest and amortization on a corporate line of credit as presented in our

Consolidated Statements of Operations and Comprehensive Income (Loss). Interest and amortization on non-funding debt excludes

interest income from mortgage loans held for sale and warehouse interest expense on warehouse facilities, which are both core to our

operations and recorded in the "total net revenues" caption of our Consolidated Statements of Operations and Comprehensive Income

(Loss).

16View entire presentation