LiveVox Results Presentation Deck

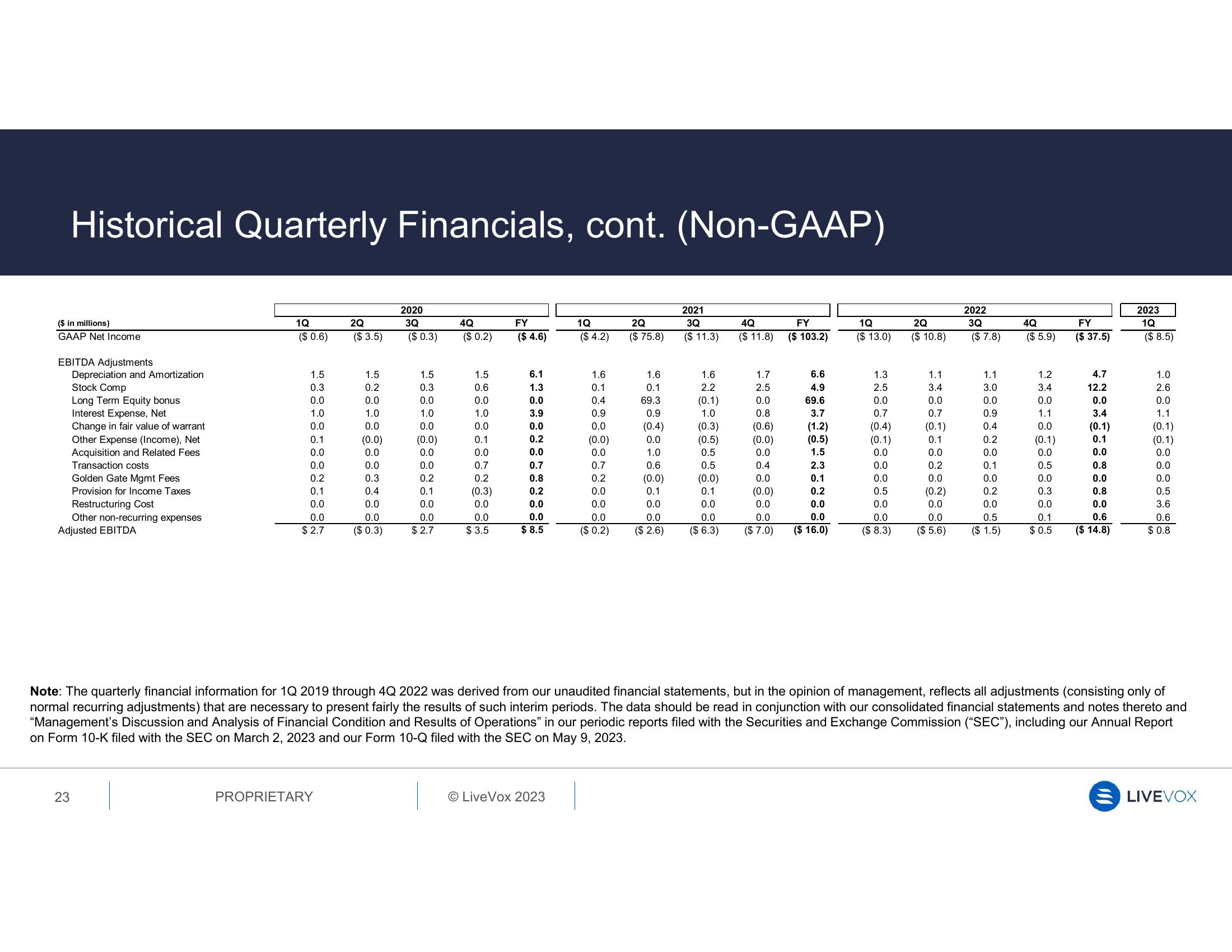

Historical Quarterly Financials, cont. (Non-GAAP)

($ in millions)

