Morgan Stanley Investment Banking Pitch Book

Morgan Stanley

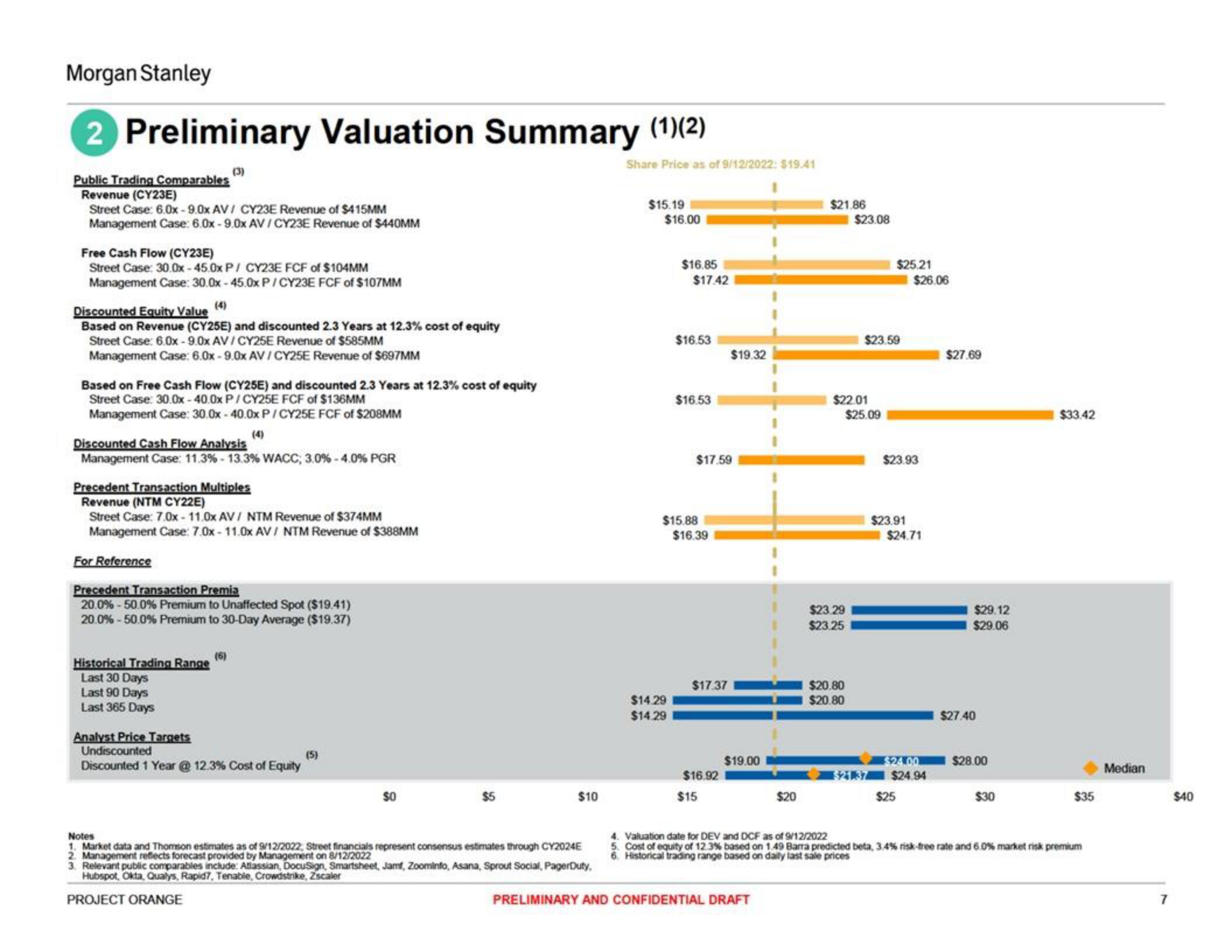

2 Preliminary Valuation Summary (1)(2)

Public Trading Comparables

Revenue (CY23E)

Street Case: 6.0x-9.0x AV/ CY23E Revenue of $415MM

Management Case: 6.0x-9.0x AV/CY23E Revenue of $440MM

Free Cash Flow (CY23E)

Street Case: 30.0x-45.0x P/ CY23E FCF of $104MM

Management Case: 30.0x - 45.0x P/ CY23E FCF of $107MM

Discounted Equity Value

Based on Revenue (CY25E) and discounted 2.3 Years at 12.3% cost of equity

Street Case: 6.0x-9.0x AV/CY25E Revenue of $585MM

Management Case: 6.0x-9.0x AV / CY25E Revenue of $697MM

Based on Free Cash Flow (CY25E) and discounted 2.3 Years at 12.3% cost of equity

Street Case: 30.0x - 40.0x P/CY25E FCF of $136MM

Management Case: 30.0x-40.0x P/ CY25E FCF of $208MM

(4)

Discounted Cash Flow Analysis

Management Case: 11.3% -13.3% WACC; 3.0% -4.0% PGR

Precedent Transaction Multiples

Revenue (NTM CY22E)

Street Case: 7.0x-11.0x AV/ NTM Revenue of $374MM

Management Case: 7.0x-11.0x AV / NTM Revenue of $388MM

For Reference

Precedent Transaction Premia

20.0% - 50.0% Premium to Unaffected Spot ($19.41)

20.0% - 50.0% Premium to 30-Day Average ($19.37)

Historical Trading Range

Last 30 Days

Last 90 Days

Last 365 Days

(6)

Analyst Price Targets

Undiscounted

Discounted 1 Year @ 12.3% Cost of Equity

(5)

$0

&

$10

Notes

1. Market data and Thomson estimates as of 9/12/2022, Street financials represent consensus estimates through CY2024E

2. Management reflects forecast provided by Management on 8/12/2022

3. Relevant public comparables include: Atlassian, DocuSign, Smartsheet, Jam, Zoominfo, Asana, Sprout Social, PagerDuty.

Hubspot, Okta, Qualys, Rapid7, Tenable, Crowdstrike, Zscaler

PROJECT ORANGE

Share Price as of 9/12/2022: $19.41

$15.19

$16.00

$16.85

$17.42

$14.29

$14.29

$16.53

$16.53

$15.88

$16.39

$17.59

$17.37

$19.32

$16.92

$15

$19.00

$20

PRELIMINARY AND CONFIDENTIAL DRAFT

$21.86

$23.08

$22.01

$23.29

$23.25

$20.80

$20.80

$23.59

$25.09

$25.21

$26.06

$23.93

$23.91

$24.71

$25

$24.00

$24.94

$27.69

$29.12

$29.06

$27.40

$28.00

$30

$33.42

$35

4. Valuation date for DEV and DCF as of 9/12/2022

5. Cost of equity of 12.3% based on 1.49 Barra predicted beta, 3.4 % risk-free rate and 6.0% market risk premium

6. Historical trading range based on daily last sale prices

Median

7

$40View entire presentation