GAAP Net Income

EBITDA Adjustments

Depreciation and Amortization

Stock Comp

Long Term Equity bonus

Interest Expense, Net

Change in fair value of warrant

Other Expense (Income), Net

Acquisition and Related Fees

Transaction costs

23

Golden Gate Mgmt Fees

Provision for Income Taxes

Restructuring Cost

Other non-recurring expenses

Adjusted EBITDA

1Q

($ 0.6)

1.5

0.3

0.0

1.0

0.0

0.1

0.0

0.0

0.2

0.1

0.0

0.0

$2.7

2Q

($ 3.5)

PROPRIETARY

1.5

0.2

0.0

1.0

0.0

(0.0)

0.0

0.0

0.3

0.4

0.0

0.0

($ 0.3)

2020

3Q

($ 0.3)

1.5

0.3

0.0

1.0

0.0

(0.0)

0.0

0.0

0.2

0.1

0.0

0.0

$2.7

4Q

($ 0.2)

1.5

0.6

0.0

1.0

0.0

0.1

0.0

0.7

0.2

(0.3)

0.0

0.0

$3.5

FY

($ 4.6)

6.1

1.3

0.0

3.9

0.0

0.2

0.0

0.7

0.8

0.2

0.0

0.0

$8.5

1Q

($ 4.2)

O LiveVox 2023

1.6

0.1

2Q

($ 75.8)

1.6

0.1

0.4

69.3

0.9

0.9

0.0

(0.4)

(0.0)

0.0

0.0

1.0

0.7

0.6

0.2

(0.0)

0.0

0.1

0.0

0.0

0.0

0.0

($ 0.2) ($ 2.6)

2021

3Q

($ 11.3)

1.6

2.2

(0.1)

1.0

(0.3)

(0.5)

0.5

0.5

(0.0)

0.1

0.0

0.0

($ 6.3)

4Q

FY

($ 11.8) ($ 103.2)

1.7

2.5

0.0

0.8

(0.6)

(0.0)

0.0

0.4

0.0

(0.0)

0.0

0.0

($ 7.0)

6.6

4.9

69.6

3.7

(1.2)

(0.5)

1.5

2.3

0.1

0.2

0.0

0.0

($ 16.0)

1Q

($ 13.0)

1.3

2.5

0.0

0.7

(0.4)

(0.1)

0.0

0.0

0.0

0.5

0.0

0.0

($ 8.3)

2Q

($ 10.8)

2022

3Q

($ 7.8)

1.1

1.1

3.4

3.0

0.0

0.0

0.7

0.9

(0.1)

0.4

0.1

0.2

0.0

0.0

0.2

0.1

0.0

0.0

(0.2)

0.2

0.0

0.0

0.0

0.5

($ 5.6) ($ 1.5)

4Q

($ 5.9)

1.2

3.4

0.0

1.1

0.0

(0.1)

0.0

0.5

0.0

0.3

0.0

0.1

$0.5

FY

($ 37.5)

4.7

12.2

0.0

3.4

(0.1)

0.1

0.0

0.8

0.0

0.8

0.0

0.6

($ 14.8)

2023

1Q

($ 8.5)

Note: The quarterly financial information for 1Q 2019 through 4Q 2022 was derived from our unaudited financial statements, but in the opinion of management, reflects all adjustments (consisting only of

normal recurring adjustments) that are necessary to present fairly the results of such interim periods. The data should be read in conjunction with our consolidated financial statements and notes thereto and

"Management's Discussion and Analysis of Financial Condition and Results of Operations" in our periodic reports filed with the Securities and Exchange Commission ("SEC"), including our Annual Report

on Form 10-K filed with the SEC on March 2, 2023 and our Form 10-Q filed with the SEC on May 9, 2023.

1.0

2.6

0.0

1.1

(0.1)

(0.1)

0.0

0.0

0.0

0.5

3.6

0.6

$0.8

LIVEVOXView entire presentation